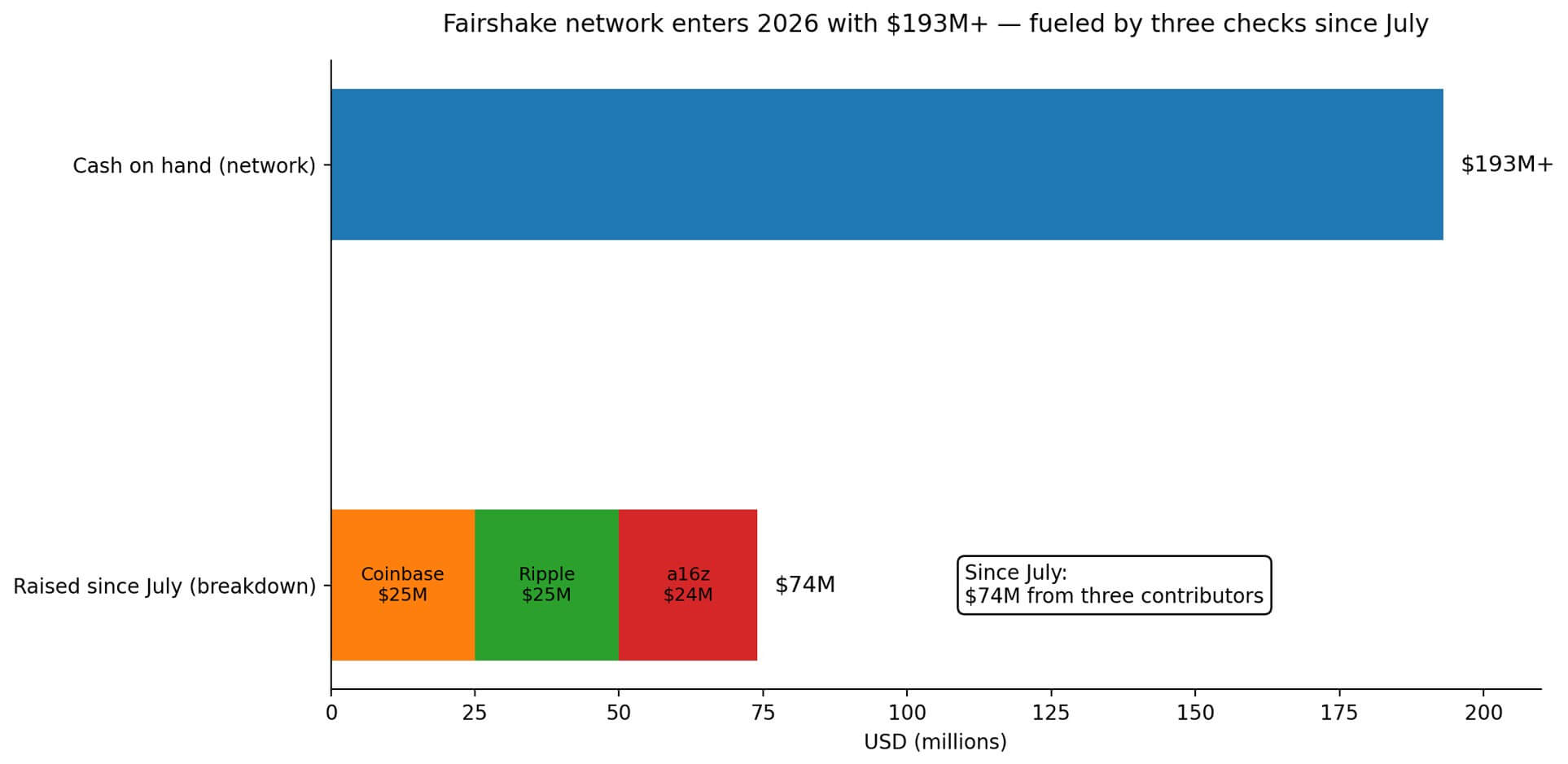

Fairshake and its affiliate super PACs announced they have more than $193 million in cash on hand heading into the 2026 midterms.

The amount includes $74 million raised since July from three contributors: $25 million from Coinbase, $25 million from Ripple, and $24 million from a16z. The network, consisting of Fairshake plus Protect Progress (Democratic-oriented) and Defend American Jobs (Republican-oriented), operates as a bipartisan machine designed to outlast partisan cycles.

The Washington Post previously documented the network spending more than $134 million across 67 candidates in 2023-2024, focusing heavily on members of key oversight committees, such as the Financial Services and Agriculture committees.

The money doesn't translate into law the way most investors think it does.

Super PACs cannot donate directly to candidates or coordinate messaging with campaigns. What $193 million buys is electoral selection and message dominance in the specific races that determine who writes and blocks crypto legislation.

The real target isn't “more pro-crypto representatives.” It's the chokepoints: committee jurisdiction and agenda control.

Committee power determines what survives

House Financial Services and its digital assets subcommittee handle the SEC-facing aspects of market structure, such as custody, intermediaries, and debates over the stablecoin perimeter.

House Agriculture and its digital assets and commodities subcommittee covers the CFTC lane: commodities and spot market oversight.

Senate Banking is where a Senate market-structure push recently stalled.

The Banking Committee delayed discussion of a draft crypto bill after Coinbase publicly opposed it in its then-current form. Senate Agriculture is simultaneously advancing its own market structure approach, announcing an updated digital commodities framework and scheduling a markup meeting for late January 2026.

Money that nudges even a handful of seats can change who becomes chair or ranking member, who sits on these committees, and what survives markup.

Fairshake's leverage operates through independent expenditures that swamp ad markets in a small number of competitive races. This is especially true for primaries, where lower turnout makes narrative-setting cheaper per vote.

| Committee | Jurisdiction | Crypto lane | Current status signal | Why Fairshake cares |

|---|---|---|---|---|

| House Financial Services | Oversees securities markets + financial intermediaries | SEC-facing market structure (custody, intermediaries, stablecoin perimeter) | Markup gatekeeper — “writes the SEC lane” | Committee composition determines what gets written and what survives amendments/markup |

| House Agriculture | Oversees commodities markets + futures/derivatives regulation | CFTC lane (commodities / spot market oversight) | Markup gatekeeper — “writes the CFTC lane” | Even small seat shifts can change who shapes the CFTC framework and who blocks it |

| Senate Banking | Banking system, securities regulation, consumer protection | Market-structure bottleneck (key Senate choke point) | Stalled/delayed after Coinbase opposed draft in its then-current form | Can slow/reshape any Senate deal and force compromises that affect final statutory scope |

| Senate Agriculture | Commodities and derivatives oversight | Digital commodities framework (Senate CFTC pathway) | Markup scheduled late Jan 2026 — “alternate Senate path” | Provides an alternate Senate route; momentum here can pressure Banking or define the negotiating baseline |

The mechanism disciplines fence-sitters, as money makes it costly to be seen as “anti-crypto” in targeted districts, especially if the PAC signals credibly that it will play again in the next cycle.

A persistent spender becomes part of the assumed landscape, forcing candidates to pre-wire positions, staff hires, and coalition memberships earlier.

The constraints are hard. Even if the network helps elect friendlies, it does not control floor votes, leadership decisions, or final bill text. This becomes trickier when crypto policy fractures along banks, exchanges, and DeFi lines.

Senate market structure remains the bigger unfinished job, with Banking versus Agriculture approaches diverging and bank and consumer issues, such as stablecoin rewards and SEC-CFTC jurisdictional lines, still unresolved.

Policy pipeline shows what's actually movable

Stablecoins already have a recent federal template. President Donald Trump signed the GENIUS Act into law in July 2025, creating a regulatory framework for US dollar-pegged stablecoins.

Market structure remains unfinished, with the Senate still a bottleneck.

Fairshake's war chest is effectively a bet that 2026 is the committee-composition election for finishing market structure and a hedge that the window narrows as the midterm calendar eats floor time.

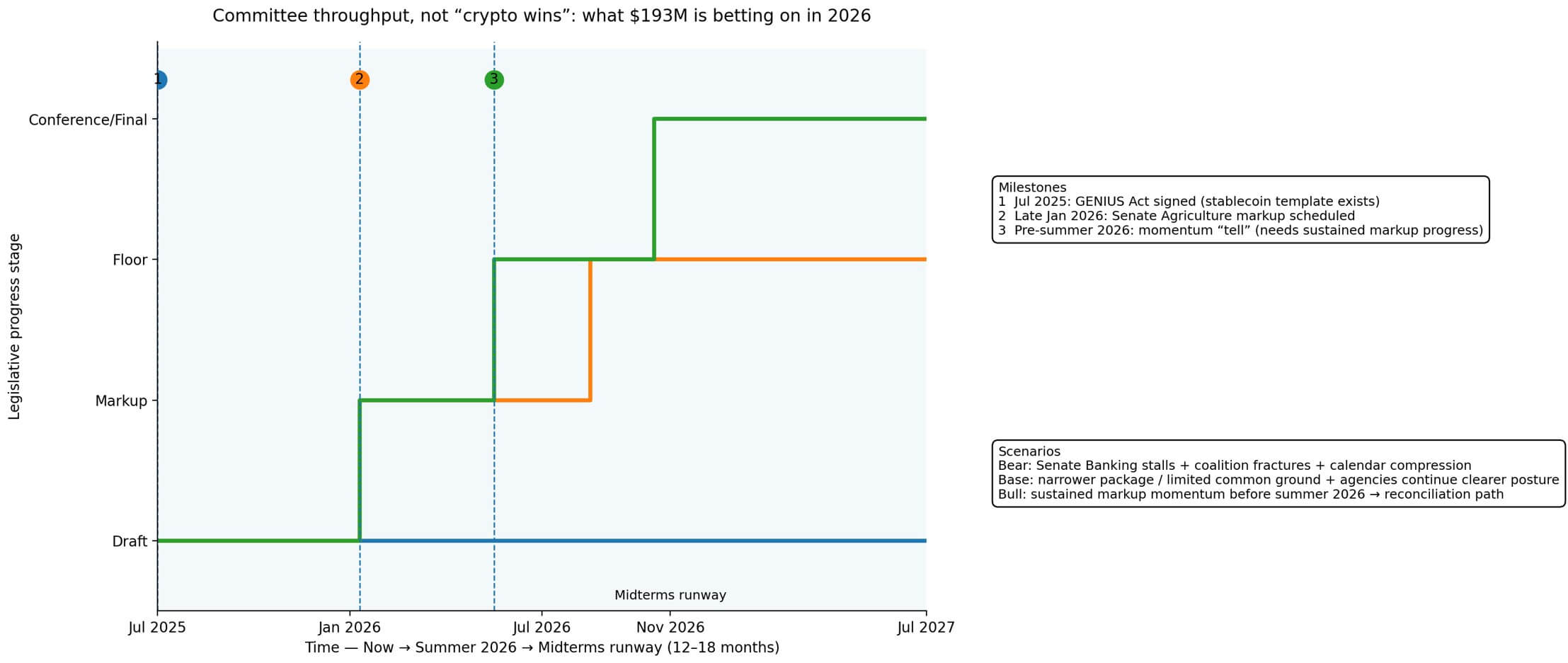

Three scenario ranges define the next 12 to 18 months, framed in terms of committee throughput rather than “crypto wins.”

A bear case sees gridlock persist, with the Senate market structure stalled, 2026 campaigns compressing the calendar, and crypto coalition fractures keeping must-pass coalitions from forming.

The current Senate delays and public industry splits support this outcome.

A base case sees partial clarity, with agency rulemaking accelerating: one chamber moves a narrower market-structure package or reconciles around limited common ground, and agencies proceed with a clearer crypto posture under current leadership, reducing enforcement ambiguity even without a grand bargain.

Paul Atkins was sworn in as SEC Chairman in April 2025, at the same time as a large drop in CFTC enforcement actions and monetary relief, and a strategic shift.

A bull case sees a full-market-structure deal: post-election, committee composition and leadership incentives align, the Senate produces a viable cross-committee deal, and the House and Senate reconcile into a comprehensive framework.

The trend would be sustained markup momentum before summer 2026.

Why markets care about committee math

Regulatory clarity changes the risk discount.

Clearer rules can change exchange listing and risk posture, stablecoin rails growth, institutional participation, and litigation and settlement expectations.

The mechanism isn't “price up,” but “uncertainty down, cost of capital down.”

Agency posture has already shifted in documented ways. The SEC now operates under Atkins, and the CFTC has visibly reduced enforcement intensity and pivoted strategy.

The remaining question is whether Congress locks those changes into statute or leaves them reversible, in an administrative posture vulnerable to the next leadership transition.

That's what makes 2026 committee composition matter: the difference between a temporary regulatory détente and a durable statutory framework.

Crypto's political strategy may be fragmenting

Fairshake's bipartisan machine is built for durability, but a new super PAC formation can signal intra-crypto strategic splits over which issues to prioritize and which party to overweight.

The Winklevoss twins launched a separate pro-crypto super PAC in August 2025 with an initial $21 million investment, explicitly oriented to pro-crypto conservatives.

The emergence of parallel vehicles suggests that crypto-political strategy may be entering a second phase, from bipartisan insurance to issue and party segmentation.

The fracture lines already visible in Senate market-structure debates, highlighted by “Banking versus Agriculture,” “SEC versus CFTC jurisdiction,” “stablecoin rewards and consumer protection,” and “DeFi oversight.”

This backdrop creates natural coalitional stress. Fairshake's network spans both parties, but sustained bipartisan coherence requires the industry to maintain unified legislative priorities.

If different crypto sectors start advocating for incompatible statutory treatments, outside money fragments along those lines. The Winklevoss move suggests some players are hedging that scenario by building partisan infrastructure in parallel.

One macro wildcard could reshape the advantage

A Supreme Court case could change the relative power of parties versus outside spenders ahead of 2026 by revisiting limits on coordinated party spending.

If party committees regain greater coordination in spending, super-PAC money may face stronger institutional competition in the same races.

That would compress Fairshake's relative advantage in narrative-setting and candidate selection, forcing the network to compete with better-resourced party apparatuses that can coordinate directly with campaigns.

The policy translation layers are clear but not deterministic.

Super PAC money shapes who arrives in Congress and makes it costly to be anti-crypto in targeted districts. Committee composition determines what survives markup. Agency posture sets the enforcement baseline. The statutory framework either locks in regulatory clarity or leaves it vulnerable to reversal.

Markets then price the delta between temporary détente and durable law.

Fairshake's $193 million is a bet that 2026 is the committee-composition election that determines whether crypto gets a statutory market structure or remains stuck in agency-discretion limbo.

The network's bipartisan architecture is designed to withstand partisan cycles, but crypto policy fragmentation and the formation of new super PACs suggest the industry's political strategy is starting to diverge.

The open question is whether unified legislative priorities hold long enough to convert committee math into statute, or whether crypto's political machine fractures before the work is done.

cryptoslate.com

cryptoslate.com