Key Highlights

- On January 8, Wyoming Senator Cynthia Lummis shared a post related to the ongoing discussion around crypto legislation bills

- In the post, she seems to be reviewing a draft of the Bitcoin and crypto market structure bill ahead of mark up session on January 15, 2026

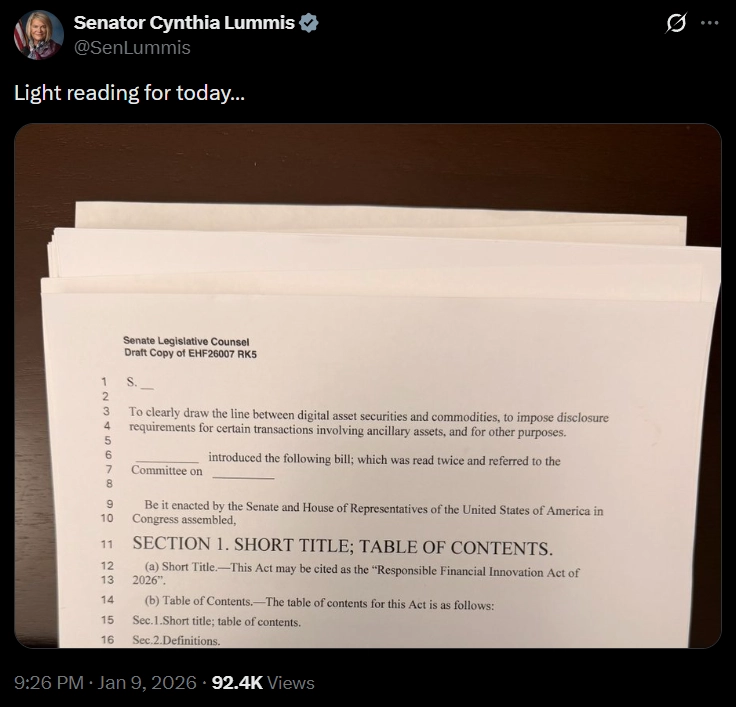

On January 8, Wyoming Senator Cynthia Lummis shared a cryptic post on X (formerly Twitter), which looks like she is reviewing an important government document. This document is none other than a draft of the Bitcoin and crypto market structure bill, which has currently sparked a discussion in the crypto community.

(Source: Senator Cynthia Lummis on X)

Inside the Bitcoin Act and Its National Strategy

One of the major proposals is the Bitcoin Act. Senator Lummis first introduced this bill with Congressman Nick Begich, a Republican from Alaska, in March of 2025. The main idea is to treat Bitcoin as a critical national strategic asset. The legislation directs the U.S. Treasury Department to build a reserve of up to 1 million Bitcoin over 5 years.

This reserve would be funded by reallocating other federal assets, not by raising new taxes. The bill includes strict rules for managing this Bitcoin, such as requiring annual audits and public reports to ensure transparency. It also places a 20-year restriction on selling any of the reserved Bitcoin, except during a declared national emergency.

Senator Lummis affirmed that this plan would protect the country from inflation and strengthen its position against global competitors like China’s digital yuan.

The bill is currently being examined by the Senate Banking Committee, where Lummis is demanding a change. She has expressed strong concern over recent government Bitcoin sales despite the U.S. President Donald Trump’s executive order, which some reports have valued at around $6 billion.

“We can’t afford to squander these strategic assets while other nations are accumulating bitcoin,” Lummis said. “I’m deeply concerned about this report.”

Trump Administration’s Push for a Clear Crypto Market Regulatory Framework

The second major piece of legislation is the Crypto Market Structure Bill, also known as the Responsible Financial Innovation Act. This is a bipartisan effort designed to solve a fundamental problem: deciding which cryptocurrencies are securities and which are commodities. This distinction is important because it determines whether the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC) is the primary regulator.

The bill proposes that most digital assets be classified as commodities, placing them under the oversight of the CFTC. The SEC’s role would be focused on assets that function like traditional stocks or bonds. The legislation also establishes rules for crypto trading platforms, outlines how customer assets are safeguarded, and stipulates the registration requirements for companies.

It includes specific measures for stablecoins, digital currencies pegged to assets like the USD, and attempts to address the unique challenges of decentralized finance, or DeFi.

The draft has undergone more than 30 revisions, with new sections added to enhance investor protections and prevent illegal financial activities. Senator Lummis recently shared a preview of the draft on her social media account, which highlights the ongoing work.

Political Hurdles and Industry Optimism

However, these legislative efforts are also facing challenges in the form of opposition. The path to becoming law is not guaranteed. Senator Tim Scott, the Republican Chair of the Senate Banking Committee, has scheduled a major markup session for January 15, 2026.

Republicans have presented what they call a “closing offer” to their Democratic colleagues. The two parties still need to bridge divides on issues like whether stablecoins should be allowed to pay interest to holders and how strictly to regulate DeFi platforms.

Despite these challenges, the crypto industry is watching with hope. Major companies and advocacy groups, such as the Crypto Council, see the legislation as a massive opportunity for growth. They believe that clear rules will allow businesses to invest and operate with confidence in the United States.

cryptonewsz.com

cryptonewsz.com