A new Massachusetts Institute of Technology (MIT) research paper says that while Bitcoin (BTC) miners claim to provide a net benefit to the power grid, their renewable energy claims should be more closely examined.

The paper cites an agreement between large flexible load operators in Texas and the state’s energy operator, ERCOT.

Bitcoin Mining Needs More Studies to Verify Flared Methane Claims

During the winter storm Elliot last December, miners could switch off power to satisfy a 1.4-gigawatt demand increase. The paper says that Bitcoin supporters champion their ability to adjust mining load to stabilize the grid.

However, the authors argue miners can only measure the grid-balancing benefits once the cost of adding Bitcoin mining to the power grid is factored in. They must also consider whether their grid-balancing efforts offset the environmental costs of starting backup generators.

Read our breakdown on cryptocurrency mining here.

In addition, the flared methane gas projects may not be as effective as miners claim.

Burned methane releases carbon dioxide into the atmosphere, which cools the planet 28-36 times less than methane over 100 years.

A recent study revealed that generators burning methane gas to produce electricity were only 91.1% efficient. Miners had previously claimed the process was 99% efficient.

The lower efficiency also meant that miners could only remove 4-10% of methane from the atmosphere.

Upstream Data, a Canadian mining firm, recently sued Colorado-based Crusoe Energy for copying its technology to harness stranded gas. It recently claimed its acquisition of Great American Mining will reduce carbon emissions equivalent to about 170,000 cars.

Renewable Energy Mix Needs Better Reporting to Avoid Greenwashing

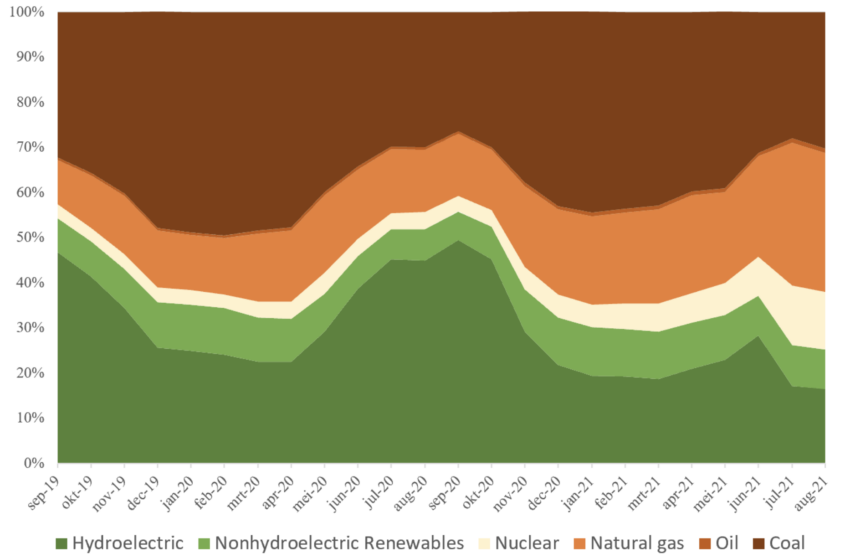

The paper also notes the importance of verifying miners’ energy mix to mitigate climate concerns.

For example, the Bitcoin Mining Council says renewables reduce mining emissions per kilowatt-hour to below the US average. However, the paper points out, miners must report green energy sources according to global carbon accounting standards to substantiate their claims.

Existing disclosures by the biggest publicly-listed companies do not provide adequate data, they argue.

The US Securities and Exchange Commission will release climate-related disclosure rules for miners in April next year, while the Federal Reserve is developing climate risk management requirements for banks involved in crypto.

beincrypto.com

beincrypto.com