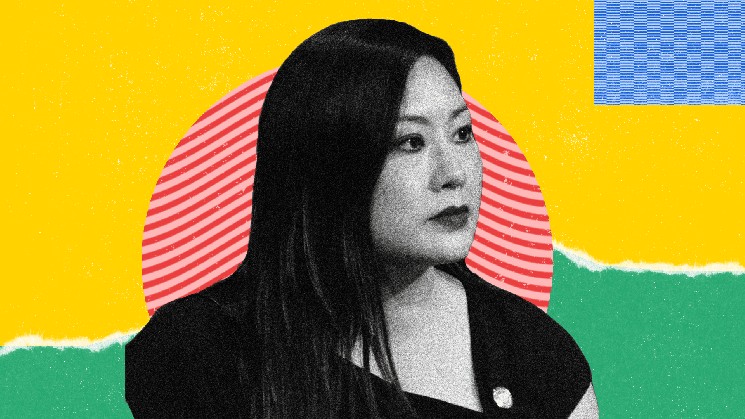

The U.S. Commodity Futures Trading Commission — a likely leading U.S. crypto regulator when the crypto industry's U.S. oversight is in place — was one of the challenging areas for President Donald Trump's efforts to get friendly watchdogs confirmed, but his acting chairman, Caroline Pham, hasn't behaved like a temporary leader.

This feature is a part of CoinDesk's Most Influential 2025 list.

Pham, a former senior executive at Citi, pressed aggressively on the pro-crypto aims set out by President Donald Trump in his executive orders and rhetoric, launching what she's called a "crypto sprint" that's been running in parallel with the Securities and Exchange Commission's "Project Crypto."

The acting chairman of the commodities agency, who worked for months as the only member of what's meant to be a five-member commission, halted and reversed the enforcement practices of the agency that devoted outsized attention to crypto cases. In recent weeks, her agency began a pilot program to allow the use of crypto assets such as bitcoin BTC$87,018.43 and Ethereum's ether ETH$3,008.59 as tokenized collateral in the derivatives market, with Bitnomial first out of the gate. Most recently, she moved to shed the agency's guidance on how "actual delivery" is defined in digital assets transactions to make way for a friendlier approach.

And as 2025 waned, she accomplished her major aim of the year, to encourage CFTC-regulated platforms to launch retail leveraged spot crypto products. Bitnomial became the first out of the gate, moving forward on such trading in December. That development could take some pressure off the congressional work toward a market structure bill that would be expected to give the CFTC more direct and explicit authority over crypto spot trading.

Pham routinely said she was seeking to help Trump usher in his promises for a "golden age of crypto."

The acting chairman has been public about her intention to leap into the private sector as soon as she's replaced by a permanent chairman. Though the process was delayed when Trump abandoned his first choice — former Commissioner Brian Quintenz. Securities and Exchange Commission official Mike Selig then became the nominee, and his confirmation is poised for a final Senate vote.

coindesk.com

coindesk.com