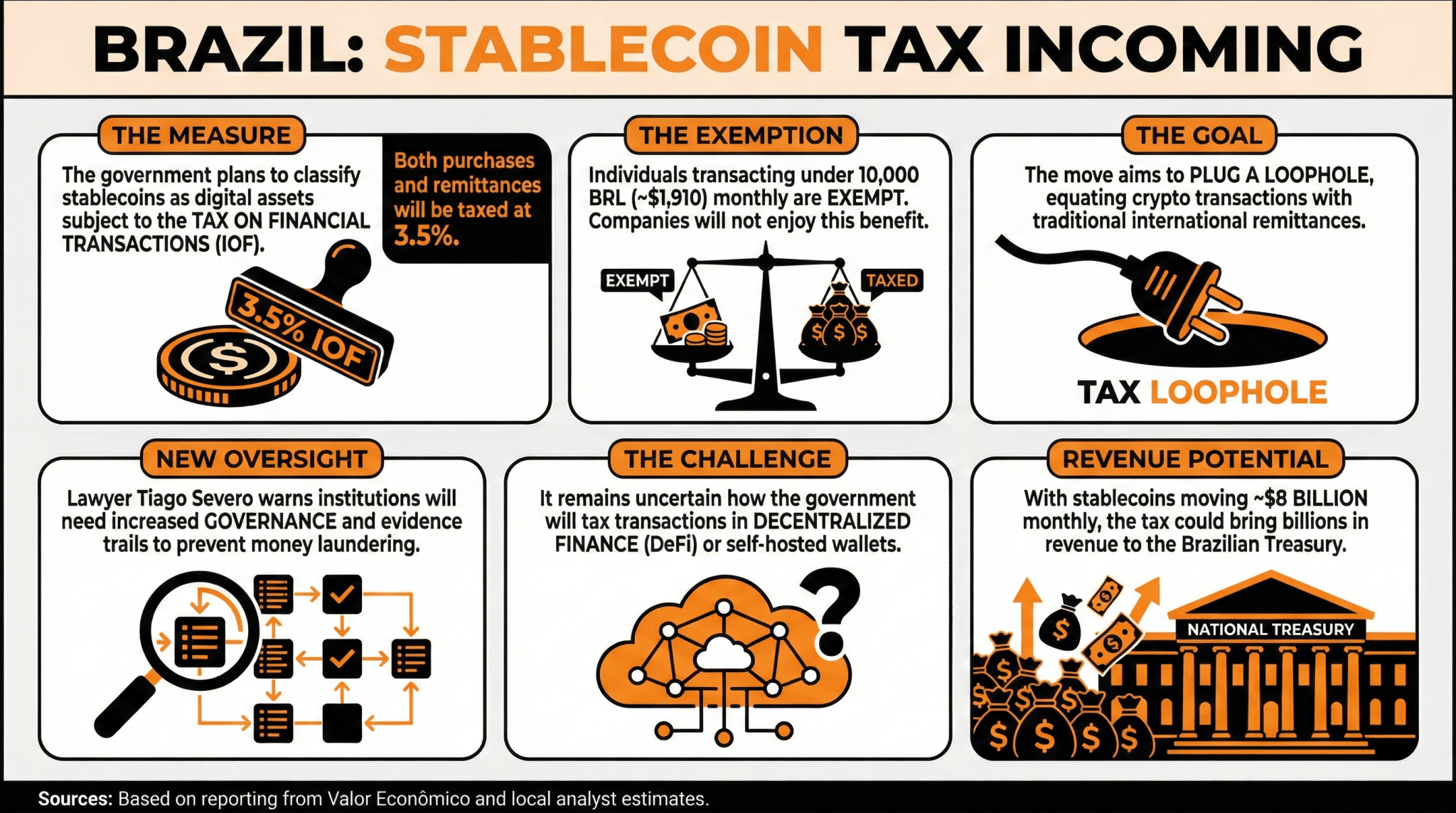

The measure, described last week, would be submitted by Brazil’s Revenue Service for public consultation and would impose a 3.5% tax on both stablecoin purchases and remittances, treating them as foreign currency exchanges subject to the existing Tax on Financial Transactions (IOF).

Brazil Prepares For Issuing Decree Taxing Stablecoin Purchases and Remittances

The Brazilian crypto industry is on the verge of changing due to a new tax measure expected to be presented in the next few days.

According to Valor Econômico, the Brazilian government is preparing to close what many considered a gray area by classifying stablecoins as digital assets subject to taxation (IOF). The proposal will come from the Federal Revenue Service (Receita Federal), which will specify that both stablecoin purchases and remittances will be taxed with 3.5% on their operations.

Nonetheless, individuals will be exempt from paying this percentage if they don’t transact over 10,000 Brazilian reais (nearly $1,910) monthly. Companies leveraging stablecoins will not enjoy this benefit.

This move would equate cryptocurrency transactions and traditional remittances, plugging a loophole that allowed both individuals and companies to sidestep taxation in these operations.

Local analysts explain that the proposal will also include a new level of oversight on institutions handling stablecoins. Tiago Severo, a crypto-specialized lawyer, highlighted that anyone who operates crypto for payments or international remittances “will need to raise governance, evidence trails, and controls to prevent money laundering to a level closer to the regulated exchange rate.”

Nonetheless, the measure is expected to face significant opposition from the crypto industry, as it will surely affect their operations as customers abandon these local businesses for decentralized finance alternatives.

It is uncertain how or even if the government plans to apply this tax to transactions outside the centralized exchange sector, as Brazilians will also be able to manage stablecoins through decentralized finance options and move them using self-hosted wallets.

According to estimates, if applied, the tax would bring billions in revenue to the Brazilian Treasury, as stablecoins move up to $8 billion each month in the country.

FAQ

-

What significant tax measure is Brazil expected to introduce for the crypto industry?

The Brazilian government plans to classify stablecoins as digital assets, subjecting them to a 3.5% Tax on Financial Transactions (IOF). -

How will this tax affect individual and corporate stablecoin transactions?

Individuals will be exempt from the tax if their transactions do not exceed 10,000 Brazilian reais monthly, while companies will not receive this exemption. -

What additional regulations are expected alongside this tax proposal?

The proposal will introduce increased oversight on institutions handling stablecoins, requiring enhanced governance and control measures to combat money laundering. -

What impact is this measure predicted to have on the Brazilian crypto industry?

Local analysts anticipate significant opposition from the crypto sector, as this tax may drive customers to decentralized finance alternatives and impact local business operations.

news.bitcoin.com

news.bitcoin.com