Marathon Digital Holdings (NASDAQ: MARA) is the world’s largest publicly traded Bitcoin ($BTC) mining company. Institutional investors have gradually increased their positions in Marathon despite the block subsidy halving expected in April.

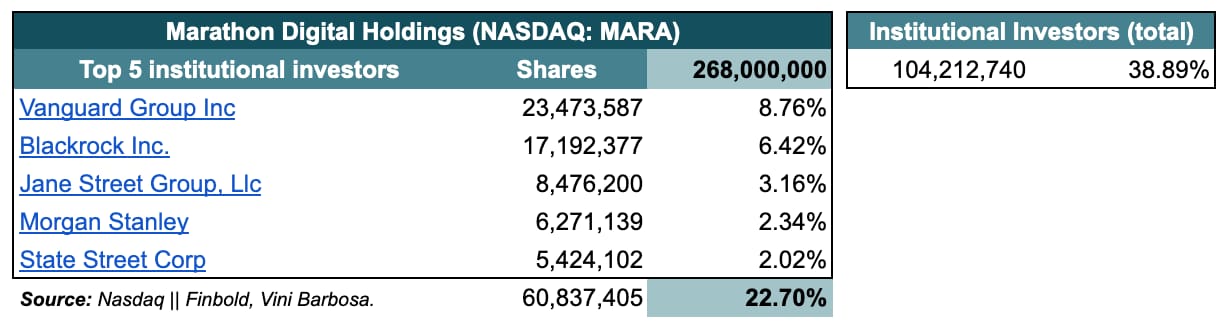

In particular, institutional investors own 38.9% of Marathon’s outstanding shares, holding 104,212,740 out of the 268 million. Finbold gathered this data from Nasdaq, which also shows the top five institutional shareholders of the Bitcoin mining company.

First, Vanguard holds 23.47 million shares (8.76%). Next, BlackRock and Jane Street have 17.19 million (6.42%) and 8.47 million (3.16%), respectively. Morgan Stanley has 6.27 million (2.34%) and State Street is the fifth-largest with 5.42 million (2.02%).

These five institutional investors sum up to 60,837,405 shares and own 22.7% of Marathon Digital Holdings.

Marathon stock analysis

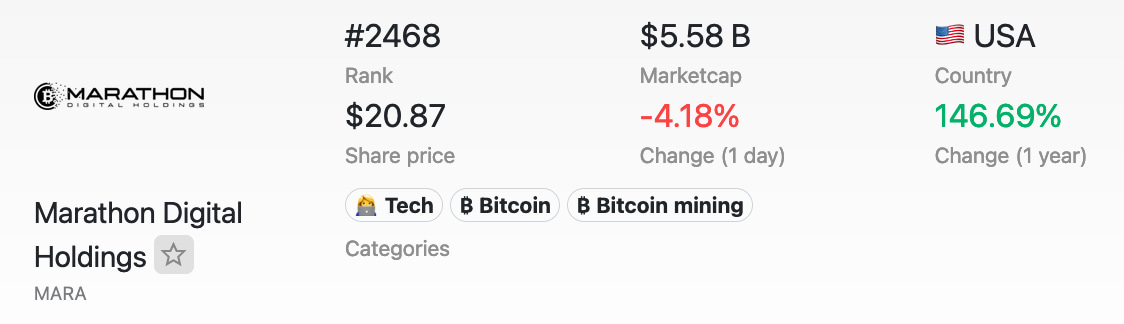

Notably, MARA is the leading company in the Bitcoin mining category, according to the CompaniesMarketCap index, with a $5.58 billion capitalization. This makes Marathon the 2,468th most valuable company in the world, also representing the technology and Bitcoin categories.

MARA stock closed March 22 at $20.87 per share. Thus, losing 4.18% intraday and registering accumulated gains of 146.69% year-over-year.

Bitcoin halving and its effects on mining companies and institutional investors results

The core revenue of Bitcoin mining companies comes from mining $BTC and collecting block rewards in fees and block subsidies. Essentially, miners compete with each other to find the next valid block through proof-of-work, measured in hashrate.

Only one miner (or mining pool) has the right to claim the rewards of each block. In the case of pools, the members will share the reward proportionally to their contributed hashrate.

However, Bitcoin’s block subsidy halves approximately every four years or exactly every 210,000 blocks. Currently, over 98% of the block rewards come from the subsidy, for 900 $BTC daily on average. That is the issuance of new $BTC units through a ‘coinbase’ transaction.

Within the halving, Bitcoin mining companies will see their revenue cut in nearly half if $BTC’s price remains the same. For that reason, stocks like MARA can show some correlation to Bitcoin, price-wise, and its revenue can suffer from this year’s halving.

In conclusion, institutional investors owning a significant part of Marathon and other Bitcoin mining companies show a positive bias towards $BTC’s price in the future. As of writing, these finance giants own over one-third of the company’s shares.

This highlights an increased influence from Wall Street over Bitcoin’s security and consensus mechanism. Moreover, the expected revenue drop unveils the challenges of the sector.

finbold.com

finbold.com