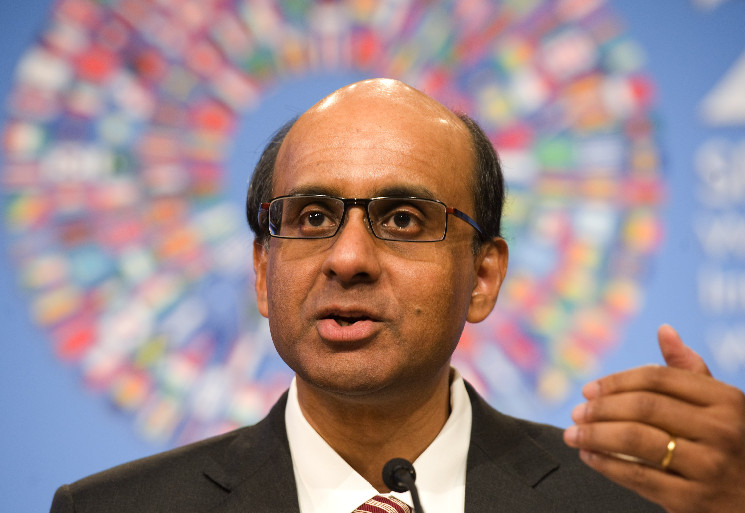

The Monetary Authority of Singapore (MAS), the country's central bank, is "actively reviewing" its approach to regulating stablecoins, the minister in charge of the bank, Tharman Shanmugaratnam said.

The bank is "assessing the merits" of a regulatory regime that targets "the specific characteristics and risks" of stablecoins, which are cryptocurrencies pegged to the value of other assets, Shanmugaratnam said while answering a question during a parliamentary session on Monday.

Through a new regime, the MAS is looking at potentially regulating reserve requirements for stablecoin issuers as well as the stability of the peg, Shanmugaratnam said, referencing the recent collapse of the $18 billion stablecoin TerraUSD (UST) which rapidly lost its U.S. dollar peg in May.

"The recent chain of high profile failures in the cryptocurrency markets, starting from the collapse of the TerraUSD and Luna tokens, illustrates the high risks involved in investments in cryptocurrencies that MAS has warned the public about repeatedly," Shanmugaratnam said.

The central bank plans to consult the public on a potential regulatory regime for stablecoins in the coming months, according to Shanmugaratnam.

Regulators around the world, including major economies like the European Union, the U.K. and the U.S., are actively working on setting up regulatory frameworks for stablecoins, particularly ones that are at risk of hurting the stability of broader financial systems.

Although Shanmugaratnam said that spillovers from the crypto market crash to mainstream financial systems are limited, and that banks in Singapore have "insignificant exposures" to crypto, MAS officials have previously vowed to crack down on crypto firms behaving badly in the country.

Read more: 'Singapore-based' Crypto Firms Leading Market Meltdown Were Not Regulated, Central Bank Chief Says

coindesk.com

coindesk.com