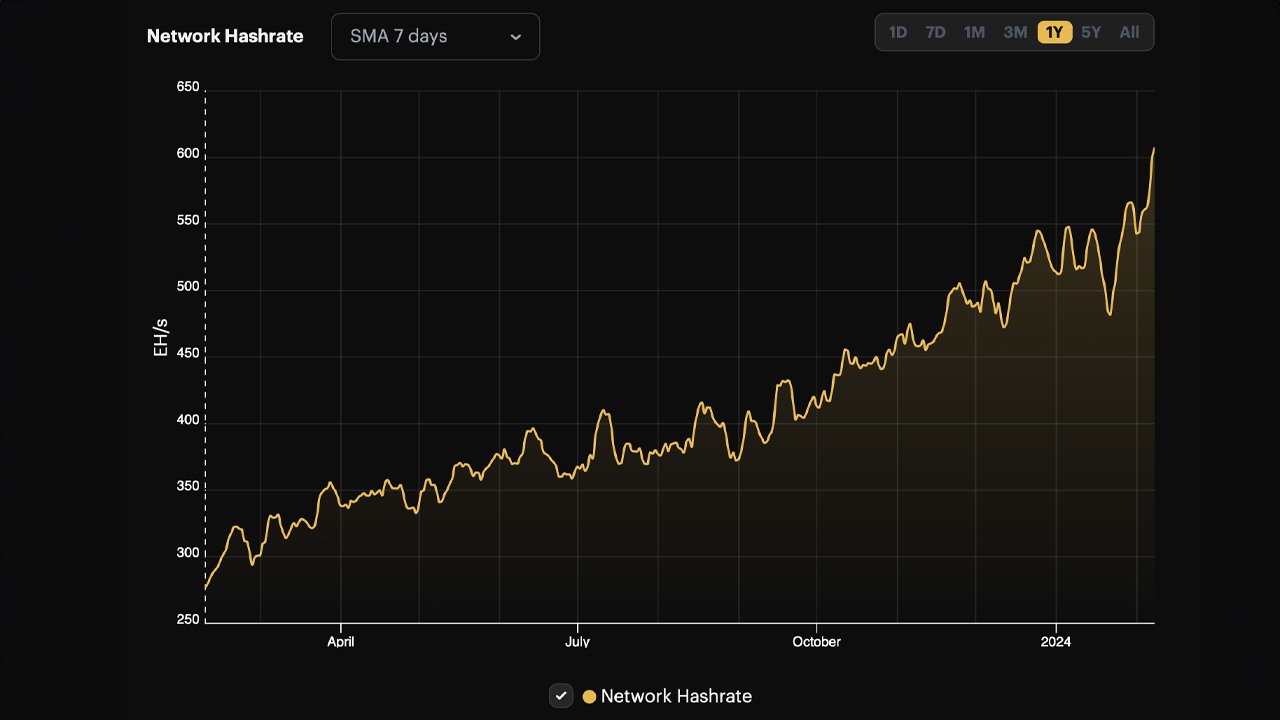

Bitcoin’s computational power soared to unprecedented heights this week, climbing to 609 exahash per second (EH/s) on Thursday, as per the seven-day simple moving average (SMA). Over the last year, figures reveal a staggering increase in Bitcoin’s hashrate, surging by 332 quintillion hashes per second.

Bitcoin’s Computational Power Skyrockets

On Feb. 8, 2024, the hashrate targeting the Bitcoin (BTC) network hit a record peak, ascending to 609 EH/s, according to the seven-day SMA. Data from the three-day SMA shows a peak at 617 EH/s, while 30-day metrics show a height of 551 EH/s.

The surge in hashrate aligns with BTC’s significant increase in value, as the leading crypto asset by market cap breached the $45K mark per unit on Thursday. This uptick in BTC’s market value has elevated the daily expected earnings from one petahash per second (PH/s), or one quadrillion hashes per second (H/s), moving up from $74.91 to the present rate of $79.61.

Over the last year, Bitcoin’s hashrate has been on an impressive upward trajectory, with a substantial increase of 332 EH/s recorded since Feb. 7, 2023. Miners recently navigated through a 7.33% increase in mining difficulty on Feb. 2, 2024, with the forthcoming adjustment anticipated on Feb. 15.

Currently, with block intervals trending quicker than the standard ten-minute target, an expected difficulty hike ranging from 5.3% to 10.3% looms. Block durations have clocked in at between nine minutes and 17 seconds to nine minutes and two seconds as of block height 829,569, indicating just over 1,000 blocks remain until the next difficulty epoch.

At press time, around 54 mining entities are actively mining BTC, with Foundry USA at the forefront. In the last three days, Foundry has committed 185.45 EH/s to the Bitcoin network, representing 30.79% of the total hashrate.

Antpool is not far behind, wielding 166.26 EH/s, or about 27.6% of the total. They are trailed by F2pool with 71.62 EH/s (11.89%), Viabtc with 69.06 EH/s (11.46%), Binance Pool with 19.18 EH/s (3.18%), Mara Pool also at 19.18 EH/s (3.18%), and Luxor with 16.63 EH/s (2.76%).

The ascension in Bitcoin’s hashrate is attributable to several catalysts, including the climb in BTC prices. Additionally, the introduction of new, more efficient mining rigs that boast greater terahash outputs and reduced energy consumption per terahash has played a crucial role.

Following the launch of these advanced application-specific integrated circuit (ASIC) bitcoin mining rigs, publicly listed mining companies have invested in tens of thousands of these machines. Mining organizations have also disclosed expansions of their sites to boost megawatt (MW) capacity, and some have managed to secure affordable ASICs and turnkey bitcoin mining setups for a fraction of the cost, following the liquidation of several entities during the last ‘crypto winter.’

What do you think about the hashrate rising to 609 EH/s on Thursday? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com