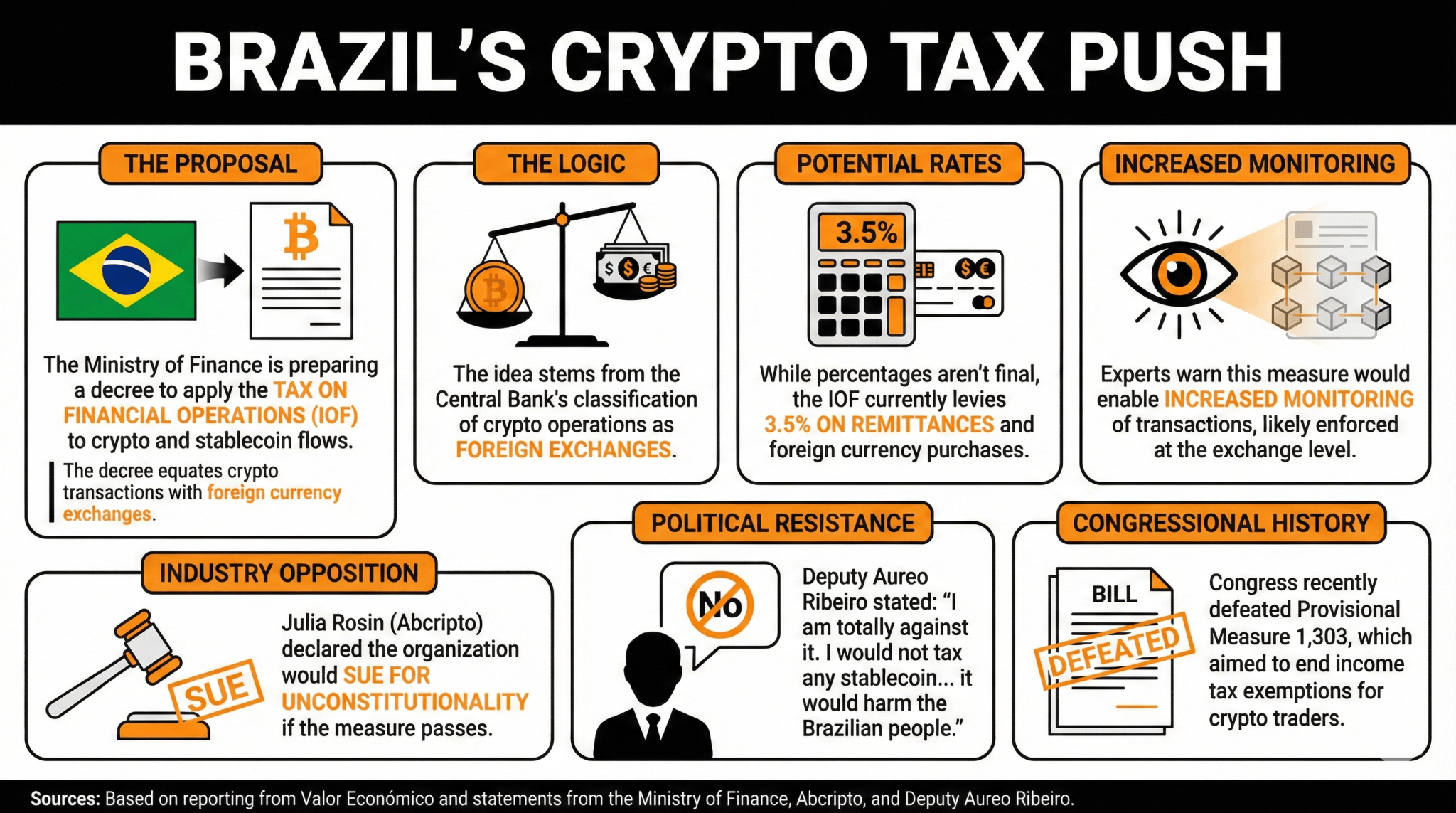

The Ministry of Finance will put a decree that equates cryptocurrency transactions to foreign currency exchanges to public consultation, a move that would allow the government to tax these flows. The subject is expected to spark a fierce discussion in Congress and even legal actions.

Brazil Aims to Tax Crypto Flows by Decree, Strong Opposition Expected

The Brazilian government is in the process of building a legal framework to apply the tax on Financial Operations (IFO) on cryptocurrency and stablecoin flows.

The Ministry of Finance is preparing to issue a decree equating cryptocurrency transactions with the exchange of foreign currency, paving the way to tax these flows. According to Valor Económico, the ministry will put the document to public consultation to measure the impact of such an action, which will surely change crypto usage trends in the country.

The proposal to tax crypto and stablecoin flows stemmed from the Central Bank of Brazil’s classification of some of these operations as foreign exchanges last year. Since then, the Ministry of Finance announced that it was working on a set of measures to curb the use of stablecoins to avoid taxation.

While there is still no specific information on specific percentages, the IOF levies 3.5% on remittances, foreign currency purchases, and credit card withdrawals outside the country. Experts pointed out that this would also enable increased monitoring of these transactions, likely enforced at the exchange level.

Nonetheless, this initiative is likely to face opposition from Abcripto, the Brazilian Association of Cryptoeconomics, and also from Congress. In January, Julia Rosin, President of Abcripto, declared that if such a measure were to pass, the organization would sue the government for unconstitutionality.

Deputy Aureo Ribeiro has also stated that he would not support stablecoin taxation, stating that if approved, it would harm the Brazilian people. “I am totally against it. I would not tax any stablecoin, neither those pegged to the dollar nor those pegged to the real,” he stressed in November.

Congress has been unsupportive of applying taxes to crypto. Provisional Measure 1,303, which terminated income tax exemptions for crypto traders, failed to pass in October, with President Lula highlighting that this action was not “a defeat imposed on the government, but on the Brazilian people.”

Read more: Brazilian Crypto Industry to Sue if Government Pursues Stablecoin Taxation

FAQ

-

What is the Brazilian government’s plan regarding cryptocurrency taxation?

The Brazilian government is developing a legal framework to apply the Tax on Financial Operations (IFO) to cryptocurrency and stablecoin transactions. -

How will cryptocurrency transactions be classified under this new framework?

Cryptocurrency transactions will be treated similarly to foreign currency exchanges, paving the way for taxation on these flows. -

What has been the response from financial authorities regarding stablecoins?

The Central Bank of Brazil has classified some stablecoin operations as foreign exchanges, prompting the Ministry of Finance to consider taxation measures to regulate their use. -

What opposition is expected regarding the proposed tax measures?

The initiative may face resistance from organizations like Abcripto and members of Congress, with some leaders promising to oppose or challenge the taxation of stablecoins on constitutional grounds.

news.bitcoin.com

news.bitcoin.com