Polymarket analysts focused on several whale wallets that made confident bets around the arrest of Venezuelan President Maduro. The recent wave of directional bets has expanded the search for potential insiders.

Polymarket and analysts are scrutinizing bets around Venezuela, reviving the narrative of insider information. A list of several wallets has been linked to suspicious prediction trades.

The predictions on Venezuela were also linked to a recent statement by US President Donald Trump regarding the arrest of individuals who leaked information. No direct connection was made between the now-deleted account of the Polymarket whale and the recent arrest.

Despite this, the bets around US military actions are closely watched for potential insider hints.

Polymarket analysts renewed their focus on the accounts that were most active around President Maduro’s arrest. The main wallet that was tracked ended up with 194,741.73 in gains before the account was deleted.

On-chain analysts noted several wallets made outsized gains around the situation in Venezuela. Two out of three wallets went dark and have not made new predictions for 11 days.

As Cryptopolitan reported earlier, Polymarket is disputing the earnings of some of the whales that made predictions on Venezuela.

One Polymarket whale makes bets on the situation in Iran

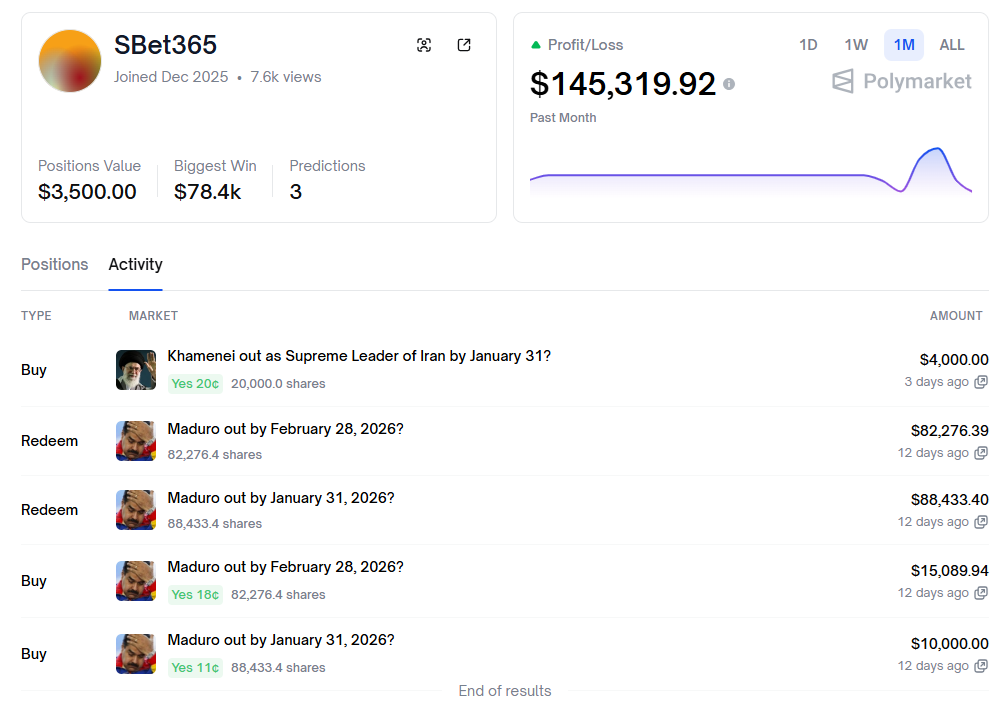

One of the three closely watched wallets switched to a new market. Trader Sbet365 continued with new bets.

As of January 15, the trader also showed redeeming transactions for the older bets on Venezuela.

The trader retained one active prediction on “Khamenei out as the Supreme Leader of Iran by January 31.” The market is trending, with over $28M in volume. The Sbet365 wallet has been buying ‘yes’ tokens at $0.20 on average, preparing for a big gain in the case of a resolution.

The prediction market saw a shift in trading, as ‘yes’ tokens dipped to $0.17, on the latest lack of any decisive US action in Iran. The prediction pair remains at the top of trending markets on Polymarket, with highly active trading.

The third whale that bet on President Maduro losing his post by January 31 has not made any new predictions. The traders made relatively high gains from their positions, but further raised the issue of potential insiders. The three wallets tracked were funded and prepared, only placing their bets immediately before the real events took place.

Traders also count big losses from Iran situation

The outcome predictions on Polymarket are sometimes a matter of luck. One trader made a big directional bet on expecting strikes against Iran by January 14. The trader ended up losing over $40K on the position.

Despite this, Polymarket accounts are still scoured through for potential insiders. Wallets are singled out for making confident bets or funding their accounts just ahead of big events. However, no strategy guarantees exposure to insider knowledge or hints on the resolution of prediction pairs.

Polymarket wallet trackers only expose behavior that breaks the patterns of the usual retail trader. The tools have also zeroed in on the top suspicious whale that was active around the time of the arrest of President Maduro.

cryptopolitan.com

cryptopolitan.com