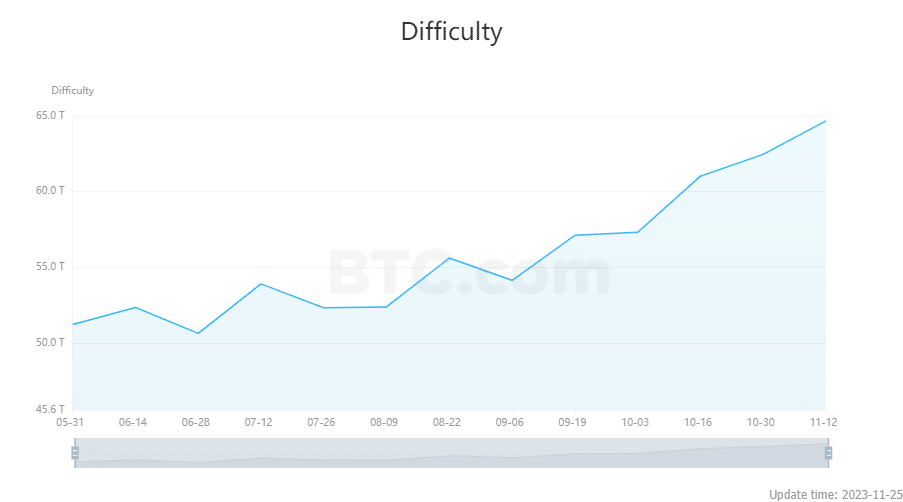

Bitcoin mining has hit a historic high, with a 5.07% surge in mining difficulty — a record 67.96 T.

Data from blockchain explorer BTC.com indicates the leap in Bitcoin (BTC) mining difficulty has reached an unprecedented 67.96 T (terahashes), with the average hashrate — the Bitcoin network’s computational power gauge — standing at a robust 504.80 EH/s (exahashes per second).

Bitcoin mining difficulty ushered in a mining difficulty adjustment at block height 818496. The mining difficulty was raised by 5.07% to 67.96 T, continuing to hit a record high. The current average hashrate of the entire network is 504.80 EH/s. https://t.co/vgAkEgyDOf

— Wu Blockchain (@WuBlockchain) November 26, 2023

Bitcoin mining difficulty has been on a steady upward trend throughout 2023, and the latest adjustment at block height 818496 is another meaningful landmark for the digital currency.

Mining difficulty is a dynamic metric that adjusts roughly every fortnight in order to uphold consistent block time, which is the duration it takes to locate and append a new block to the blockchain.

These tweaks are vital to offset changes in the Bitcoin network’s hashrate and preserve a 10-minute average block time.

Alongside the climb in mining difficulty, Bitcoin’s hashrate has rocketed to a new peak of 491 EH/s. This figure represents a rise in the combined computational power miners are dedicating to the Bitcoin network’s security.

The latest difficulty increase is particularly significant as crypto market watchers look forward to the upcoming Bitcoin halving event, slated to happen in approximately five months.

Historically, Bitcoin halving events, which curtail the rate of new coin production, have coincided with BTC price hikes due to the combined influence of diminishing supply and speculative anticipation.

The coin is currently trading at $37,283 per data from CoinGecko, a 1.3% dip from the previous day. However, it is a 2% improvement over the last seven days and 10% over the month. Significantly, BTC is also up 125% on its previous level from a year ago.

Apart from the halving event, analysts also anticipate a significant price surge for BTC in the next year, propelled by the expected approval of spot Bitcoin exchange-traded funds by the U.S. Securities and Exchange Commission.