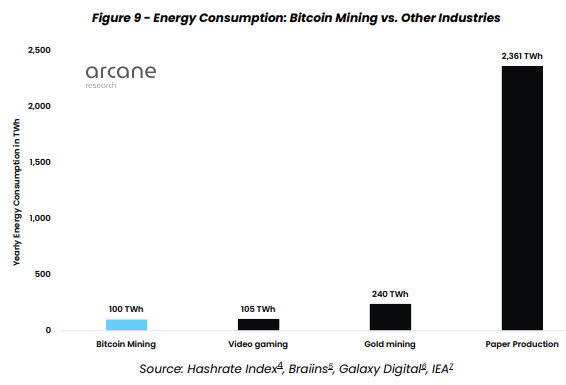

Data indicates that the Bitcoin mining sector consumes a bit less energy cumulatively compared to the video gaming industry.

Bitcoin Mining Energy Consumption Is 100 TWh Annually Currently

Based on a recent report released by Arcane Research, while Bitcoin (BTC) mining energy consumption has increased considerably in recent years, the sector still makes up a small part of the global total.

Today, Bitcoin miners are using electricity at a rate of nearly 100 TWh per year. The figure accounts for around 0.06% of the world’s cumulative energy demands, quite immaterial. Bitcoin mining compares with some of the other energy-intensive sectors on Earth.

As seen in the graph, the video gaming sector consumes around 105 TWh per year, just a bit more than what the Bitcoin miners normally use. Gold mining, on the flip side, consumes a lot more electricity to run as its yearly energy intake stands at about 240 TWh for now, nearly 2.5x BTC mining needs.

The market chart also features data for paper production that demands 2,361 TWh every year, 10 times Gold mining’s, and 24 times BTC miners. The report also insists that the way Bitcoin miners consume power is different from the other energy-intensive sectors.

Bitcoin Miners Are Distinct Consumers Of Electricity

Five main things make these miners “unique consumers of energy.” For starters, nearly 80% of the operation costs of Bitcoin mining are made up of electricity alone. That means miners have lots of incentive to do with as little energy as they can, or move to regions where prices are significantly lower.

The other difference is that mining is location agnostic. The miners can set up their facilities anywhere, and can therefore utilize energy resources not being used by anybody else due to location limitations of other sectors.

Thirdly, Bitcoin miners can turn their machines on or off at a short notice. Not only that, they can adjust their consumption watt by watt. The report shows that this feature makes the mining quite suitable for acting as a demand-response tool, which may help increase the strength of electricity grids.

The fourth notable point about Bitcoin mining is modularity. Individual AISC machines can get clubbed together in any quantity, therefore making miners able to scale up their facilities exactly based on how much energy is available. This indicates that miners can make use of 100% excess energy coming out of the power projects.

Finally, there is the portability of the Bitcoin mining rigs. Bitcoin miners can readily transport their machines to other locations due to the way portable AISC setups are. At the time of publication, Bitcoin’s price floats about $19.8K, down 2% in the last week.

cryptovibes.com

cryptovibes.com