With roughly just two months left until the fourth halving reduces the BTC production supply by half, miners seem to be operating on a high level on the largest blockchain.

The Bitcoin mining difficulty metric increased by more than 8% yesterday and soared to a new all-time high, while the hash rate has slightly declined since its peak earlier this month.

Difficulty Grows by 8%

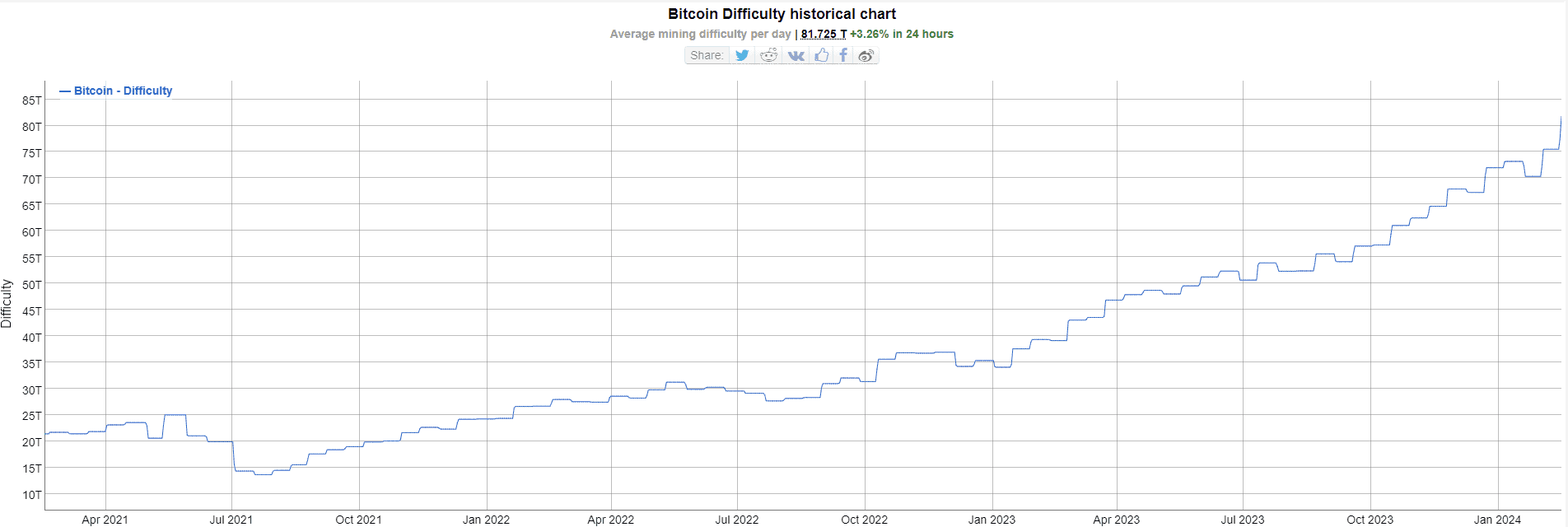

The Bitcoin mining difficulty is among the most important features of the BTC blockchain. It readjusts every 2,016 blocks (about two weeks) depending on the mining power. In other words, when there are more miners putting their computational devices to work on the Bitcoin blockchain, the difficulty increases, making it harder for them to mine new BTC in order to preserve the block production ratio and vice versa.

The metric has been rising steadily for the past several years, showing no signs of miners’ capitulation despite the Chinese ban on everything crypto and the painful bear market in 2022 and 2023.

In fact, the mining difficulty has quadrupled since February 2021, when it hovered around 20T. Data from BitInfoCharts shows the latest increase when it came yesterday of 8.2%. It took the mining difficulty to a new all-time high of over 81T.

As mentioned above, this showcases the network robustness, which is particularly interesting to follow given the upcoming halving. As reported yesterday, speculations arose that the hash rate could go down ahead of the event as some miners might unplug their machines from the blockchain.

There are some signs that this could be the case, as the BTC hash rate (currently at 550 Ehash/s) is already down by 15% since its ATH of over 650 Ehash/s registered at the beginning of the month.

BTC Price Update

The mining difficulty is not the only part of the Bitcoin landscape that has been increasing lately. BTC’s price has been on a roll for the past ten days, jumping by nearly $10,000.

This resulted in breaking out of its $43,000 resistance and soaring past $50,000 for the first time in over two years. Furthermore, the cryptocurrency kept going further and neared $53,000 yesterday to chart a new peak.

Nevertheless, the rally was halted at this point as BTC couldn’t breach that level. As of now, the asset stands close to $52,000 and is up by 10% over the past week.

cryptopotato.com

cryptopotato.com