As summer looms, CryptoQuant warns that Bitcoin miners could face significant challenges ahead, particularly if prices fail to recover substantially during the warmer month.

Despite Bitcoin‘s price dipping below the $58,000 mark and prompting weaker investors to sell at current levels, major capitulation among Bitcoin miners has yet to begin. CryptoQuant head of research Julio Moreno said in an interview with crypto.news that the network hashrate remains slightly higher than pre-halving levels, noting that miners “can still make a profit” with “relatively efficient equipment.”

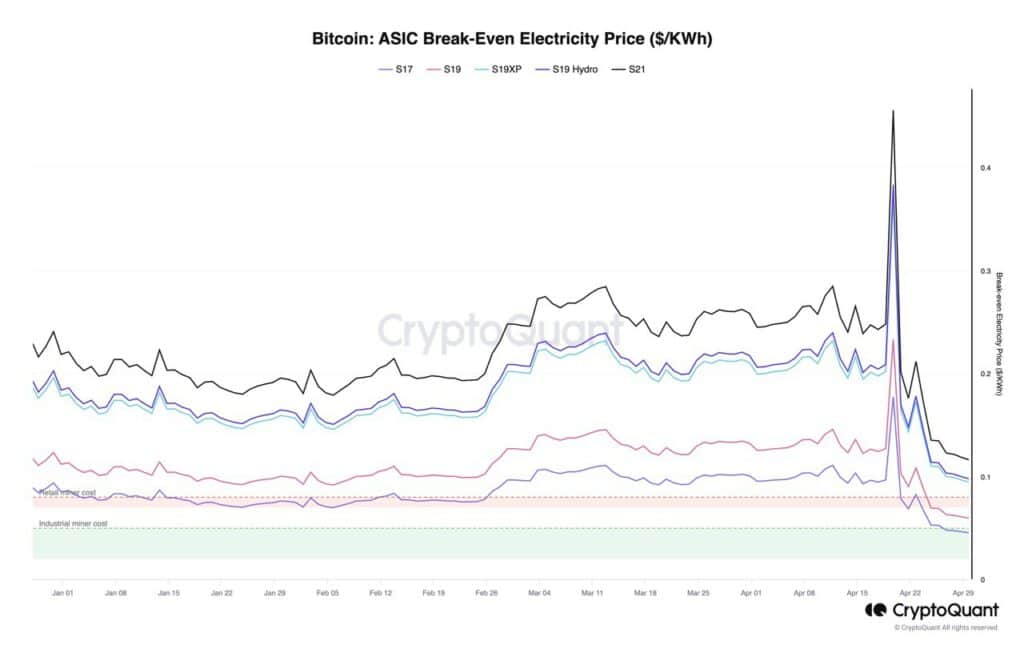

Moreno says the profitability is still can be seen in the break-even electricity price for ASIC models S19 and S21, which remain above the electricity cost of large industrial miners (green area).

However, he also noted that some retail miners, particularly those using older ASICs like S17 and S19, may be experiencing negative profits “due to higher electricity costs,” adding a capitulation event “will depend on how network hashrate and prices evolve in the next few weeks.”

Addressing concerns about potential price volatility during the summer trading slowdown, Moreno emphasized that miners typically respond to price movements rather than the other way around. Yet, he didn’t rule out the possibility that Bitcoin could see more selling pressure in the coming months.

“[The market is] more likely to see a miner capitulation if prices don’t recover significantly during the summer. Especially with the hashprice (average miner revenue per hash) making new lows.”

Julio Moreno

As crypto.news reported earlier, Bitcoin miners are not selling their crypto holdings at current prices even though their revenue has dropped to levels last seen in early 2023 due to the recent halving, which reduced fixed block rewards from 6.25 $BTC to 3.125 $BTC. According to CryptoQuant CEO Ki Young Ju, miners now have two options: capitulate or wait for a rise in Bitcoin’s price, which is currently trading below the $58,000 mark.