Nvidia (NVDA) gave an extremely rosy financial forecast as the chipmaker benefits from surging demand for hardware to power the artificial intelligence (AI) revolution ushered in by the likes of ChatGPT. It was the talk of Wall Street on Thursday as Nvidia's stock price soared.

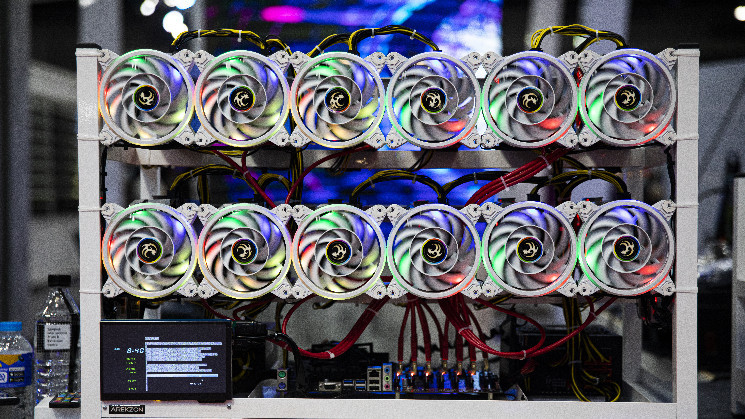

For bitcoin (BTC) miners, it's a reminder that they already have the expertise and data-center space to join in and run AI applications.

"The overwhelmingly positive market reaction" to Nvidia's news "will incentivize more mining companies to follow suit making announcements of their own and allocating more of their power capacity to other forms of compute," said Ethan Vera, chief operating officer at mining services firm Luxor Technologies.

Vera noted the Wednesday announcement that Applied Digital (APLD) is working with data center design firm Supermicro (SMCI) on its AI cloud offering.

Applied Digital is one of a handful of miners that have had their eyes on diversifying their data center space into other areas of computing for a while, along with peers Hut 8 Mining (HUT) and Hive Blockchain (HIVE). Miners will see better margins in AI than mining, said Applied Digital CEO Wes Cummins – at least before another bull run in the price of bitcoin.

However, the transition might not be a straight line. High-performance computing such as AI and cloud applications "requires a different level of infrastructure build" than bitcoin mining, Vera said. Firms will have to hire engineers to plan their sites differently and sales staff to sign up clients, he said.

“It’s not a straightforward process for a miner to repurpose their mines for AI compute - latency, compliance, cooling, environmental factors (humidity, dust), and power redundancy all need to be factored in when upgrading a site,” said Hut 8 Senior Vice President of communications and Culture Erin Dermer, echoing Vera.

Meanwhile, Nvidia’s forecast is lifting AI-linked crypto tokens, including SingularityNET (AGIX), which climbed about 13% on Thursday. Fetch.ai (FET) and Render (RNDR) are up more than 5% in the past 24 hours, according to CoinGecko data.

Read more: Crypto and Bitcoin Miners Rebrand and Diversify to Survive: A Look at Their New Strategies

coindesk.com

coindesk.com