It’s dark days in crypto, but especially in the metaverse.

Tokens linked to digital worlds and NFTs have suffered the most this past week after the United States Securities and Exchange Commission (SEC) labeled many of them as securities in its lawsuit against Coinbase and Binance.

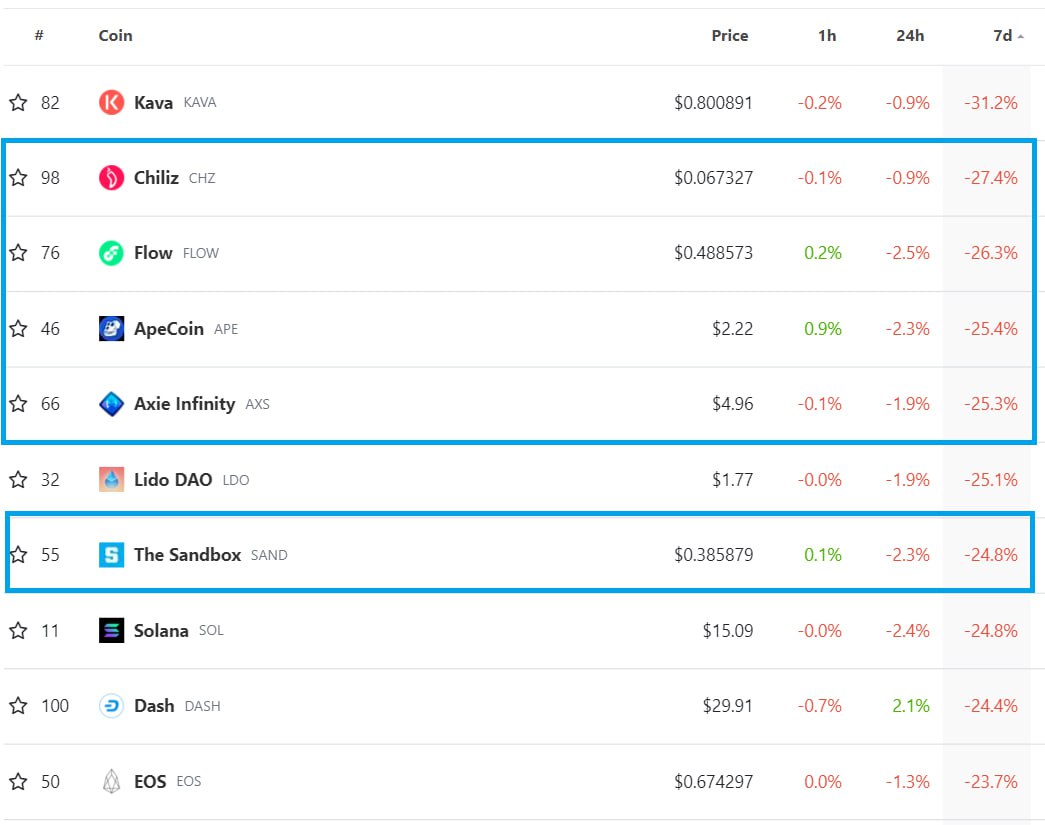

A week after the American regulator filed the cases, specific tokens cited now dominate the top ten losers among the top 100 crypto tokens by market capitalization on CoinGecko.

These include Chilliz ($CHZ), Flow ($FLOW), Axie Infinity (AXS), and The Sandbox ($SAND). They posted roughly 25% losses on a weekly scale.

In the complaints against Binance and Coinbase, the SEC alleged that $CHZ, $FLOW, $SAND, and Decentraland ($MANA) were all securities.

While ApeCoin (APE) was not mentioned in the lawsuits last week, the SEC had previously issued a probe on its creators Yuga Labs.

Apple headset can't save the metaverse

The lawsuits came at a specifically bad time for metaverse tokens, coinciding with the launch of Apple's virtual reality (VR) and augmented reality (AR) headsets.

In January earlier this year, the metaverse-based tokens surged, with tokens like Decentraland's $MANA rising over 80% a week after Apple first hinted at news of its headset.

However, the SEC's lawsuit weighs heavily on metaverse tokens.

The development teams behind the companies have come out refuting the American regulator's claims.

The Sandbox's COO told the press last week that the firm does not "necessarily agree" with SEC's categorization and "the qualification of $SAND as a security."

Flow Blockchain tweeted this morning that they "welcome a regulatory environment" with more clarity and remain confident in the decentralization of the $FLOW tokens, adding that "Flow is not only secure and accessible but also compliant."

At the same time, a Chilliz team member said in their Discord that "we do not discuss legal matters of other parties, re Binance US / Coinbase."

decrypt.co

decrypt.co