Ampleforth (AMPL) is one of the projects in the decentralized finance (DeFi) space that took the community by a storm, despite being on the market for over a year.

Over the past couple of months, AMPL managed to become arguably one of the most widely-discussed protocols, largely because of its quick exponential growth.

Now, however, the team has taken an essential step towards providing its users with further incentives to provide liquidity to its pools and receive attractive yields.

Ampleforth to ‘Donate’ 10% Foundation Tokens to Ecosystem

In a detailed report called State of the Network, published on August 4th, Ampleforth’s team provided insights on the network’s development, user base, and future plans.

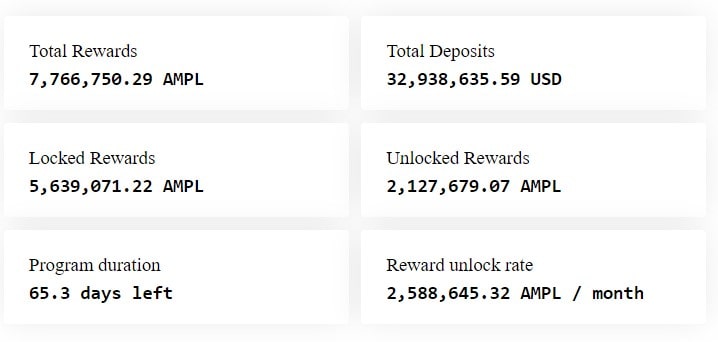

According to the document, they’ve been able to achieve 70% retention rate on liquidity locked into their Geyser program since its launch on June 22nd this year, with more than 4,242 users active to date.

At the time of this writing, the APY of the Geyser is 126%, and there are almost $33 million in total deposits.

Going forward, Ampleforth’s Foundation “will donate 10% from the Foundation Treasury to the Ecosystem.”

Per the report, “the plan is to distribute the entirety of the Liquidity Mining Programs over the next ten years in open participation, rules-based, and decentralized fashion to community and ecosystem participants where possible,”

This transfer should take place on August 31st, 2020, and the new total of 23.5% of tokens are intended to support Geyser or Geyser-like programs for the next ten years.

Ampleforth (AMPL) Price in Negative Rebase Territory

As CryptoPotato reported toward the end of July, AMPL saw 75% of its dollar value disappear in a few short days. This sent the protocol in the state of negative rebases.

In a detailed post earlier in the month, we explained how Ampleforth’s elastic supply protocol works.

While a lot of people are confusing AMPL to be a stablecoin, that’s not the case. Its value has never been pegged to an underlying fiat currency, as is the case for conventional stablecoins such as USDT, for instance.

Instead, AMPL’s protocol inflates or deflates the current circulating supply of tokens on the markets in an attempt to achieve equilibrium and bring AMPL’s price to its target, which is ultimately $1 (approximately).

Hence, if AMPL’s price is above $1, the protocol would increase the circulating supply on the market, and every holder receives an amount relative to their holding right in their wallets. On the other hand, however, if the market price is below $1, the protocol would “take” tokens out of circulation and reduce the amount holders have.

At the time of this writing, AMPL’s market price is around $0.9, which puts it below the target price, meaning that, if things stay the same until 02:00 UTC, users will see a small number of tokens disappear from their account. This, in turn, should bring the price up toward the target.

cryptopotato.com

cryptopotato.com