The metaverse was meant to herald a bright new future for humanity. With none other than Mark Zuckerberg at the helm, it was supposed to welcome five billion users and grow to $13 trillion, according to researchers at Citi.

Unfortunately, it appears that these analysts — and Metaverse cheerleaders — were getting a little ahead of themselves.

Zuckerberg’s metaverse division at Meta (formerly Facebook) lost $4.5 billion last quarter alone, adding to its lifetime, $46 billion-and-counting metaverse losses. His flagship metaverse game for adults, Horizon Worlds, is embarrassingly popular with children.

Similarly, the crypto metaverse industry — at least when measured using the prices of assets like land parcels, metaverse currencies, and in-world characters — has all the characteristics of a dazzlingly popped bubble.

Decimated digital land and asset prices

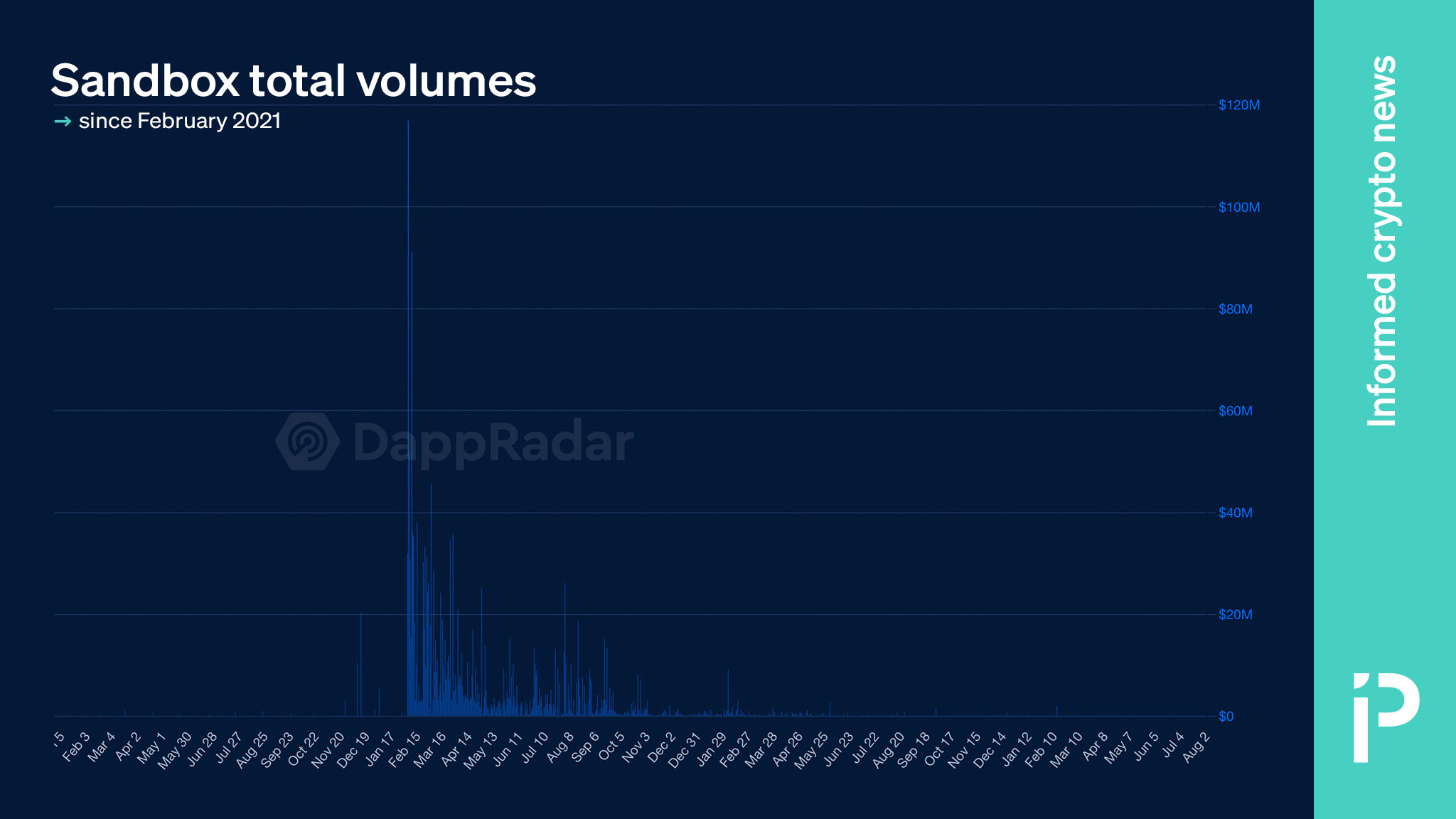

Consider The Sandbox, a metaverse once worth over $7 billion. As of August 8, its transaction volumes per DappRadar were down 99.9% from its 2022 highs of $117 million, to less than $8,000.

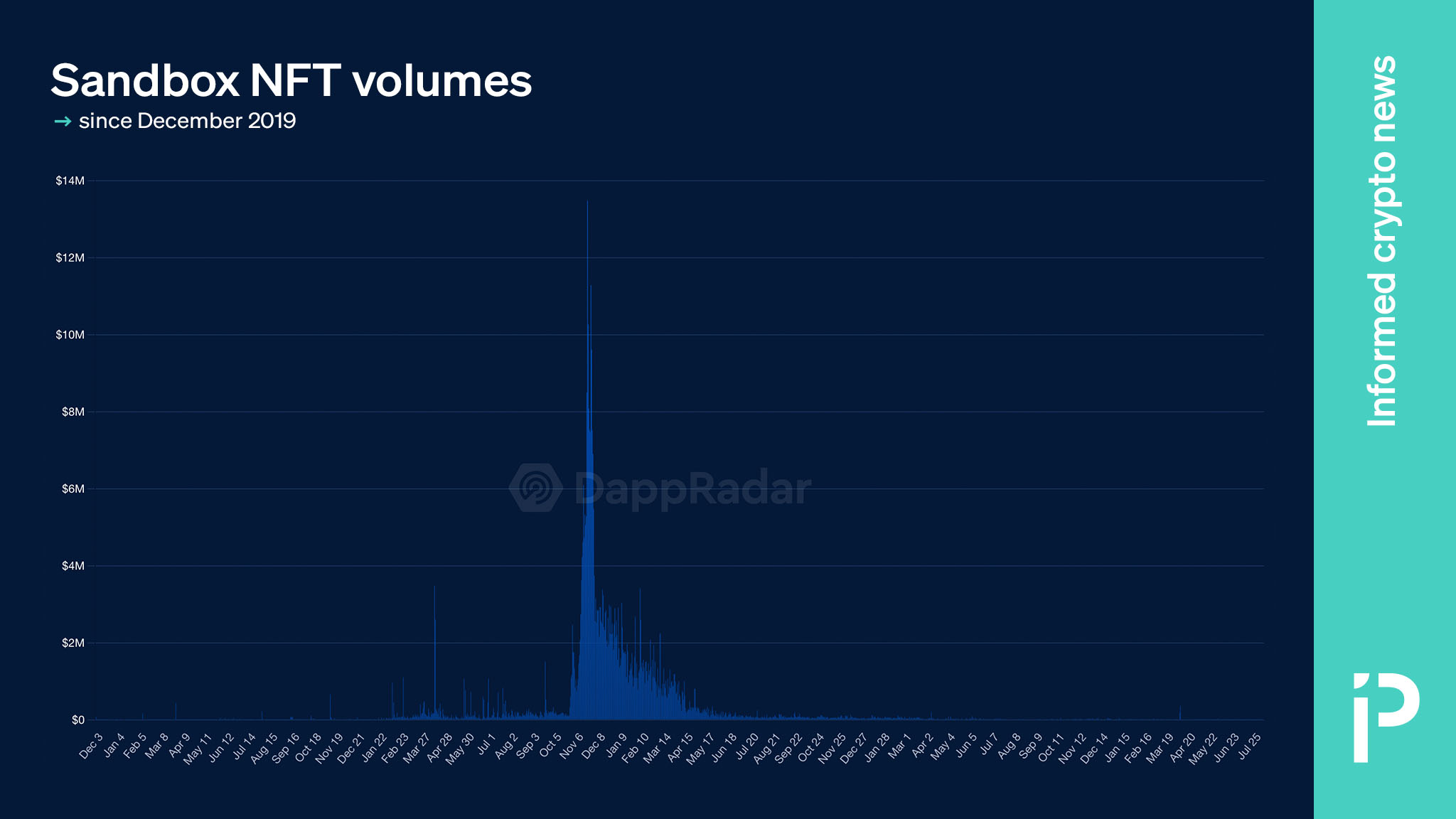

Zooming in on The Sandbox’s non-fungible token ($NFT) sales doesn’t provide any redemption. Its NFTs traded $10.2 million on November 24, 2021 alone. On any average day this August, NFTs from those collections traded less than $10,000. That’s a decline of over 99.9%.

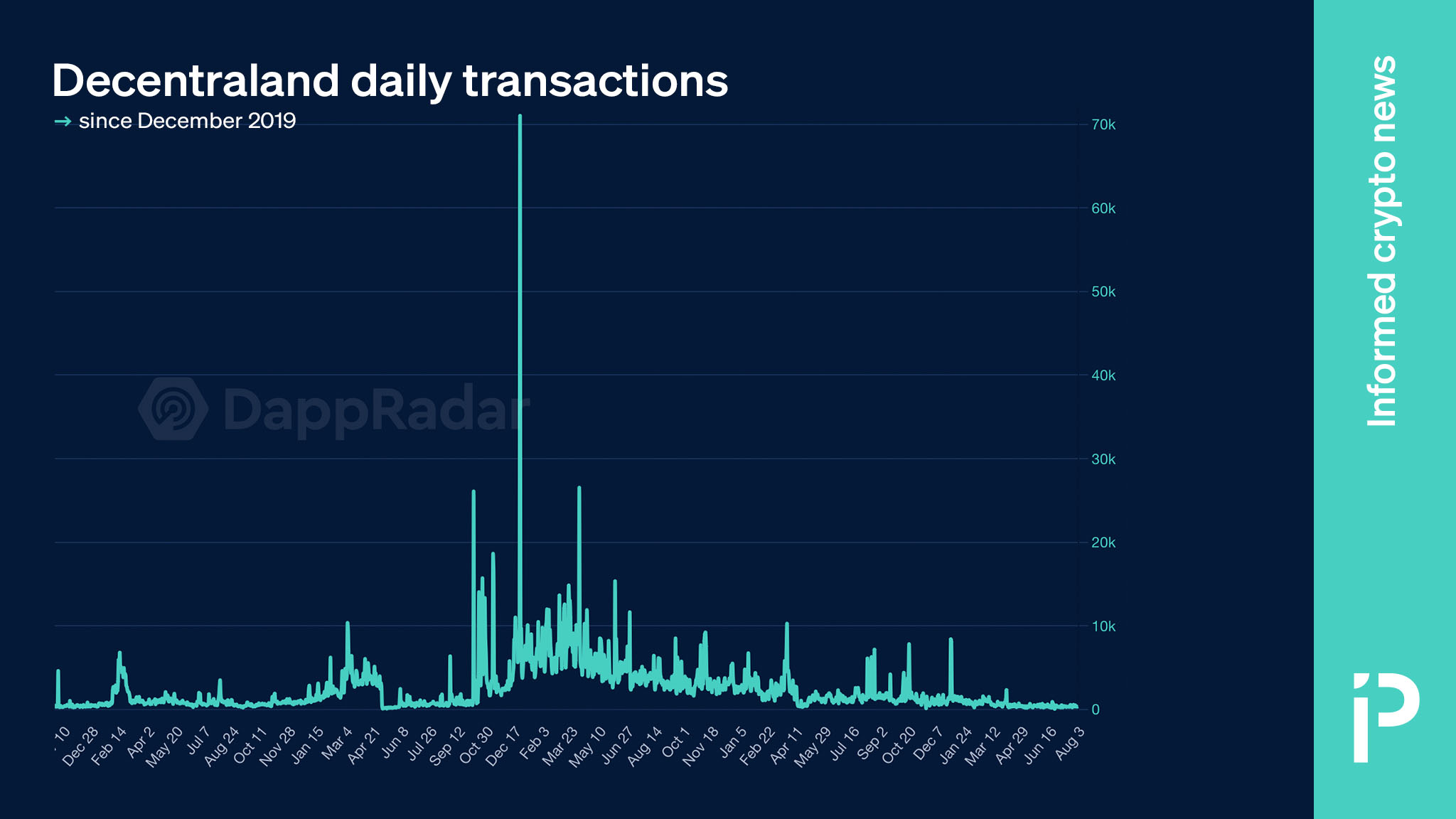

Then there’s, Decentraland, one of the oldest crypto metaverses. Its daily transactions have declined 99.9% from $2.5 million on November 29, 2021, to less than $5,000 on an average day this month.

Other metaverse lands have suffered similar humiliation. Axie Infinity trading volumes are down 99% from nearly $1 billion on September 30, 2021, to less than $2 million today. Metaverse transactions are down 99% from 672 on April 6, 2022, to less than five on average this month. League of Kingdoms transactions are something of an outlier, down a ‘mere’ 90% from their March 19, 2022, all-time highs.

By almost any measure, whether by unique active wallets, $NFT floor price, land parcel resales, skin values, or in-game actions, crypto metaverses are less popular almost without exception than in 2021 and 2022.

Read more: The $NFT market bubble has popped and we’ve got the charts to prove it

Metaverse currencies and governance tokens down 90%

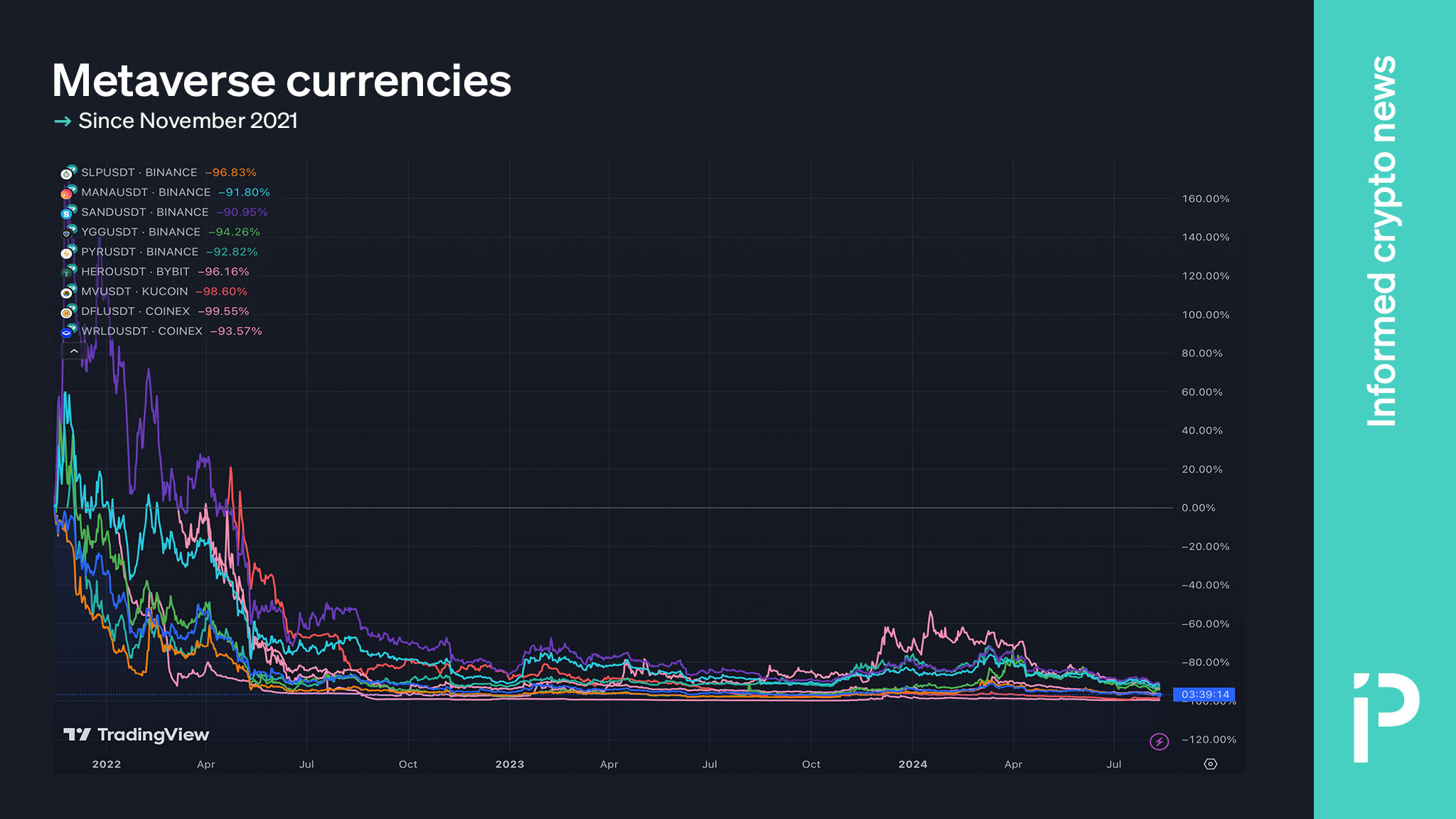

Following the ICO model that began with MasterCoin and NextCoin in 2013, many crypto metaverses sold a proprietary token to serve as an in-game currency and governance token. Almost all of these metaverse tokens are, like user engagement statistics within digital worlds, down at least 90% from their highs.

A chart of various metaverse currencies from mid-November 2021 to today shows declines exceeding 90%. Decentraland’s MANA, Axie Infinity’s AXS and SLP, The Sandbox’s SAND, Yield Guild Games’ YGG, Vulcan Forged’s PYR, Metahero’s HERO, GensoKishi Metaverse’s MV, DeFi Land’s DFL, and $NFT World’s WRLD have all declined over 90% since mid-November 2021.

Despite two years of decay, there are still believers in the metaverse — especially Bloomberg’s #3 ranked billionaire, Mark Zuckerberg. With 10X more wealth personally than the combined market capitalization of all CoinMarketCap-categorized metaverse tokens, Zuckerberg and his Reality Labs division at Meta are seemingly undeterred in their commitment to making Horizon Worlds a success.

As with any bubble-popped industry, there will be rare survivors. Even eBay and Amazon emerged from the dot-com bubble as victors. Generally speaking, the combined market capitalization of over 100 CoinMarketCap-categorized metaverse assets has declined from $50 billion on November 25, 2021, to $16 billion.

If this crypto sector is to stage a comeback, it will certainly be a long journey.

protos.com

protos.com