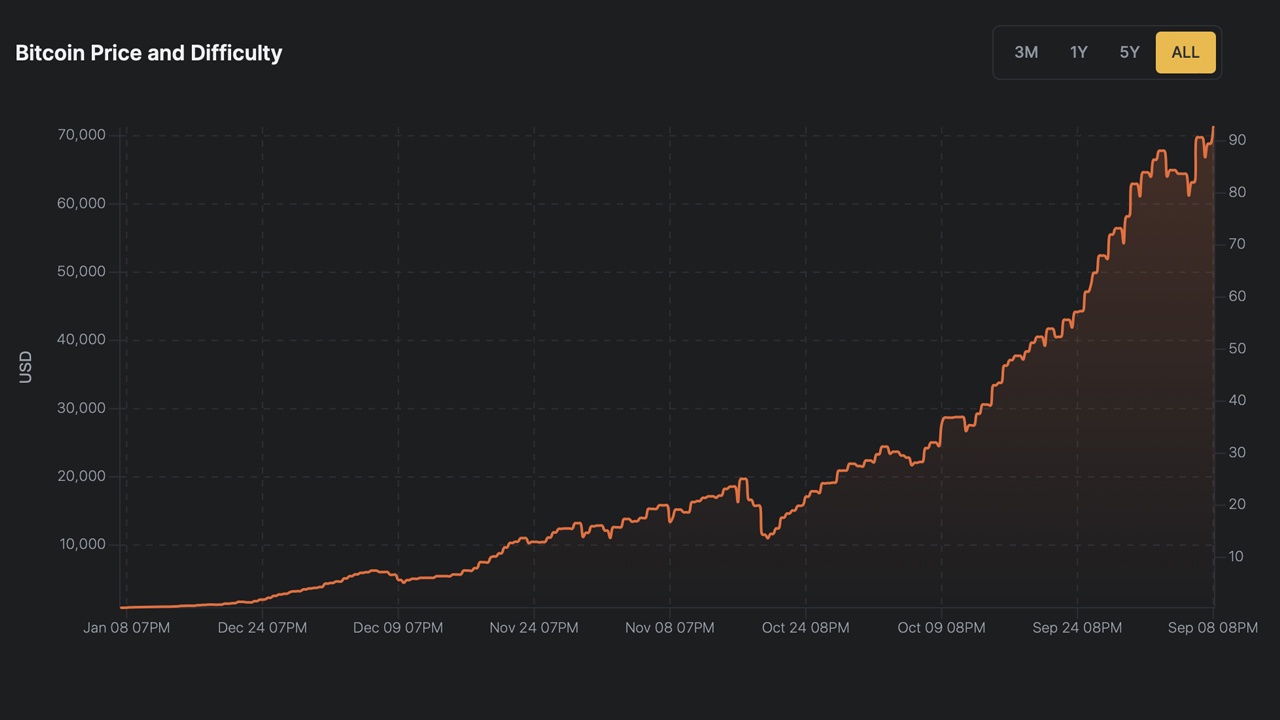

Bitcoin’s difficulty has soared once again at block height 866,880, reaching a record-breaking 95.67 trillion. Meanwhile, the network’s computational power is keeping pace, operating at a blazing 729.13 exahash per second (EH/s) at the time of reporting. In the coming days, it’ll be fascinating to watch how the combination of increased difficulty and dipping prices impacts bitcoin miners moving forward.

Bitcoin Miners Enter the Unknown as Difficulty Climbs

According to recent data, Bitcoin’s difficulty climbed to 95.67 trillion, reflecting a 3.94% increase. In other words, it’s now 3.94% tougher to mine BTC blocks than before the latest adjustment. This difficulty level means the mining process is 95.67 trillion times harder than when Bitcoin first launched in 2009.

The network regularly adjusts this figure to keep block production close to the ten-minute target. At this moment, Bitcoin’s difficulty has reached its highest point in the network’s entire history. What makes this difficulty adjustment particularly interesting is that the network’s hashrate remains well above the 700 exahash per second (EH/s) mark. According to Luxor’s hashrateindex.com, as of 8 p.m. Eastern on Oct. 23, the hashrate stands at 729.13 EH/s.

Presently, the leading five mining pools are Foundry USA, Antpool, Viabtc, F2pool, and Mara Pool. The next adjustment could bring more changes, and those committed to mining will need to stay adaptive in a market where conditions shift rapidly. At the current pace, Bitcoin’s mining difficulty will soon be at a whopping 100 trillion.

news.bitcoin.com

news.bitcoin.com