A few years ago, many publicly traded companies significantly transformed their business to capitalize on the growing popularity of cryptocurrency mining. Now, as the profitability of these operations becomes decidedly smaller, they are looking for alternatives and moving towards a new boom. As a result, more miners are beginning to offer access to substantial computing power from their data centers to companies in the rapidly growing artificial intelligence (AI) sector.

Miners Move from Bitcoin to AI

According to the latest report by JPMorgan published last week, the largest mining companies are no longer restricting themselves to mining Bitcoin (BTC) and other cryptocurrencies. Additionally, they offer high-performance computing (HPC) services in the AI industry. This industry is developing dynamically and has an increasing demand for computing power.

Popular brands in the Bitcoin mining industry, such as Riot Blockchain (RIOT) and Hive Blockchain Technologies (HIVE), have even changed their names to emphasize the diversification of their business. RIOT is now Riot Platform, and HIVE is Hive Digital Technologies. Cryptocurrencies mined and held as reserves have served them in recent quarters to carry out new investments and adapt to a market increasingly driven by the AI craze.

Ethereum (ETH) miners who used graphics processing units (GPUs) to mine this cryptocurrency will also benefit. These rigs became useless after the Ethereum network update and the shift from the energy-consuming mining model to the staking model. However, now they may find a second life.

"With the rapid growth of AI, the increased demand for high-performance computing is now opening a new and perhaps more profitable avenue for utilizing GPUs previously used for ether mining," JPMorgan commented in the research.

In June, another digital asset miner, Iris Energy, announced plans to move towards AI. The shift to AI seems like a natural evolution, especially after a weak 2022. Last year, the global mining industry generated $6 billion less revenue than in the record-setting 2021.

HPC More Profitable than Crypto Mining

Significantly, the JPMorgan report suggests that if the results from the beta tests are confirmed in reality on a larger scale, providing HPC services to the AI industry could be much more profitable than mining Bitcoins.

"If the profitability reported in beta tests is able to be repeated on a large scale, it will overshadow the revenues coming from Bitcoin mining at the moment," the report added.

Miners are increasingly switching from Bitcoin to HPC and changing locations for service provision. Russia is becoming increasingly popular, having significant energy surpluses since its aggression towards Ukraine began. Currently, the Russian Federation offers some of the cheapest energy for companies in the digital asset mining sector.

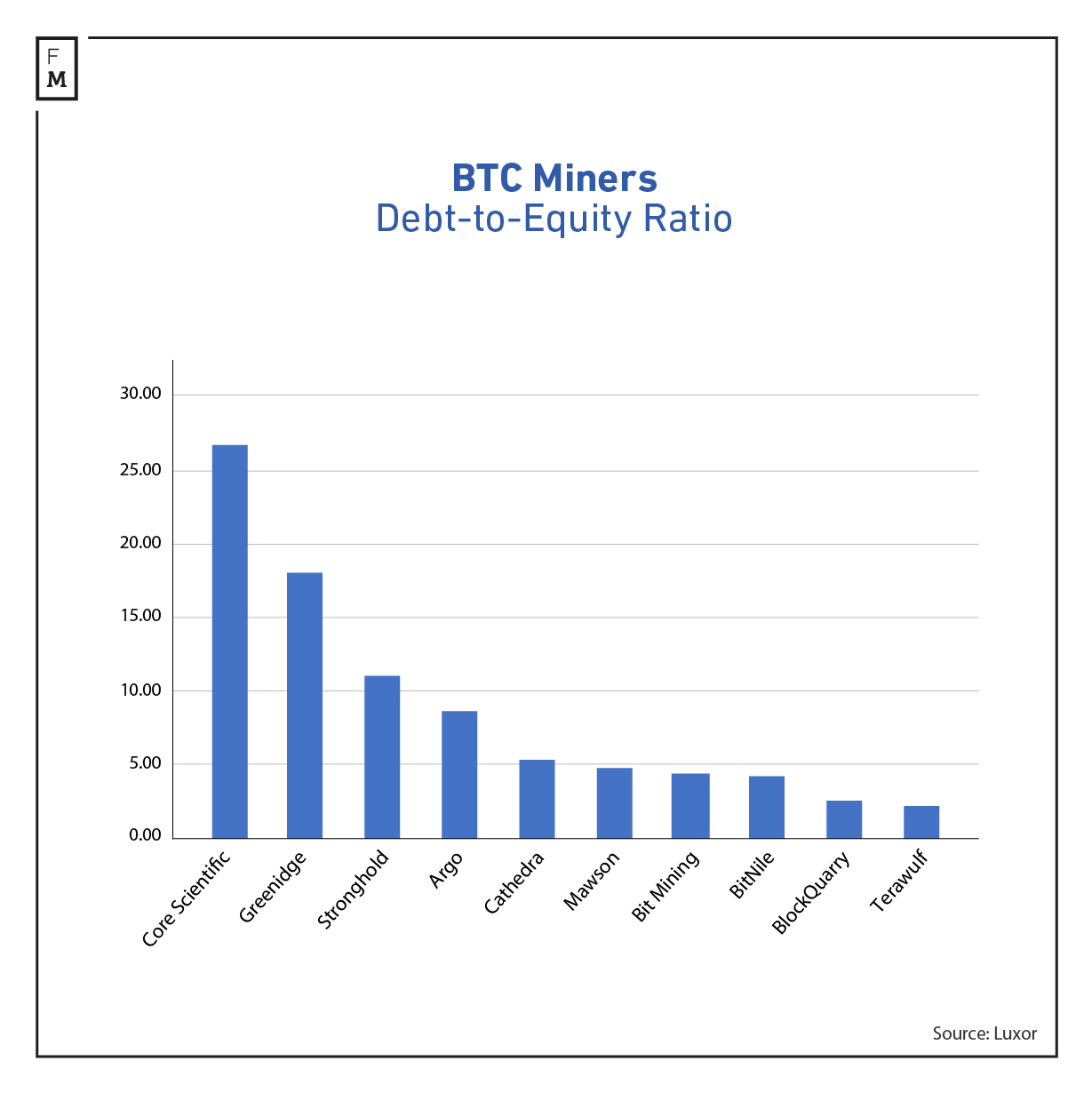

For publicly listed mining companies, it could also be a chance to improve results, which have not been optimistic recently. Riot Platforms Inc. and Galaxy Digital Holdings Ltd. reported negative financial results for the last quarter. Moreover, the mining companies' stocks have lost heavily from their 2021 peaks through low Bitcoin prices and a growing number of hacks.

financemagnates.com

financemagnates.com