Bitcoin mining company Riot stocks are predicted to make a comeback after experiencing a 28.96% decline in year-to-date. Its shares are on an upward trend in anticipation of the company’s Q3 2024 earnings report on Oct. 30.

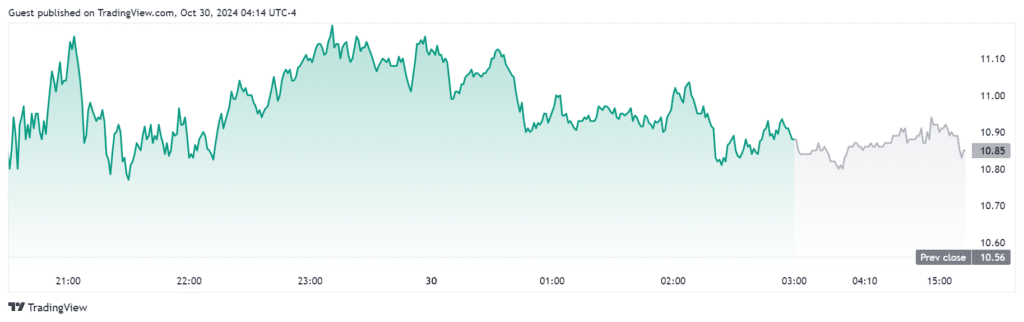

According to data from Trading View, Riot’s stocks are on the rise at nearly 3% in the past day. The Bitcoin (BTC) mining company is expected to release its third quarter 2024 earnings on Oct. 30 after markets close at 4:00 PM EST.

Riot Platform’s shares have been experiencing a year-to-date decline of 28.96%. Although, its stock price has seen a rise of 13.91% in the past year. In fact, the company is anticipating a loss of $0.16 per share with revenues of $95.35 million. At the time of writing, the Riot stock is trading hands at $10.87.

Although things are not looking good, there are signs that suggest a turnaround for Riot may be possible. Riot’s shares are on a bullish run, going above their five, 20,and 50-day exponential moving average. If it can maintain its bullish pressure, Riot Platforms could experience a comeback.

Moreover, Riot’s moving average convergence or divergence is indicated to be positive, at 0.73. While the stocks’ Relative Strength Index is at 73.07, which means that the stock is currently in overbought territory.

Based on data on Trading View, the stock has been going up due to a similar rise also found in other crypto mining stocks.

Reminder: Riot’s Q3 2024 earnings conference call is tomorrow, Wednesday, October 30, 2024, at 4:30 PM EST!

— Riot Platforms, Inc. (@RiotPlatforms) October 29, 2024

🖥 For the audio-only webcast, register here: https://t.co/YOrtZ57wgo.

📞 To dial in from the U.S. or internationally, register here: https://t.co/yNuMCbHmKX.

On Oct. 29, Riot Platforms posted a reminder on its X account that the company will be holding a conference call to go over its third quarter Q3 2024 earnings report on Oct. 30 4:30 PM EST. Its previous Q2 2024 earnings report showed a total revenue of $70 million, decreasing by 8.7% compared to its Q2 2023 revenue, which was $76.7 million.

The company stated the decrease was driven by a $9.7 million decrease in engineering revenues. Though, this was offset by a $6 million increase in Bitcoin mining revenue.

According to its press release, Riot is a Bitcoin mining and digital infrastructure company focused on a vertically integrated strategy. Founded in 2000, Riot has Bitcoin mining operations located in central Texas and Kentucky, as well as electrical switchgear engineering and fabrication operations in Denver, Colorado.