Institutional investors are being drawn to Bitcoin mining companies for their artificial intelligence (AI) potential, but they may end up reaping unexpected benefits from cryptocurrency bull markets.

“If we are right about our $200K Bitcoin price forecast, investors will come for AI and might end up enjoying the Bitcoin bull markets, without asking for it," a Bernstein report released Monday states, as it encapsulates a dual opportunity that institutional investors may not have anticipated.

This unexpected synergy between AI infrastructure and cryptocurrency mining is attracting attention from institutional investors who see beyond the traditional boundaries of these technologies.

According to Bernstein, Bitcoin miners are uniquely positioned in this space due to their substantial power resources and strategic locations.

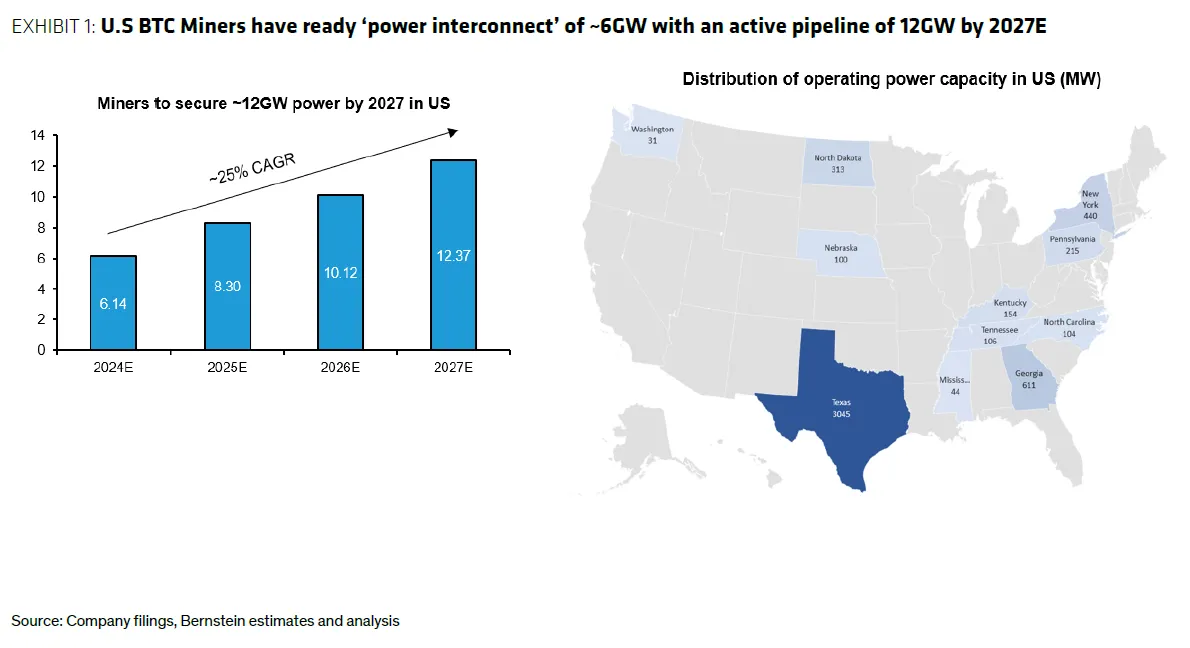

"Together Bitcoin miners have access to 4GW of power today, with operational interconnect going to 6GW by end of 2024," the report notes, underlining the significant infrastructure these companies have at their disposal.

Making a case for the re-rating of Bitcoin miners, Bernstein analysts write that they have equivalent power portfolios, however, trade at a discount to legacy data centers. ~$4mn per MW to ~$30-50mn/MW, however, miners also make a fraction of revenue per MW - $0.6mn per MW vs. $4.7mn per MW.

“As Bitcoin miners execute on their AI data center campuses, we believe this gap in both revenue and trading multiples will narrow,” Bernstein states.

According to Bernstein's analysis, Bitcoin miners have a significant edge when it comes to power infrastructure.

These operations currently have access to 4GW of power, with projections suggesting this could reach 12GW by 2027.

This massive power capacity, coupled with miners' experience in running high-density operations at 70-80KW per rack, aligns with the demanding power requirements of AI computing.

Unlike traditional data centers, Bitcoin miners have strategically built their operations around "stranded power" sources, often in unconventional locations where land and power are abundant.

This approach has led to the development of sprawling sites, some spanning hundreds of acres, with power capacities ranging from 100MW to 1GW.

For instance, TeraWulf's (WULF) Lake Mariner site in Western New York boasts a potential 500MW hydropower capacity, complete with ample water resources for cooling—a crucial factor for both cryptocurrency mining and AI operations.

Bernstein further states that Bitcoin miners' expertise extends beyond mere access to power and that their profitability hinges on sophisticated power cost management, including hedging strategies in wholesale trading markets and collaborative relationships with utilities and grid operators.

This know-how could prove invaluable in managing the energy-intensive demands of AI computing.

Edited by Stacy Elliott.

decrypt.co

decrypt.co