The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

With Bitcoin’s next halving set to take place this month, miners are using record profits to adapt their business models for chaotic opportunities.

The halving is almost upon us. As the whole world of Bitcoin waits with bated breath for mining rewards to be cut in half, the potential for new revenue streams has left us wondering how the space will react to new market conditions. Halvings in the past have generally been associated with prosperity for Bitcoin, but they’ve also been known to shake up previously-held assumptions in a big way. We’re already seeing a few examples of these market changes; just to name one, the larger miners have been modernizing their equipment to ensure maximally efficient hardware. This has led to a fire sale of outdated equipment from these companies, with many thousands of mining rigs finding their way to aspiring miners in Africa and Latin America. The cheap hydroelectricity from Ethiopia has already been attracting international capital to become a new mining hub, and a large portion of these rigs are going there for pennies on the dollar.

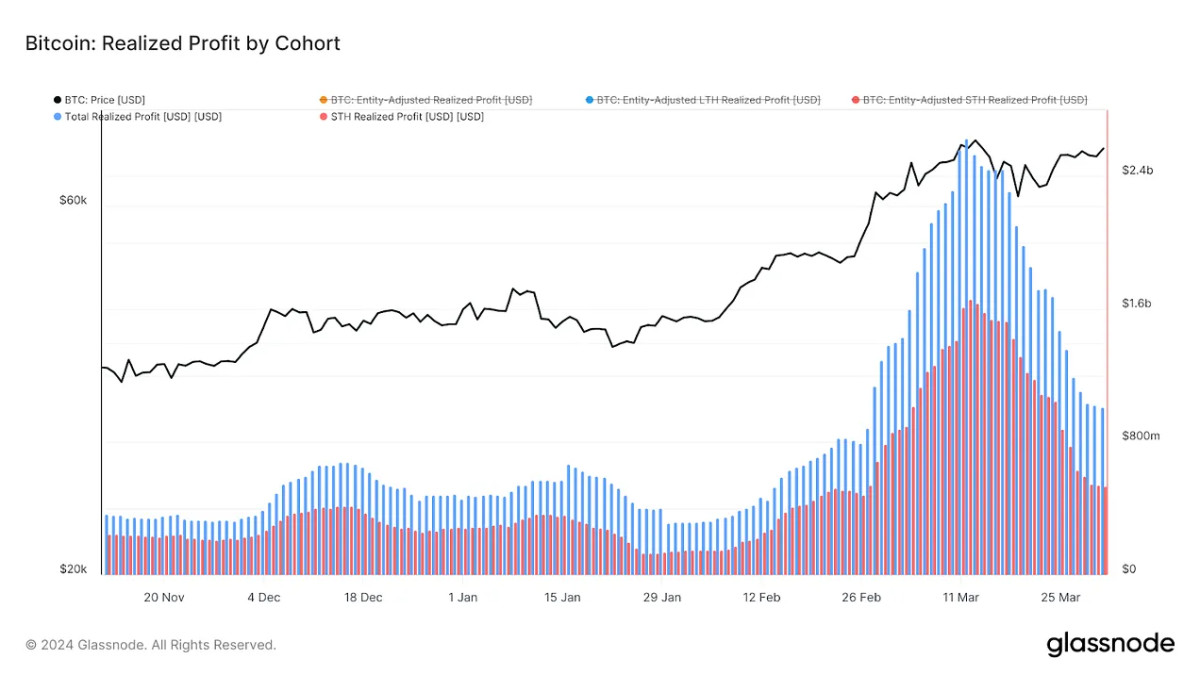

In other words, miners are expecting to see less output in the immediate future, but this has nevertheless incentivized the creation of new mining companies worldwide and net growth for the industry. This is just one illustration of the sorts of unexpected opportunities that will take the digital asset space by storm, and it’s up to Bitcoiners to seize on them. For miners as a whole, opportunities are certainly plentiful. March 2024 saw the highest ever monthly revenues for the collective mining industry, just topping $2 billion. This is particularly noteworthy because less than half of this revenue has come from transaction fees, a far cry from the situation in December where transaction fees outpaced mining rewards.

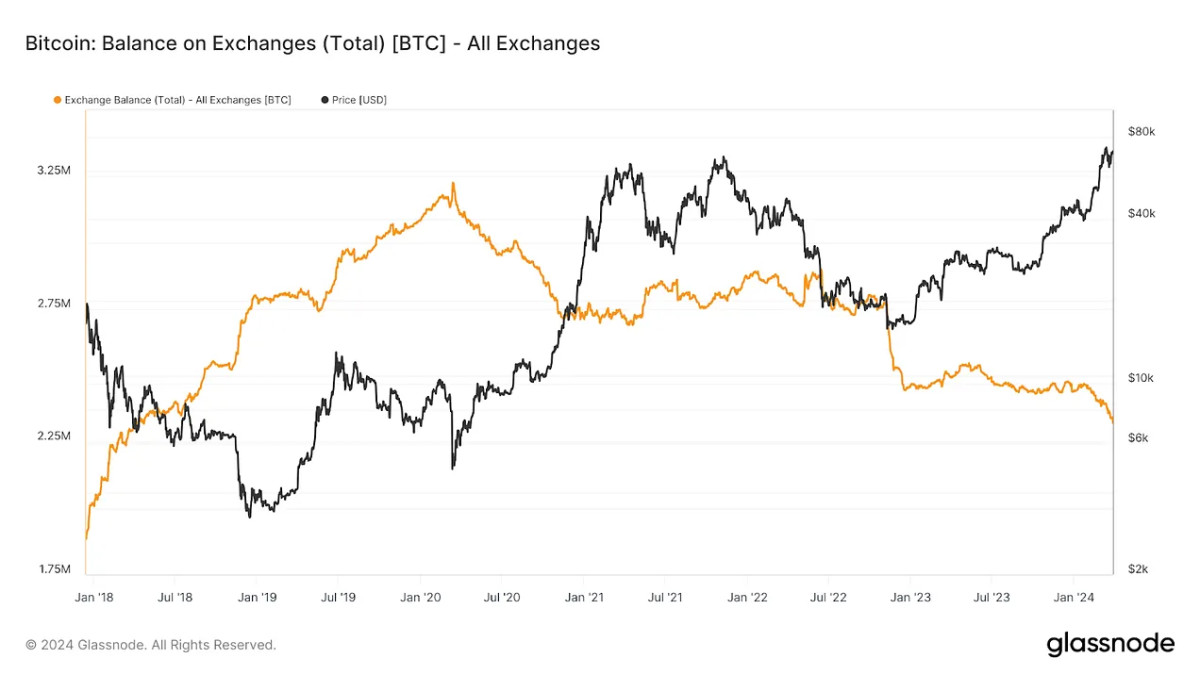

In December, the price of Bitcoin was far lower, and the blockchain was plagued with congestion. Not only did this congestion suppress the demand for buying Bitcoin, but it also raised the demand for miners to process the blockchain. Simply resolving transactions on already-mined Bitcoin made up a larger share of profits than mining and selling new ones, and this enterprise became a lifeline for many smaller firms. Now, however, it seems like the money is flowing all around. Bitcoin ETFs are gobbling up Bitcoin at extreme rates—more than 6x the actual output of miners. The bonanza has even brought venture capital interest squarely back into focus, further increasing the frenzy. In the first three months of 2024, major exchanges collectively saw their reserves of Bitcoin drop by nearly $10 billion, revealing the immense demand for newly-mined coins. With market conditions like this, it’s no wonder that miner profits have hit an all-time record.

However, although this period of intense sales has certainly created an opportunity for the miners, there are also perils associated with the halving. These companies are in a mad dash to secure as much revenue as possible pre-halving, and the race is so desperate for one simple reason: trendlines may give encouraging data, but there’s no actual guarantee that Bitcoin’s price will climb accordingly after its supply is cut down. Halving hype and the runaway success of ETFs have brought Bitcoin’s price to its highest levels, but this record has been followed by volatility. Bitcoin has hovered around its great benchmark ever since passing it without continuing to rally in a bombastic spike. If Bitcoin’s price continues to behave in unexpected ways, it will eventually wreak havoc on smaller firms and promote industry consolidation.

Additionally, a particularly interesting development has emerged in the secondary Bitcoin markets. Since the rapacious demand of ETF issuers and other financial institutions has completely outpaced supply, some long-term holders (LTHs) have been awakening to fears of a generalized liquidity crisis. Whales previously content to hold Bitcoin for years at a time have changed their behavior, evidently deciding that now is the time to finally realize massive profits. March 2024 has seen long-term holders begin selling their assets at unprecedented rates, raking in a disproportionate amount of profit in relation to other Bitcoin sellers. Obviously, a resource like this cannot last forever, but it’s an important reminder to some of the miners: just because you’re having trouble making ends meet post-halving, it doesn’t mean the industry is. Adapt, or the space will find new ways to leave you behind.

Nevertheless, miners big and small have not taken on the challenge of the halving lying down. These runaway profits have enabled businesses to invest in a wide variety of preparation strategies, sometimes even dramatically shaking up their business models. For example, the American firm Arkon Energy has previously operated more as an infrastructure company, viewing itself as a provider for a client base of independent miners. As it announced a major purchase of state-of-the-art mining equipment on April 2nd, it joined an industry-wide trend of preparing for the halving with maximally efficient machines. Rather than offering this equipment to its previous clientele, however, Arkon has stated its intention to pivot and simply mine Bitcoin themselves. This simple shift represents a dramatic change in their overall business model, and they plan to follow through by “aiming to make Arkon one of the most efficient miners in the world”.

Leading miner Hut 8, on the other hand, has initiated a business model pivot of its own, but in a slightly different direction. A Q1 earnings call in late March saw CEO Asher Genoot acknowledge that 70% of the company’s revenue came from asset mining, but that plans were expected to change somewhat as the halving approaches. Hut 8 is still focusing on upgrading its hardware and exploiting energy resources at new sites, like many other mining companies, but it’s also investing in a new direction. This new direction is not in a different asset, as its mining operations are focused on Bitcoin, but rather in developing high-performance computing and AI operations. Genoot claimed that these new operations were “sub-scale today… But we are excited about that business because we see it as a foundation to be able to grow." He added that “You’ll see us continuing to be creative in how we maximize the value of every machine,” stressing the need to maintain an eager and disciplined attitude toward the existing mining operations.

These are just a couple of the different new strategies that miners are taking to anticipate the halving. Companies have been preparing for months now, and there is still time to make additional new plans. At the time of writing, the halving is in less than three weeks, and the countdown to this event reveals the optimistic and celebratory attitude of Bitcoiners everywhere. No matter what happens when the long-awaited day finally gets here, a few constants seem very reliable. There will be an immense demand for the world’s leading digital asset, and the Bitcoin community will have the same innovative spirit as always. Whether Bitcoin jumps right away or behaves unpredictably, it’s certain that someone will wind up a big winner. For us Bitcoiners, that means there’s plenty to look forward to.

bitcoinmagazine.com

bitcoinmagazine.com