After the U.S. Senate takes next week off and returns to hash out the federal budget that expires on January 30, the odds may favor February as the next window for action on the crypto market structure bill in the Senate Banking Committee.

But no matter when it returns to the agenda, the crypto industry must still overcome the traditional finance lobbyists if it wants to secure significant changes and get a bill done that digital assets businesses will find acceptable.

Despite Coinbase's high-visibility decision to abandon the bill on Wednesday, virtually everybody, including the U.S. exchange, has said they're ready to get back to the table to work things out. Though crypto firms may be frustrated about the body slam that Wall Street's lobbyists (on behalf of banks and the securities industry) inflicted in recent weeks, complaints won't overcome the policy resistance they face. The differences between the crypto side and the traditional finance side are significant in several sections of the bill, especially after the bankers secured restrictions on how stablecoin yield rewards can be paid out.

Coinbase has repeatedly held up the stablecoin yield question as its top issue, and hesitant lawmakers from both parties haven't yet been convinced about the compromise that was central to the committee's draft bill this week. The bankers' argument that stablecoin yield constitutes a threat to the banking system's reliance on deposits made headway with some lawmakers who value relationships with the community banks on their Main Streets, even if the Democrats historically distrust Wall Street.

And elsewhere in the bill, the securities lobbyists sought to squeeze decentralized finance (DeFi) protections. U.S. lawmakers have been dealing for years with the representatives of banking and the securities sector, while the crypto crowd are new entrants into the arena. Jaret Seiberg, a veteran Washington financial policy analyst at TD Cowen, argued that the yield compromise presented in the bill seems to be the only logical avenue to consider, but so far, the debate isn't going well for crypto.

"We are hard-pressed to see a different middle ground," he wrote in a note to clients on Thursday. "It is why this could end up being a straight up or down vote on whether stablecoins can earn rewards on platforms."

And he went on to describe the headwinds the industry has two or more weeks to overcome:

"We would give an edge to the banks on such a vote, even though crypto campaign contributions are greater," Seiberg said. "This is because small banks are important in local communities. That gives them clout with Capitol Hill."

Timing

Crypto insiders in Washington had been frantic over the aggressive timeline Senate Banking Committee Chairman Tim Scott had pursued this week, because so many big-ticket items hadn't yet been settled in the bill. Scott explained his thinking in an interview with CoinDesk on Wednesday as pushing fellow lawmakers who were dragging their feet because they're "afraid of the consequences of voting no"

Seiberg sees the delay now stretching "until at least February," he said in his note to clients.

As always, the Senate calendar is at the mercy of many variables and pressures, including significant disputes over international policy crises (Venezuela and Greenland) and domestic clashes (Minnesota). But both political parties have already devoted massive effort to the crypto work, showing they mean to finish something despite other ongoing disagreements.

However, the focus on the Banking Committee's work can risk forgetting about the parallel effort in the Senate Agriculture Committee in which bipartisan talks are still underway. That panel is so far set for a January 27 hearing, according to Republican Chairman John Boozman, who praised his "great partner" in Democratic Senator Cory Booker.

Congress being Congress

The crypto sector tends to react strongly to setbacks, such as in the lamenting on social media that this same bill was doomed last October when Democrats circulated some unpopular ideas on DeFi. But ups and downs and false starts are normal in Congress. The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act last year faced a number of roadblocks, including a moment in May of 2025 in which Democrats blocked progress. (It passed a month later with a massive bipartisan turnout.)

As the Banking Committee's chairman, Scott, pointed out to CoinDesk this week, "People are very passionate about this issue."

When the chairman suggested that other lawmakers feared what would happen if they vote no on a crypto bill, one of the big consequences is apparent to anybody reviewing the Fairshake political action committee's Federal Election Commission filings. The crypto industry's primary super PAC has said it has well over $100 million ready to deploy in this year's congressional midterm elections for crypto-friendly politicians in both parties. The PAC rose to become one of the top campaign-finance powers in the most recent races in 2024, and it has a stronger financial start in this cycle.

The coming weeks will test the influence the crypto sector has been aggressively building in Congress, but the evidence of months of negotiating and so many hours of staff time on the Hill demonstrates that both parties are eager to keep going. When he postponed this week's markup hearing, Chairman Scott called it a "brief pause.

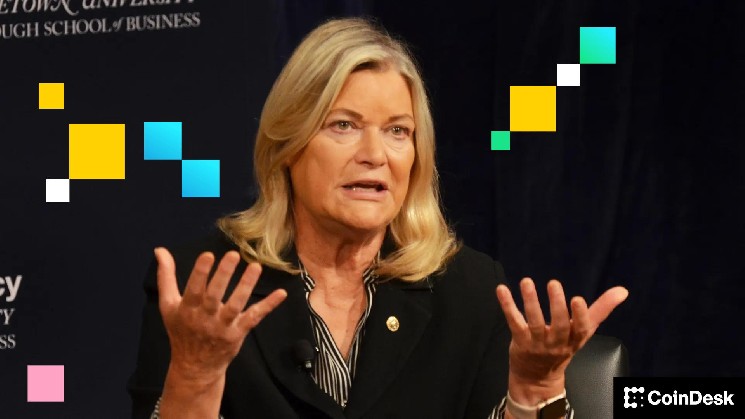

"Senator Cynthia Lummis, chair of the committee's crypto subcommittee, said in a Thursday post on social media site X that "everyone is still at the negotiating table."

Though the intense politics of the midterm elections are held up as a likely constraint to getting anything done later in the year, it's not unheard of to get significant work accomplished under those conditions. One of the biggest pieces of financial legislation of all time, the Dodd-Frank Act response to the 2008 global financial crisis, passed in July of 2010, just a few months before the midterm elections that year.

However, one of the main points of debate on the market structure bill has nothing to do with market structure and is out of the hands of the crypto negotiators: the Democrats' ethics provision. Scott told CoinDesk he didn't think his committee has the jurisdiction to include the issue in its bill, while some Democrats have said it's the most important point to resolve — focusing on President Donald Trump's personal interests in the crypto industry as their central evidence of inappropriate conflicts of interest.

Senator Ruben Gallego, the lead Democrat negotiating protections against government corruption, told reporters on Wednesday that he would need some sort of guarantee on an ethics provision before he could vote for the overall bill.

Crypto lobbyists must instead focus on their own policy concerns about yield, regulatory reach of federal agencies and potential DeFi constraints that could risk the future viability of that corner of their industry.

Coinbase CEO Brian Armstrong, who dropped support for the legislation that he argued was no longer viable, also struck a positive note about the future, saying he's "quite optimistic that we will get to the right outcome with continued effort."

And Cody Carbone, the CEO of the Digital Chamber that's been one of the leading advocates for crypto legislation, said "inaction is unacceptable."

"We cannot afford to walk away from the table at a moment when clarity is within reach," he said in a Thursday statement. "Market structure must move forward, and the only path to longstanding policy is getting back to the negotiating table and finishing the job."

coindesk.com

coindesk.com