Bitcoin briefly slid to $72,863 on Bitstamp on Tuesday, but publicly traded mining stocks managed to post mixed-to-positive daily performances even as U.S. stock indexes closed firmly in the red.

Bitcoin Miners Defy Red Screens Amid Geopolitical Jitters

Bitcoin’s dip followed a risk-off jolt after Reuters reported the U.S. shot down an Iranian drone approaching an aircraft carrier, unsettling global markets. While stocks like Strategy (MSTR) and Coinbase (COIN) weakened alongside the move, bitcoin steadied near the $76,000 level by press time, helping miners avoid deeper damage.

Among the top miners by market capitalization, according to bitcoinminingstock.io stats, IREN Limited traded at $54.47, rising 2.61% on the day despite a 5-day decline of 8.97%. Applied Digital climbed 5.37% to $36.67, trimming its weekly loss to 3.67%, while Cipher Mining added 2.81% to $16.25, though it remains down 8.16% over five days.

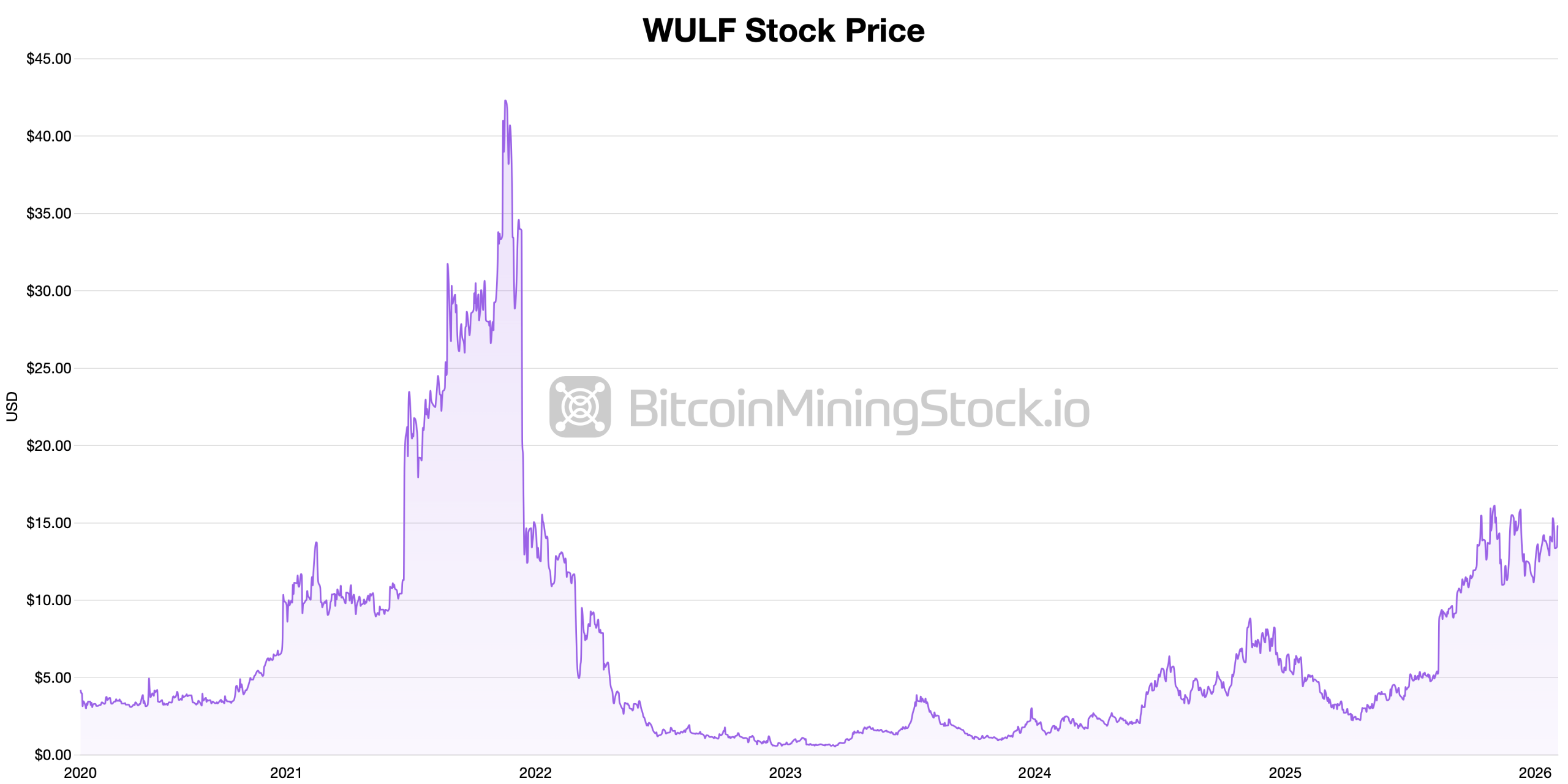

Hut 8 Corp. advanced 5.01% to $59.00, outperforming peers on a daily basis, while Terawulf, Inc. stood out as the lone miner with gains across both time frames, jumping 10.08% on the day and up 1.75% over five sessions. Terawulf explained on Tuesday that new acquisitions the company made now provide it with approximately 1.5 gigawatts (GW) of new capacity.

Not all miners shared in the bounce. Riot Platforms edged up just 0.19% to $15.35 but remains down 9.54% on the week. Core Scientific, Inc. slipped 0.72% to $17.74, while MARA Holdings, Inc. fell 0.76% to $9.05.

Also read: Prediction Markets Price a Short 2026 Government Shutdown

Weekly pressure was evident elsewhere, with Cleanspark up 2.89% on the day but down 9.76% over five days, and Bitdeer Technologies sliding 1.74% on the day to $12.96, off 2.26% for the week.

The split performance suggests investors are selectively rotating within the mining sector, favoring balance-sheet strength and operational scale as bitcoin attempts to stabilize after a volatile session. Despite this, in terms of operations, the network’s hashprice is getting very low at $34.18 per petahash per second (PH/s) on Tuesday.

FAQ ❓

- Why did bitcoin dip on Feb. 3, 2026? Bitcoin slid after geopolitical news heightened risk aversion across global markets.

- Did all bitcoin miners rise on Tuesday?No, daily gains were mixed, with some miners posting modest losses.

- Which miner performed best on both time frames?TeraWulf was the only top miner showing gains on both the 1-day and 5-day view.

- Where is bitcoin trading now? Bitcoin is holding around the $76,000 range at press time.

news.bitcoin.com

news.bitcoin.com