Bitcoin mining crossed a historic threshold in late 2025. According to a recent report from GoMining, the network entered the zetahash era, surpassing 1 zetahash per second of computing power.

But while hashrate surged to record levels, miner profitability moved in the opposite direction. The result is a mining industry that is larger, more industrialized — and more exposed to price risk than at any point this cycle.

Bitcoin mining has entered a new regime.

— GoMining Institutional (@GoMiningInst) January 28, 2026

Our 2025 Bitcoin Mining Market Review examines:

🔹 How mining economics changed across the year

🔹 What persistent hashprice pressure revealed about the sector

🔹 Why scale, power strategy, and capital structure now matter more than cycle… pic.twitter.com/bh5GJM5WaE

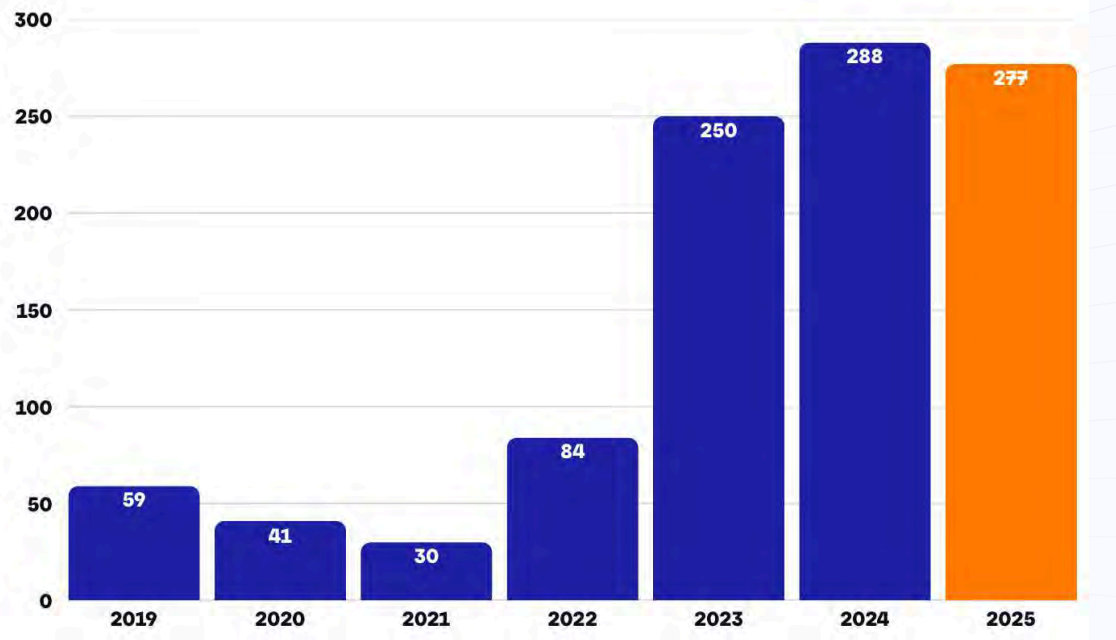

Hashrate Reaches Record Highs as Mining Scales Up

The report shows Bitcoin’s network sustained over 1 ZH/s on a seven-day average, marking a structural shift rather than a temporary spike.

This growth reflects aggressive hardware upgrades, new data centers, and expanding industrial operations. Mining is no longer dominated by marginal players. It now resembles energy infrastructure.

As a result, competition for block rewards has intensified sharply.

Revenue Per Miner Falls Despite Network Growth

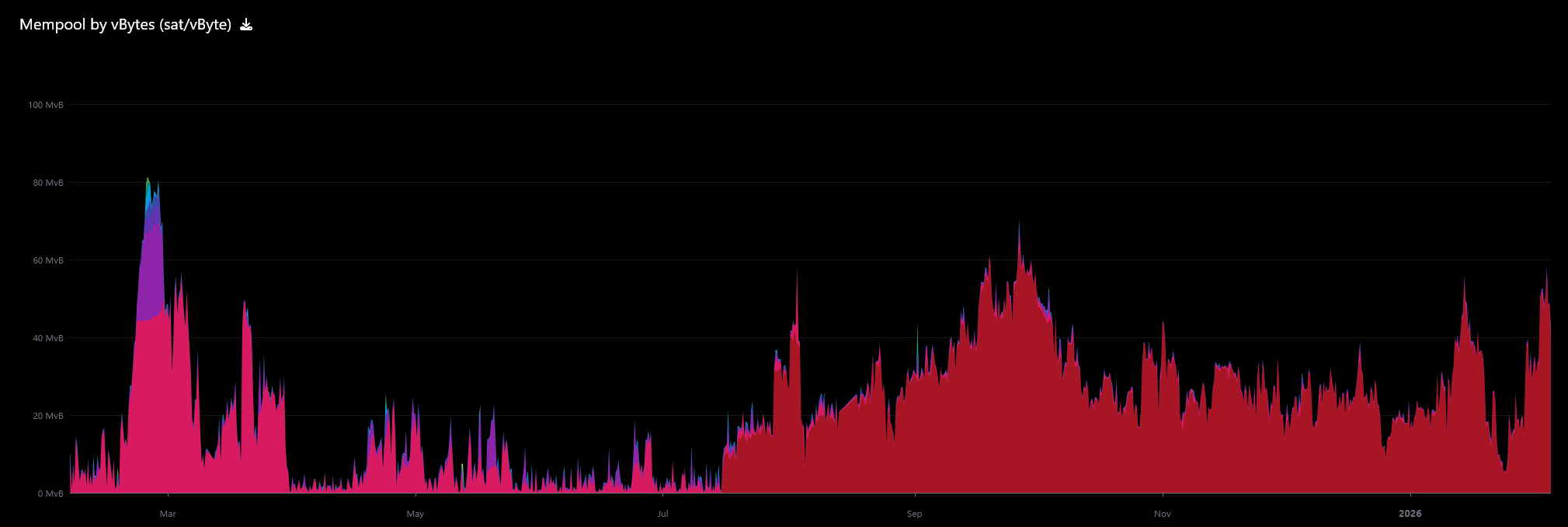

While hashrate expanded, revenue per unit of compute fell into one of its tightest ranges on record.

The report highlights that miner earnings increasingly depend on Bitcoin’s price and difficulty alone. Other buffers have faded, including transaction fee spikes and the higher block subsidies that once softened margin pressure

This compression means miners now operate with thinner margins, even as they deploy more capital and power.

According to GoMining, the impact was visible in the mempool. For the first time since April 2023, the Bitcoin mempool fully cleared multiple times in 2025.

It means the Bitcoin network was so quiet that transactions cleared immediately, even at the lowest possible fees.

As a result, miners earned almost nothing from fees and had to rely almost entirely on Bitcoin’s price and block subsidy for revenue.

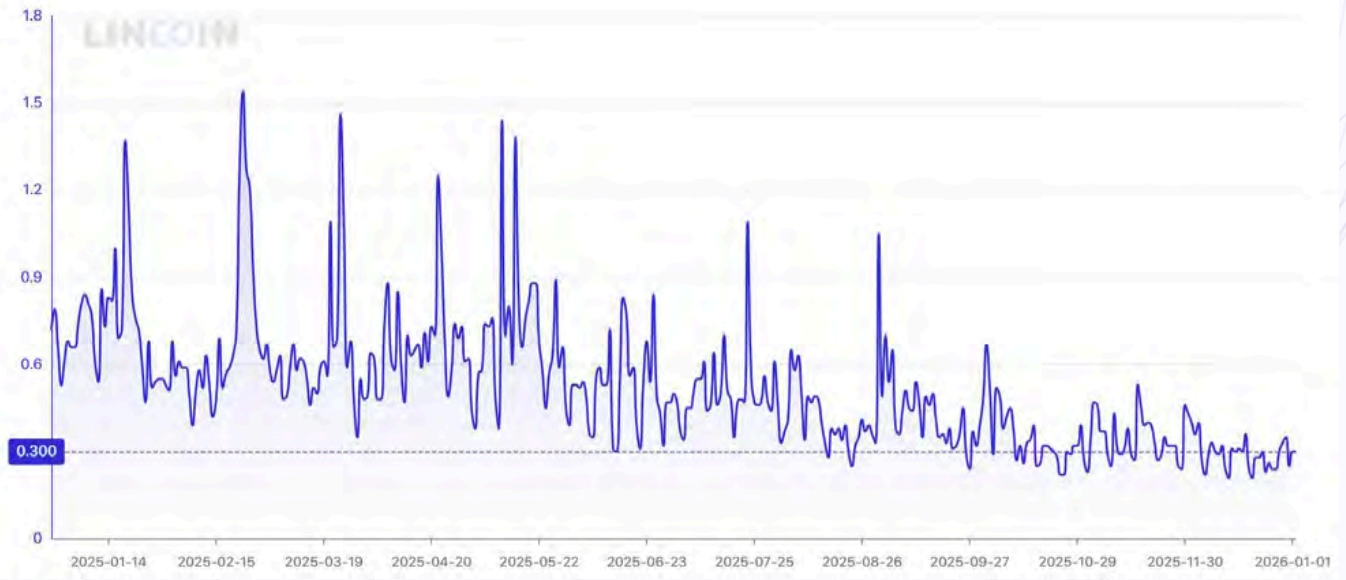

Transaction Fees Offer Little Relief After the Halving

Post-halving dynamics worsened the pressure.

With the block subsidy reduced to 3.125 $BTC, transaction fees failed to offset lost revenue. The report notes that fees made up less than 1% of total block rewards for most of 2025.

As a result, miner economics became directly exposed to Bitcoin price swings, with fewer internal stabilizers.

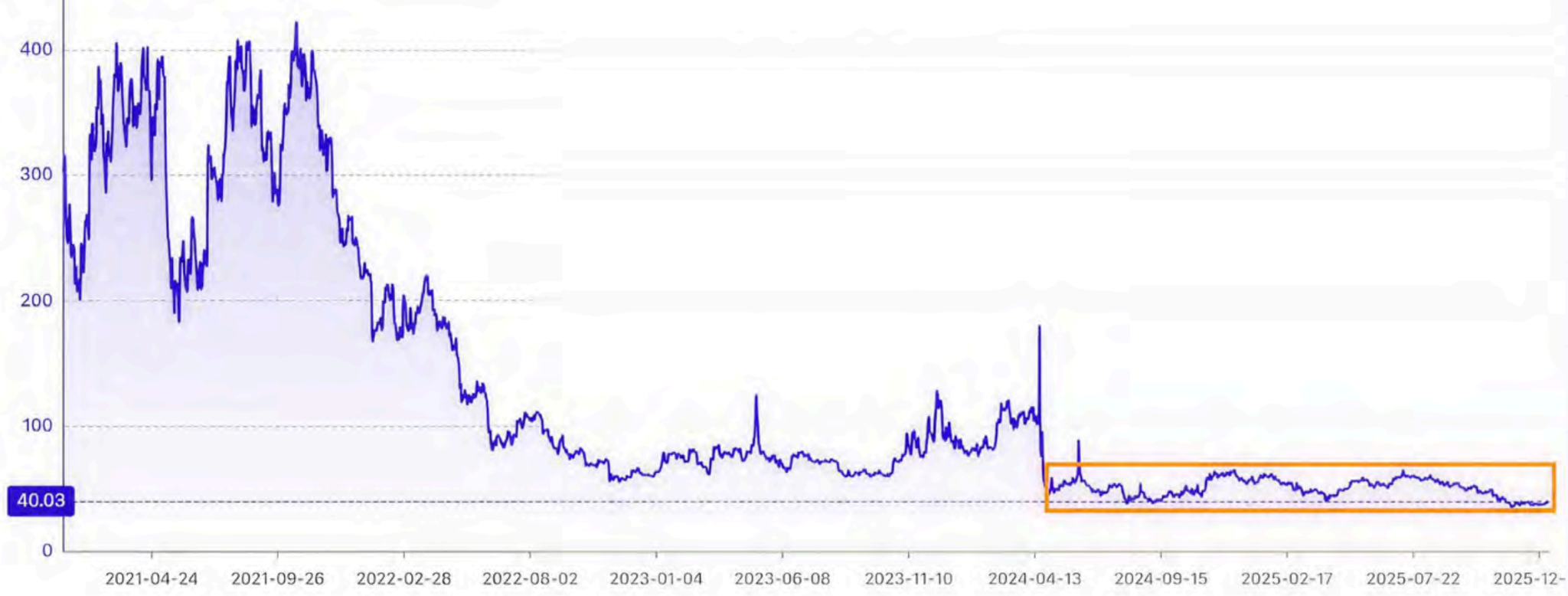

Hashprice Hits Lows as Margins Stay Under Pressure

The squeeze showed up clearly in hashprice — the daily revenue earned per unit of hashrate.

According to the report, hashprice fell to an all-time low near $35 per PH per day in November and remained weak into year-end. It finished the quarter near $38, well below historical averages.

This left little room for operational error.

Shutdown Prices Turn Price Levels Into Economic Triggers

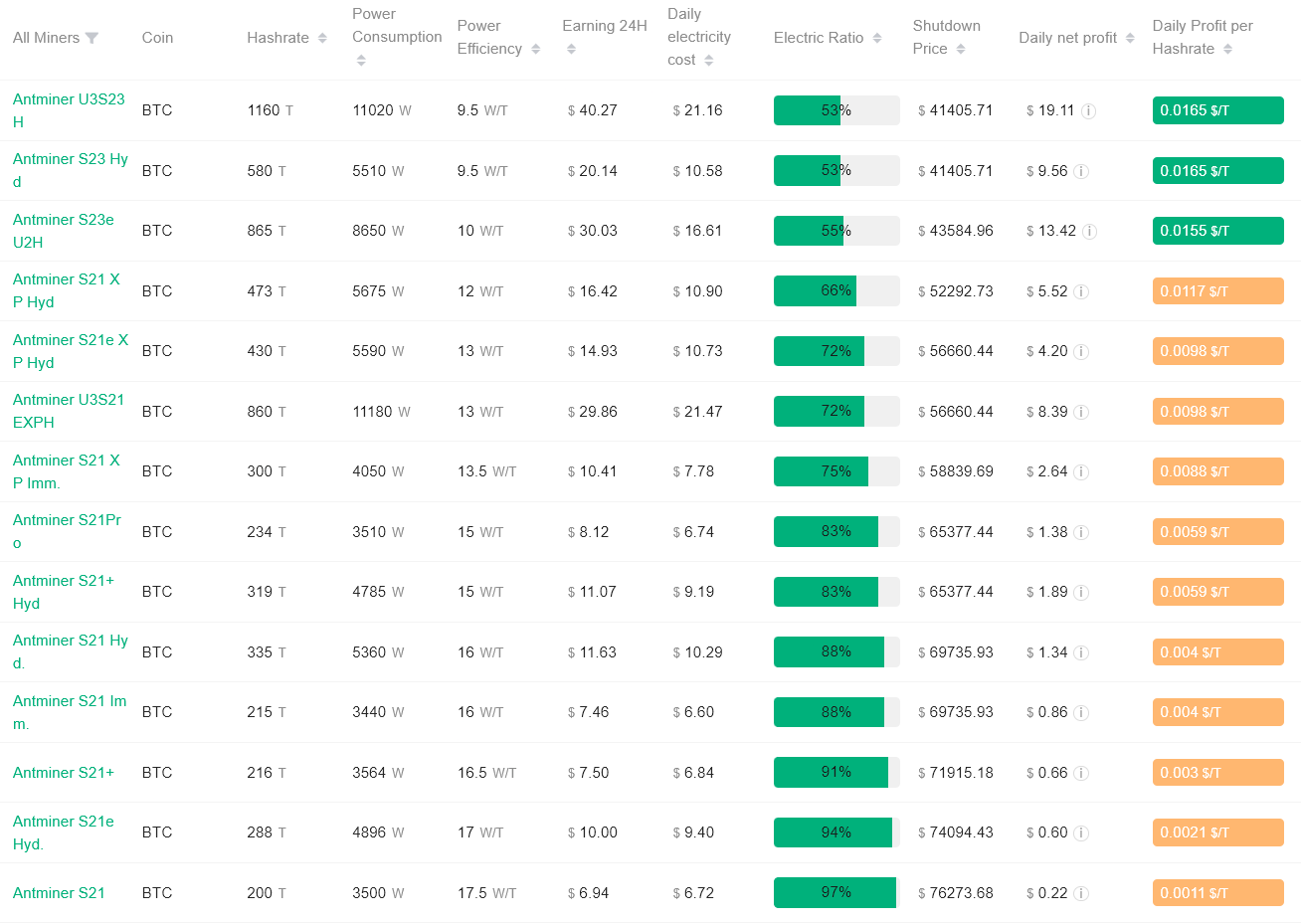

These findings align closely with recent data on miner shutdown prices.

At current difficulty and electricity costs near $0.08 per kWh, widely used S21-series miners approach breakeven between $69,000 and $74,000 per $BTC. Below that range, many operations stop generating operational profit.

More efficient, high-end machines remain viable at much lower prices. But mid-tier miners face immediate pressure.

Why This Matters for Bitcoin Price Now

This does not create a price floor. Markets can trade below mining breakeven.

However, it creates a behavioral threshold. If Bitcoin stays below key shutdown levels, weaker miners may sell reserves, shut down equipment, or reduce exposure.

In a market already strained by tight liquidity, those actions can amplify volatility.

Bitcoin mining is stronger and more industrial than ever. But that scale comes with sensitivity. As hashrate grows and fees fade, price matters more, not less, for miner stability.

That makes levels like $70,000 economically meaningful — not because charts say so, but because the network’s cost structure does.

The post Bitcoin Mining Enters the Zetahash Era as Profitability Tightens appeared first on BeInCrypto.

beincrypto.com

beincrypto.com