CleanSpark Inc. is gearing up to double its hash rate by the first half of 2024 as it prepares for the Bitcoin halving event. The Bitcoin miner has announced plans to acquire four new mining facilities ahead of the impending reward reduction for cryptocurrency mining.

You might also like

Primary US Bank Allowing Customers to Hold Cryptocurrency in Checking Accounts Withdraws from Crypto Market

EigenLayer Raises Staking Cap, Total Value Locked Surges Above $3B

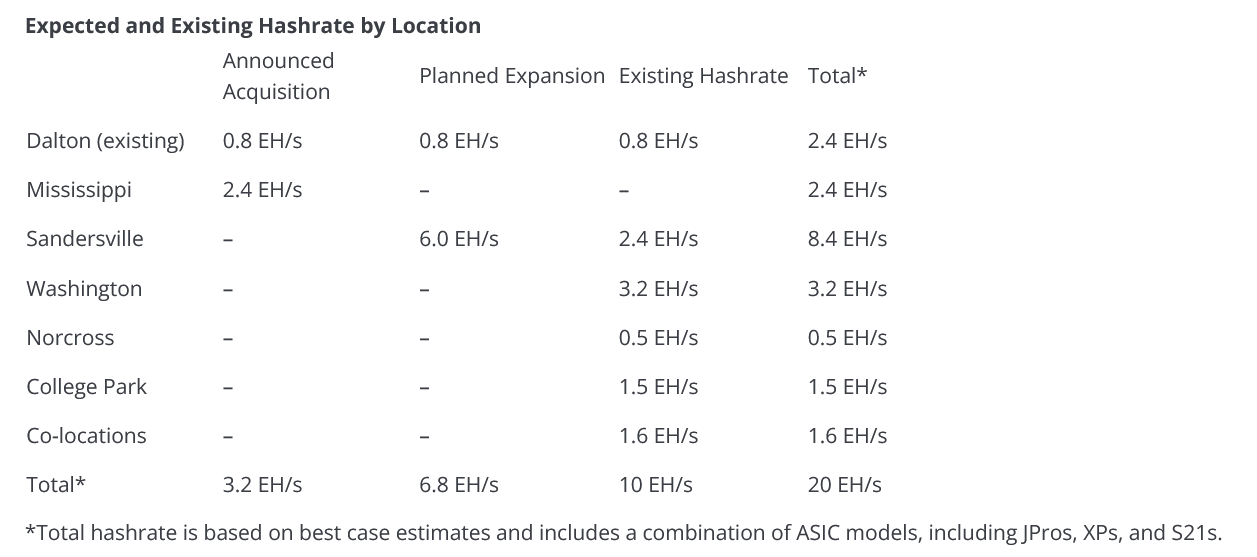

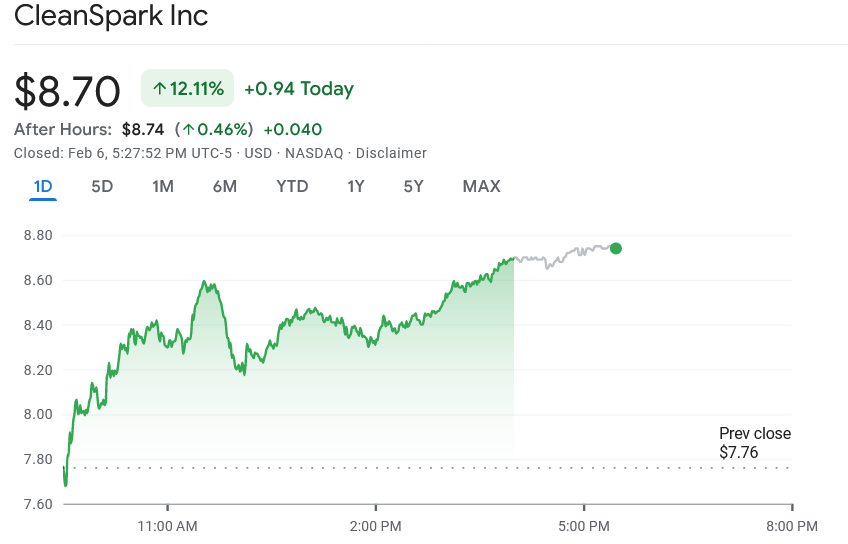

On February 6, CleanSpark disclosed its purchase of three mining facilities in Mississippi for $19.8 million, expected to yield an immediate hash rate of 2.4 exahashes/second (EH/s) upon finalisation. Additionally, the company has agreed to acquire another mining facility in Dalton, Georgia, for $6.9 million, generating 0.8 EH/s. However, this facility is still under construction and is scheduled to become operational by April 2024. Following the announcement, CleanSpark’s shares surged by 12%.

With the upcoming energization of its Sandersville expansion, which will add 6 EH/s to its hash rate, CleanSpark anticipates doubling its operating hash rate from 10 EH/s to 20 EH/s in the first half of 2024.

Today we announced two new acquisitions, that combined with the imminent energization of the Sandersville expansion, provide us the additional power needed to double our current operational #hashrate of 10 EH/s and exceed 20 EH/s during the first half of 2024.$CLSK is venturing… pic.twitter.com/LLge0BlcOV

— CleanSpark Inc. (@CleanSpark_Inc) February 6, 2024

These strategic moves align with CleanSpark’s readiness for the impending Bitcoin halving event, expected in late April, where the mining reward will decrease from 6.25 BTC to 3.125 BTC.

CleanSpark CEO Zach Bradford highlighted that these acquisitions enhance operational efficiencies in preparation for the halving.

The company’s stock (CLSK) closed trading on February 6 at $8.70, marking a significant gain of over 12% for the day. In after-hours trading, CleanSpark saw a slight increase of less than 0.5%, according to Google Finance.

Shares of CleanSpark’s competitors, Marathon Digital Holdings and Riot Platforms, also experienced gains on the day, rising by 2.5% and 4.5%, respectively.

Throughout 2023, CleanSpark shares surged by 440%, although the company faced a price correction at the beginning of 2024, resulting in a 20% year-to-date decline.

coinculture.com

coinculture.com