- NCBA Bank, Kenya, discourages users from indulging in crypto trading

- Bank asks its clients not to use debit or credit card for crypto trade

- Bank asks its clients not to hold, buy or trade crypto on any exchange like Bitcoin and Ethereum

The NCBA Bank Kenya, has warned its clients from indulging in crypto trading. The leading Bank of Kenya has sent alerts to its clients warning them not us use their debit or credit cards while trading in cryptocurrencies.

Vide a circular no 14 of 2015 the bank further added that Kenya does not authorize any virtual currency like Bitcoin and Ethereum as a legal tender. The Bank further added that it would not be able to afford any protection to its clients if the platform they are executing the crypto trade fails. The email also revealed the other pitfalls in the crypto trade, especially if the consumer uses his credit or debit card to effect any payment related to the crypto transaction.

What is a Crypto Debit Card?

A Crypto card just like the conventional card, are virtual card, which allows you to complete day-to-day transactions using BTC, ETH, XRP and other altcoins. Often, you don’t need to worry about whether your debit cards will be accepted by a merchant. That’s because many of the products out there have been released in conjunction with Visa and Mastercard, meaning they can be used in millions of locations.

Here’s how they work. First, you top up your crypto debit card with the digital currency of your choice — often through a mobile app or website. Then, you can hit the shops. Many cryptocurrency debit cards offer more generous spending limits, as well as lower transaction fees.

Let’s imagine you finally get that long-awaited cappuccino with your crypto debit card. Once the transaction is complete, the card provider will convert the digital currency into cash, meaning that the coffee shop will get your payment in fiat currencies such as USD, GBP or EUR. What could be easier than that?

Many dangers of cryptocurrency trade

One of the biggest pitfalls that the email pointed out about any crypto trade using a credit card or debit card is that it is difficult to trace and leaves no trail to follow if any swindle happened. There is every possibility that the client’s fund is prone and susceptible to criminal abuse. The cryptocurrency trade is accomplished via exchange which is usually overseas and is scantily regulated globally. There is every possibility that the client may end up losing money.

Clients lack resources to fight in case of fraud

The Bank also added that clients do not have the legal or the professional resources to pursue if any loss is incurred. Another pitfall while indulging in crypto trade is that actual assets do not back virtual currencies. Therefore fraudsters can build virtual currencies without any verifiable investments.

NCBA ended the email noting that it does not approve any crypto transactions made using its debit or credit card. It also does not support its clients dealing with any institution or financial entity which indulges in virtual currency trade.

There is a growing trend across the globe of governments trying to discourage cryptocurrency trade. However, crypto trading is booming in countries like Kenya, India, and China, etc. Interest in virtual currencies is rising across the African subcontinent. There are two reasons for this- hyperinflation and lack of stability of local currencies. Kenya, also known as Africa’s Silicon Valley, has seen a boom in cryptocurrencies. Despite warnings from Kenya’s central bank about the volatility of cryptocurrencies, it continues to thrive, and businesses in Africa have started accepting Bitcoin payments.

Blockchain Technology finds varied use

According to the Blockchain Association of Kenya, the value of the crypto trade in Kenya is estimated to be above $1.5 million. At present digital tokens like Bitcoin, Dash and Lisk are running in Botswana, Ghana, Kenya, Nigeria, South Africa, and Zimbabwe. Blockchain, which runs the cryptocurrency setup, is also used by start-ups and tech giants in Kenya to help solve problems

The Blockchain Association of Kenya, also known as BAK, revealed that digital currency awareness is increasing among Kenyans. They are using Bitcoin to pay for their education and other products. Kenyans also choose exchanges to choose from to make a buy of any crypto token like bitcoin.

Is Kenya’s Regulatory Response Hindering Cryptocurrency Growth?

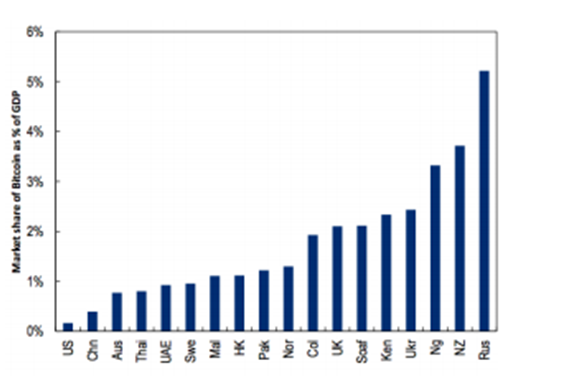

Last year, in a study done by Chainlysis suggested that Kenya among the 10-top cryptocurrency-adopting nations in the world. But despite the heavy adoption of this blockchain technology, Kenya’s heavy-handed regulatory response and slow compliance is hindering digital economy growth.

While several economies in Africa are developing digital financial services, and in the larger markets, policymakers have taken measures to support financial institutions’ digital transformation.

thecoinrepublic.com

thecoinrepublic.com