The current Bitcoin bear market will likely end this year, according to mining data company Hashrate Index. Other industry insiders, however, aren’t so sure.

The company’s optimistic outlook is welcome news, given the sluggish cryptocurrency market, which has subdued mining profits.

However, Hashrate Index emphasized that a full-fledged bull market will likely not kick into gear anytime soon.

Will the Bitcoin Mining Market Consolidate?

The mining data company also notes that Bitcoin’s hashrate growth could slow in 2023.

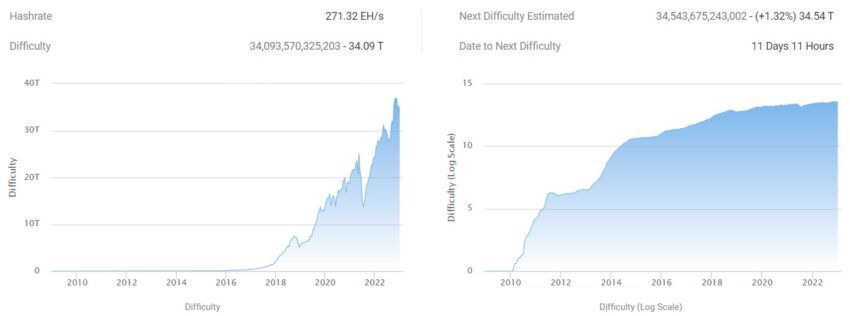

Because of severe winter storms in the U.S. last week, numerous miners had to shut down their equipment, causing the Bitcoin hashrate to drop by 35% in a single day. After a substantial recovery, the hashrate has recovered to 271.32 EH/s based on data by BTC.com.

In the latest difficulty adjustment, BTC difficulty has fallen by almost 3.6% due to a decreasing hashrate.

That said, Hashrate Index suggests that there will be fewer public miners. A prediction that indicates a mining market consolidation. Last month, popular American Bitcoin miner Core Scientific announced that the public company has filed for Chapter 11 bankruptcy protection. Meanwhile, it recently received a $17 million loan from BlackRock to keep it solvent during the process. In addition, the Celsius Network bankruptcy has forced Core Scientific to turn off more than 37,000 cryptocurrency mining units belonging to the firm.

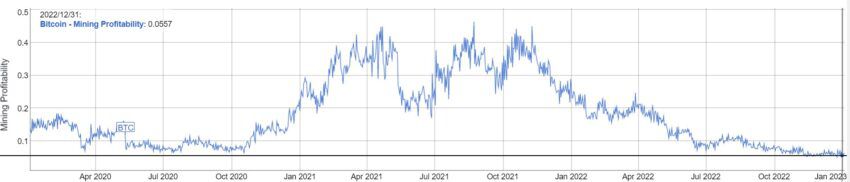

Due to the prolonged crypto winter and the weak Bitcoin prices, which were made worse by the FTX bankruptcy, several of its peers also face trouble. BeInCrypto reported in December that BTC profitability plummeted in 2022 due to several factors. The top factors are rising electricity costs and the collapse of Bitcoin from its record high of $69,000 in November 2021. As per data by BitInfoCharts, BTC profitability appears to remain near its lowest point since 2020.

For 1 THash/s, Bitcoin mining profitability was 0.0664 USD/day.

Other King Coin Profitability Predictions

As mentioned earlier, electricity cost is a primary deterrent for miners; 2023 predictions include that the hosting costs will decrease. Hashrate Index notes that in 2023, minimizing costs will be crucial. With that, ASIC prices will likely plummet, as per the company. And miners could need help to obtain enough up-time.

Despite the troubles, the data company anticipates that miners will try to improve their balance sheets. Especially when the cumulative debt of publicly traded Bitcoin mining companies has surpassed $4 billion, according to research from Hashrate Index. In the latest, Stronghold Digital Mining declared its intention to convert notes into equity to bring down $17.9 million in outstanding debt.

At the same time, miners might resort to more derivatives, per the company.

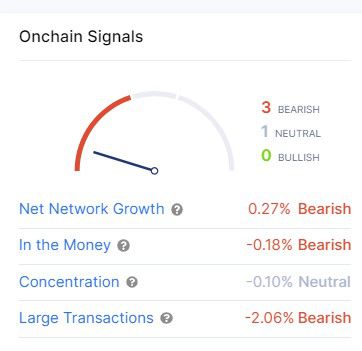

However, when it comes to on-chain data, king coin remains mostly bearish at press time—including the momentum of large transactions. According to IntoTheBlock, 50% of holders remain out of money, with 5% breaking even at current price levels.

BTC is currently hovering in a 24-hour range of $16,625 and $16,929.

Lastly, Hashrate Index predicts that regulators will continue to focus on Bitcoin mining. With the U.S. Congress resuming for 2023 on Jan. 3, the focus remains on crypto legislation.

At the beginning of 2023, The Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC) issued a joint statement highlighting the ‘risks’ associated with crypto-assets.

beincrypto.com

beincrypto.com