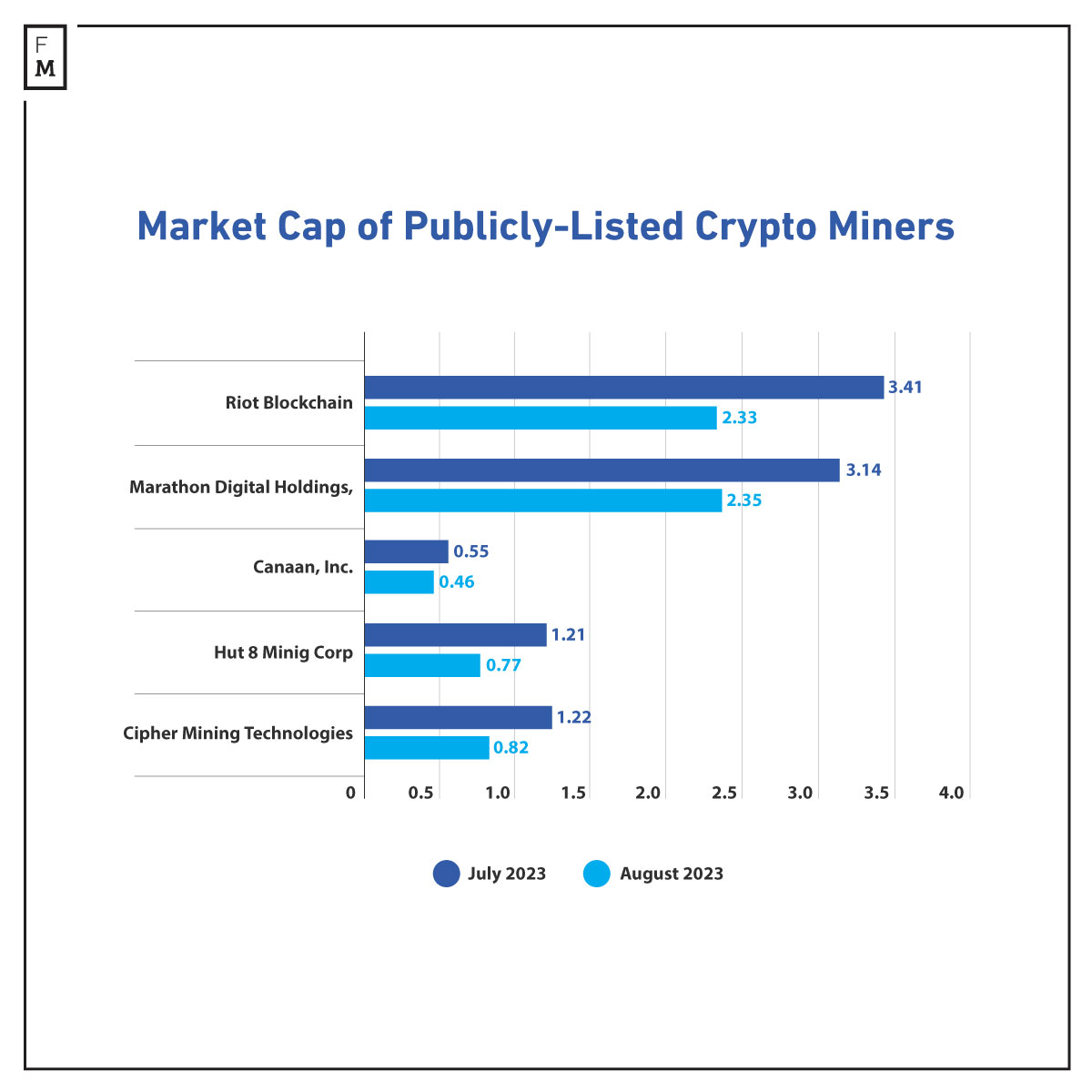

Five companies lost $2.8 billion due to a sudden drop in Bitcoin (BTC) and the broader cryptocurrency market last Thursday. According to data from AltIndex, the total market capitalization of publicly listed cryptocurrency miners fell by 30% within a month, from $9.5 billion to $6.7 billion. At the same time, miners' revenues from cryptocurrency mining dropped to monthly lows.

Bitcoin's Flash Crash Cuts Mining Companies' Capitalization

Last Thursday, Bitcoin's price unexpectedly fell by more than 7%, dropping to its lowest levels in over two months, testing $26,000. As a result, the market capitalization of exchange-listed BTC miners and other digital assets suffered significantly, sliding by almost $3 billion over the entire month.

Major players, including Riot Platform and Marathon Digital Holdings, felt the most significant losses. In their case, capitalization fell by $1.1 billion (31%) and $800 million (25%), respectively. Canaan, Hut 8 Mining, and Cipher Mining Technologies also lost a substantial part of their market share.

Looking at Riot Platform's (NASDAQ: RIOT) chart, we see that the price is testing over two-month lows and has fallen by almost 50% from July highs. The company has still gained over 200% since the beginning of the year but has had to part with a significant portion of the profits realized since January.

Moreover, RIOT and Galaxy Digital Holdings disclosed disappointing financial results in the previous quarter.

BTC Miners' Revenues Lowest in a Month

Data published by Glassnode earlier this week also does not inspire optimism. They show miners' revenues have fallen to the lowest level in a month, amounting to just under $170 million.

📉 #Bitcoin $BTC Miner Revenue just reached a 1-month low of $169,708.61

— glassnode alerts (@glassnodealerts) August 22, 2023

Previous 1-month low of $179,351.54 was observed on 17 August 2023

View metric:https://t.co/UYhnd9eeZH pic.twitter.com/hXbbDPERHl

In such a situation, miners usually face a difficult decision: sell their BTC reserves to cover ongoing operations costs or weather the challenging period by cutting profits. In the meantime, the difficulty of BTC mining was updated the day before yesterday (Tuesday) and increased by 6.17% to a historical maximum of 55.62 trillion hashes. This is another complication for companies operating in the industry, negatively affecting generated revenues. In 2022, a similar situation cut their total revenue by $6 billion.

As a result, miners are beginning to look for alternative branches of money generation. For many, artificial intelligence (AI) is becoming an attractive direction.

Cryptocurrency Miners Eye AI Horizons

Cryptocurrency miners are increasingly branching out to offer their substantial computing capabilities to the rapidly expanding AI sector. A recent report from JPMorgan reveals that top mining companies are no longer limiting their operations to mining Bitcoin and other digital currencies. Instead, they are providing high-performance computing (HPC) services to the AI industry, which is experiencing a growing need for computational power.

Well-known names in the Bitcoin mining world, such as Riot Platform (formerly Riot Blockchain) and Hive Digital Technologies (formerly Hive Blockchain Technologies), have even rebranded to highlight their business diversification. Cryptocurrencies mined and held in reserve have enabled them to invest and adapt to a market increasingly influenced by AI developments.

"With the rapid growth of AI, the increased demand for high-performance computing is now opening a new and perhaps more profitable avenue for utilizing GPUs previously used for ether mining," JPMorgan commented in the research.

JPMorgan's research notes that the burgeoning AI industry's demand for high-performance computing may offer a more lucrative opportunity than traditional Bitcoin mining, provided that large-scale real-world results confirm the promising beta test findings.

financemagnates.com

financemagnates.com