The US Securities and Exchange Commission (SEC) has finally dismissed its case against Ripple after five years.

Brad Garlinghouse, the CEO of Ripple, confirmed the news in a tweet labeling the development as a win for the crypto industry.

Leveraging on this, XRP price rose by more than 10% within minutes touching a price of $2.55.

US SEC Officially Concludes Ripple Lawsuit

Brad Garlinghouse announced on X that the SEC had dropped its lawsuit against Ripple, marking a major win for the company.

He stated that the SEC’s legal battle against Ripple had been “doomed from the start” and that this outcome was a victory for the entire crypto industry.

The SEC’s case against Ripple started in 2020, arguing that XRP was a security and that Ripple violated securities laws by selling it to institutional investors.

However, Judge Analisa Torres ruled in 2023 that XRP was not a security. With the SEC dropping the case, Ripple can now operate without legal restrictions.

Garlinghouse also criticized SEC Chair Gary Gensler asserting that the agency never intended to protect investors but rather seek malice against crypto businesses.

According to the Ripple CEO, this decision is crucial for the company’s development and regulation in the cryptocurrency market.

XRP Price Shoots Up After SEC’s Decision

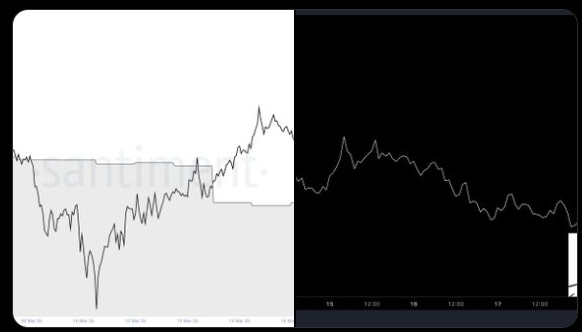

XRP’s price surged over 10% to $2.49 immediately after the SEC dropped its lawsuit against Ripple.

Market data shows a sharp increase in trading volume, which spiked by 52% to $5.35 billion within hours of the announcement.

The rapid price movement highlights strong investor confidence and renewed interest in XRP.

The market capitalization of XRP also improved by 11% to $1.449 billion, which was spurred on by traders following the regulatory announcement.

The price rise can be attributed to greater market expectations of the firm’s growth as Ripple diversifies its business.

Experts believe that it may go on as regulatory certainty ensures XRP’s standing in the crypto sphere.

Following the Ripple lawsuit closure, analyst Ali Martinez also noted that the recent XRP price rally lacked significant whale accumulation.

Instead, data from Santiment revealed that open interest surged by $200 million, suggesting a leverage-driven rally.

This indicates that the price surge may be fueled by speculative trading rather than strong institutional buying.

Future Plans: IPO and Banking Expansion?

Following the case in the SEC, Ripple is now likely to hit the expansion button. Ripple CLO Stuart Alderoty hints that Ripple is now in the driver’s seat.

More so, the XRP company is likely to make an Initial Public Offering (IPO) soon. This would greatly improve XRP value, and probably bring in more institutional investors to the market.

Additionally, the firm is likely to expand its banking partnerships, strengthening its role in the global payment industry.

The company has already established relationships with major financial institutions, and with regulatory uncertainty lifted, it could attract even more partners.

According to Garlinghouse, this indicates that Ripple can proceed with its growth as a firm, without having to worry about rules and regulation.

Ripple is expected to see major developments in the next few months as its price bounces back and investors sentiment turns positive.

thecoinrepublic.com

thecoinrepublic.com