Cryptocurrency mining is one of the ways in which blockchain networks can achieve distributed consensus and ensure that all transactions are following the protocol’s rules. However, crypto mining has fallen out of favor as of late and Proof-of-Stake cryptocurrencies have become increasingly popular. In fact, Ethereum has completely abandoned mining and transitioned over to Proof-of-Stake.

So, is crypto mining dead or is there still profit to be made? In this article, we’ll explore the current state of crypto mining and whether it’s worth your time.

Is crypto mining dead?

The short answer is that crypto mining is not dead, but it seems quite evident that cryptocurrency mining will become less relevant over time, with the exception of Bitcoin mining. Out of the 10 largest cryptocurrencies by market capitalization, only two (Bitcoin and Dogecoin) are secured through mining. The others use Proof-of-Stake or are issued as tokens on top of existing Proof-of-Stake blockchains.

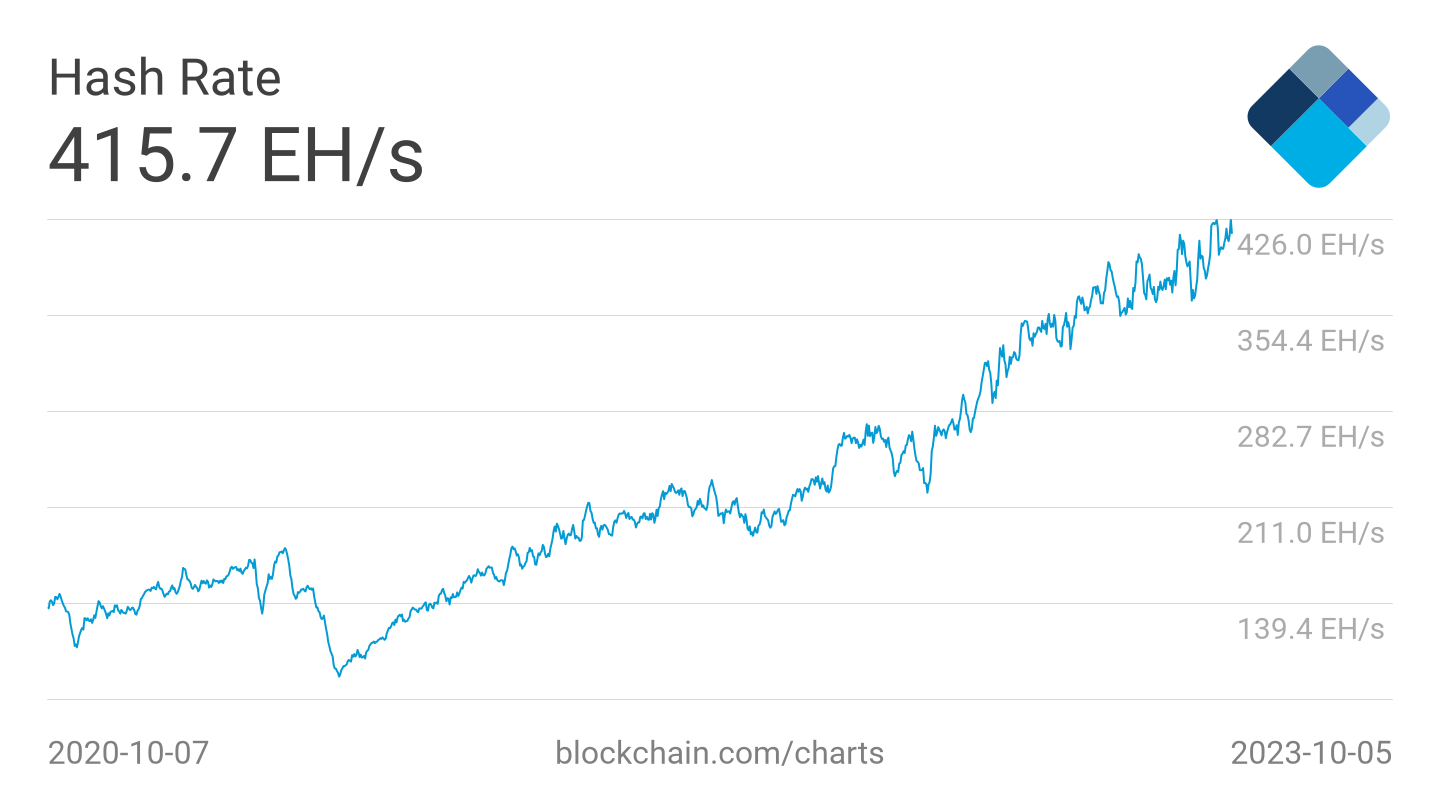

Despite the declining popularity of Proof-of-Work cryptocurrencies as a whole, the Bitcoin mining ecosystem is still very strong. As we can see from the 3-year Bitcoin hashrate chart, the mining power of the Bitcoin network has been increasing steadily despite the fact that Bitcoin has been in a bear market since 2022.

Bitcoin hashrate chart over the last 3 years. Image source: Blockchain.com

While the raw hashrate chart indicates that the Bitcoin network is very healthy and becoming more secure over time, there are some concerns about the dominance of the largest Bitcoin mining pools.

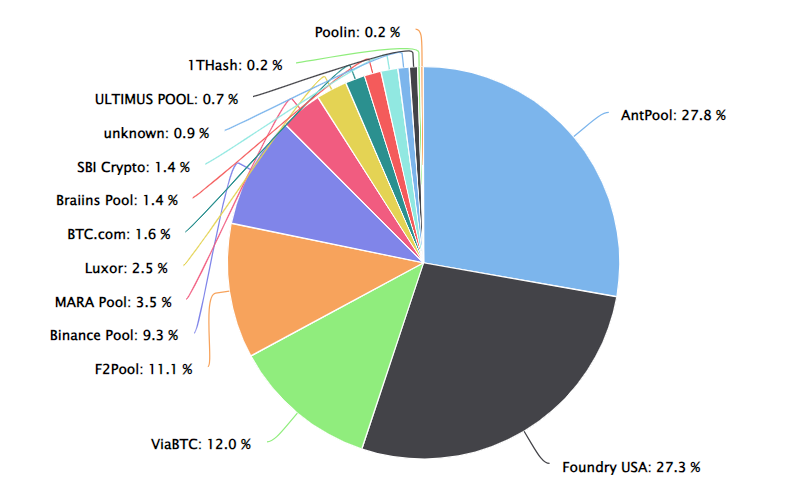

The three largest Bitcoin mining pools — AntPool, Foundry USA and ViaBTC — control 67.1% of the Bitcoin hashrate at the time of writing this article. By themselves, AntPool and Foundry USA combine for 55.1%. If the largest pools were to collude with each other, the integrity of the Bitcoin network could be at risk.

The distribution of Bitcoin hashrate by mining pool. Image source: BTC.com

Is there a future in crypto mining?

In the near future, crypto mining will almost assuredly remain a part of the crypto and blockchain sector. However, over the long term, there are some questions about the sustainability of crypto mining, especially for coins such as Bitcoin that have a limited supply.

In Bitcoin, for example, the rewards issued to miners are reduced by 50% approximately every four years through a mechanism called the Bitcoin halving. This process will continue until approximately 2140, when the last Bitcoin is expected to be mined.

Bitcoin miners earn revenue through two mechanisms. When they add a block to the Bitcoin blockchain, they receive the block reward (currently 6.25 BTC), as well as the transaction fees users pay to get their transactions into the block.

Currently, the vast majority of the revenue generated by Bitcoin miners comes from the block reward. The chart below demonstrates what percentage of total rewards collected by miners comes from fees. In the last two years, fees have usually accounted for less than 5% of the total rewards collected by miners, outside of a spike in May 2023.

Bitcoin fee to reward ratio chart. Image source: BitInfoCharts.

As the block reward continues to drop over time, Bitcoin miners will become increasingly reliant on transaction fees to finance their operations. Over the long term, we will either have to see a large increase in the Bitcoin price or a big spike in demand for Bitcoin transactions. Otherwise, the Bitcoin network’s hashrate could drop as some miners would be forced to shut down their operations.

Some cryptocurrencies, for example Monero, have put mechanisms in place to prevent such a scenario. For example, Monero will keep its current 0.6 XMR block reward in perpetuity to ensure that miners will continue to be sufficiently incentivized. However, the trade-off is that the XMR supply will continue to slowly inflate over time.

Is mining crypto worth it in 2023?

The answer to whether crypto mining is worth it in 2023 depends on the cryptocurrency you are trying to mine. For individuals with relatively small amounts of capital, mining Bitcoin is not the best idea in 2023. This is because Bitcoin can only be profitably mined with ASIC miners, which are quite expensive to obtain.

The Bitmain Antminer S21 Hyd, which is estimated to bring about $5.46 per day in profit according to ASIC Miner Value and is currently the most efficient Bitcoin miner, costs a whopping $7,599 in preorders. Based on current estimates, it would take almost 4 years for the miner to pay for itself.

The bottom line is that Bitcoin mining isn’t worth pursuing unless you have enough capital to benefit from economies of scale. For most regular cryptocurrency investors, the math simply doesn’t add up. If you’re bullish on Bitcoin, it’s a much better idea to simply buy some BTC rather than trying to get into Bitcoin mining.

The reason why crypto mining is not profitable for most people is that the space is simply too competitive, and large players benefit from economies of scale that most individuals simply don’t have enough capital to achieve.

Of course, if you’re interested in Bitcoin mining as a hobby and like the idea of contributing to the security of the Bitcoin network, Bitcoin mining might still be a worthwhile pursuit for you even though it might not be profitable.

For average crypto investors, it might be worth it to look into mining a cryptocurrency that can be mined efficiently with consumer-grade computer hardware. Such cryptocurrencies are usually called “ASIC resistant”, as they are designed to deter mining with ASIC chips.

One example of an ASIC resistant cryptocurrency is Monero, which can be mined effectively with the CPUs (central processing units) used in mainstream desktop and laptop computers.

Will crypto mining last forever?

One of the main reasons why investors are attracted to Bitcoin is its stability (outside of price movements), and the Bitcoin community is usually quite hesitant to make any significant changes to the protocol. At the moment, it seems extremely unlikely that Bitcoin would ever move away from its Proof-of-Work consensus mechanism or introduce any changes to the supply dynamics of BTC.

Ethereum, the second largest cryptocurrency by market capitalization, moved away from mining and adopted Proof-of-Stake consensus in September 2022. So far, the transition has been received as a success by the Ethereum community and the move to PoS has also made ETH a more attractive long-term investment thanks to the concept of the Ethereum triple halving.

Overall, most new layer 1 blockchains that enter the market don’t use mining. Instead, they rely on different variants of Proof-of-Stake consensus.

Here, we should also mention that Zcash, which is current the eighth-largest Proof-of-Work cryptocurrency by market cap, will likely transition over to a Proof-of-Stake consensus mechanism in the coming years. We would not be surprised if certain other PoW cryptocurrency projects decided to make the same transition as well, especially if Ethereum’s move to PoS continues to be proven as successful.

The bottom line

Crypto mining is not dead, but the crypto and blockchain sector is quite clearly favoring Proof-of-Stake at the moment. Of course, the biggest exception here is Bitcoin, which will likely keep its Proof-of-Work consensus mechanism for as long as possible.

Most Bitcoin miners will likely survive, although the sector is bound to become increasingly competitive with each halving, forcing the least efficient miners to shut down their operations. The sector will also be interesting to watch from a regulatory perspective, as some lawmakers are alleging that Bitcoin mining is a waste of resources.

If you would like to learn more about how mining works, check out our article explaining Proof-of-Work consensus.

coincodex.com

coincodex.com