What is the true cost of producing one Bitcoin? A fresh report from Coinshares revealed some interesting findings, underscoring the rising mining difficulty and the potential impact on miners.

Bitcoin halving events carry a lot of significant and this year’s having was particularly notable. This is because it was characterized by a surge in mining difficulty which may reduce the profitability. As a result, many miners are forced to shut down their operations due to the inability to breakeven.

The most notable impact of the higher mining difficulty observed recently is a surge in production costs. The Coinshares reports estimated that the current cost of producing one Bitcoin was $49,500, which means BTC mining is rapidly becoming less accessible to individual miners.

CoinShares' latest report shows that based on second quarter cash cost data, the average cost of producing one bitcoin for all listed miners is now $49,500, and if depreciation and stock compensation are included, this average cost will rise to $96,100. Mining companies are…

— Wu Blockchain (@WuBlockchain) November 3, 2024

Bitcoin mining risks becoming more centralized as difficulty soars. This is because institutional participants in the BTC mining segment will eventually be able to keep up with the rising costs.

Bitcoin Miner Reserves Drop as Uncertainty Soars

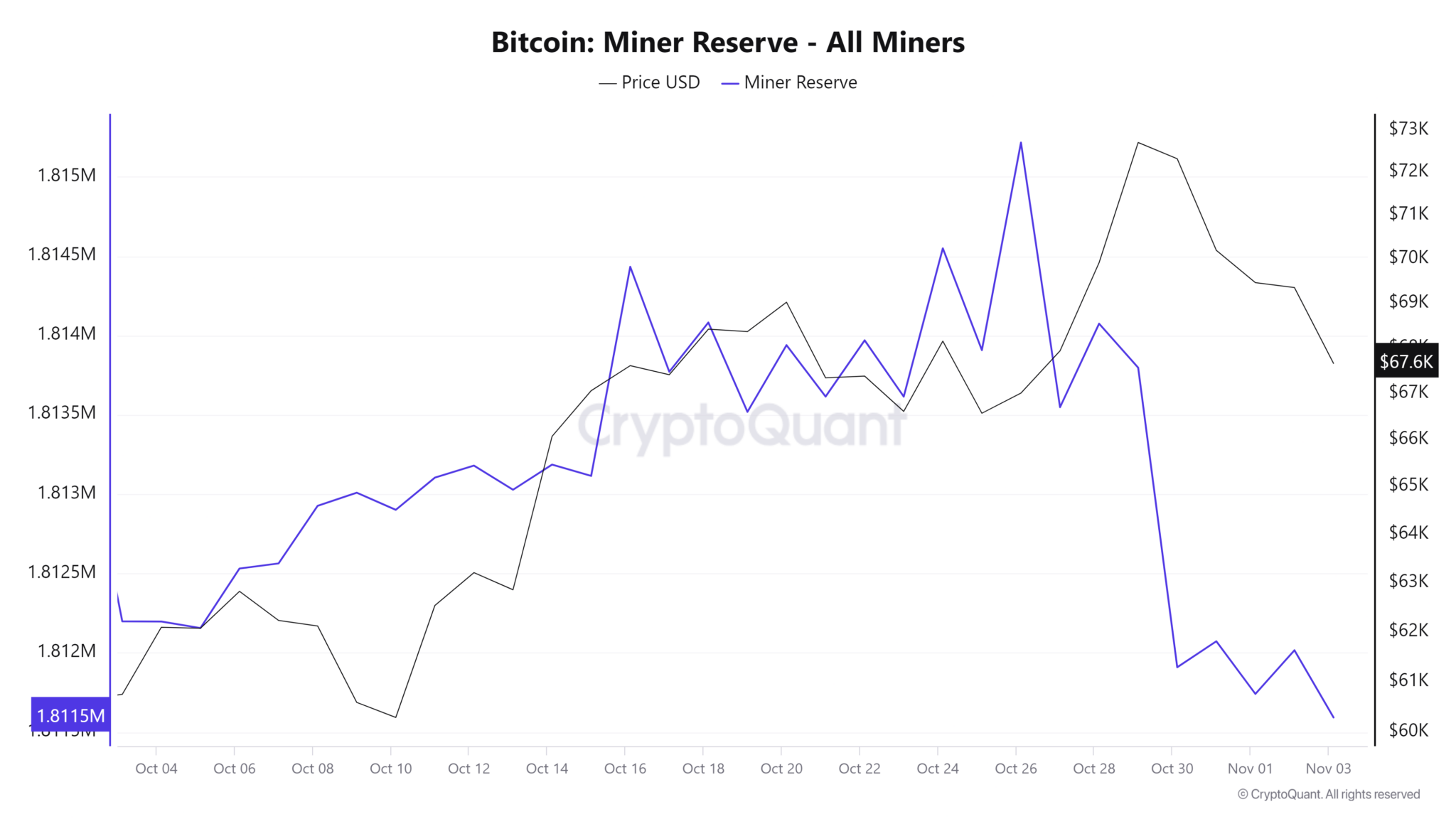

Bitcoin miner reserves maintain an interesting relationship with the price of Bitcoin and the prevailing market sentiment. Miner reserves tend to grow when miners anticipate higher prices and dip during times of uncertainty.

October was an overall bullish month for BTC and sentiments were in favor of more upside in the coming months. This led to a surge in Bitcoin miner reserves to a 4-week peak of 1.815 million BTC on 26 October. have been declining 26 October and have since dropped to 1.811 million BTC.

The difference was equivalent to 40,000 BTC which equated to roughly $2.6 million at present market value at the time of writing. In other words, miner reserve inflows and outflows contribute significantly to BTC’s price action.

The decline in miner reserves was largely thanks to a surge in uncertainty about the U.S elections. A rise in miner reserves indicates that miners opt to hold in anticipation of higher prices.

Will BTC Revisit the $60,000 Range?

Just a few days ago it looked like Bitcoin was headed towards price discovery. However, the return of uncertainty has had a negative impact on price. BTC had already tanked as low as $67,208 in the last 24 hours at the time of writing.

The cryptocurrency was in the red for the last 6 consecutive days, demonstrating a high level of sell pressure. Sustained uncertainty during the week may lead to more downside. Fibonacci retracement suggests that price may find the bottom of the current trend between $60,500 and $63,100.

Note that this was based on the lowest price in September which was the start of its latest uptrend, and the recent peak at the end of October. Bitcoin had a $67,829 price at the time of writing which was only a 6.92% dip away from the Fibonacci accumulation range.

thecoinrepublic.com

thecoinrepublic.com