With Donald Trump ready to be announced the winner of the 2024 U.S. Presidential election, the crypto world is bracing for major changes in policies regarding Bitcoin and crypto.

Trump’s return to the White House comes with bold plans to reset crypto regulation, from removing SEC Chair Gary Gensler to creating a national Bitcoin reserve. His promises are sparking intense discussion among investors eager for a pro-crypto administration and skeptics questioning what’s truly achievable.

Gensler Out, Crypto-Friendly Policies In: Donald Trump’s Promises

One of Trump’s most anticipated moves is his pledge to remove SEC Chair Gary Gensler “on day one.” Under Gensler, the SEC launched over 130 enforcement actions against crypto projects, including big names like Coinbase, ConsensYs, Immutable and more, stirring uncertainty across the sector.

Donald Trump’s supporters argue that removing Gensler could foster an era of clear, pro-crypto policies that would attract innovation and investment back to U.S. shores.

If Trump follows through, Gensler’s exit could lead to policy revisions. Trader T, a well-known crypto analyst, outlined expectations on X (formerly Twitter), stating: “Fire Gary Gensler (Day 1).”

Ross Ulbricht’s Freedom: Divisive Yet Popular

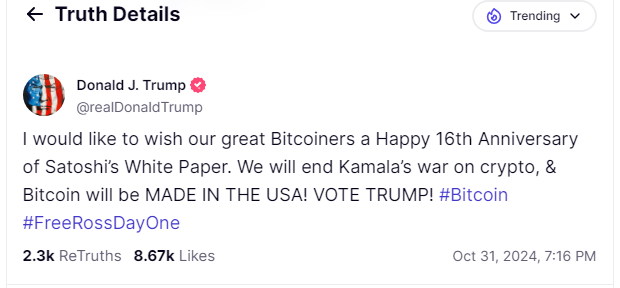

Trump has also promised to commute the sentence of Ross Ulbricht, the Silk Road founder serving two life sentences. Ulbricht’s case has long split opinions—supporters call his sentence excessive, while others see it as justified for his role in enabling illegal online trade.

Ulbricht’s potential release could impact how the crypto industry is viewed in Washington. The proposal to free Ulbricht has stirred strong reactions, with some viewing it as a move toward justice for a victim of overreach, while others fear it may complicate the industry’s reputation in the eyes of mainstream financial regulators.

Donald Trump’s Support For National Bitcoin Reserve and U.S. Mining

Trump’s proposal to establish a “National Bitcoin Stockpile” aligns with recent pro-crypto legislation introduced by U.S. Senator Cynthia Lummis, advocating for the government to retain seized Bitcoin rather than liquidate it.

This policy could potentially grow a strategic reserve of Bitcoin, which some proponents argue could strengthen the dollar or, in the long term, provide the U.S. with a hedge against economic downturns.

His plan to mine all the remaining Bitcoin in the USA (MADE IN THE USA) aims to attract Bitcoin miners to America, with an emphasis on sustainable practices. Industry voices suggest that clear support from the White House could place the U.S. at the forefront of crypto mining, appealing to both domestic and international investors.

No CBDCs, More Self-Custody Rights

Donald Trump’s aversion to Central Bank Digital Currencies (CBDCs) reflects a broader conservative stance on financial privacy. He has promised to block the development of a U.S. digital dollar, a move celebrated by crypto advocates who argue that CBDCs represent potential government overreach.

Instead, Trump’s plans promote “self-custody rights” for Americans, reinforcing the freedom to control one’s own digital assets without reliance on centralized exchanges.

Trump’s proposed crypto agenda could redefine the U.S. role in digital finance and make it a friendlier environment for innovation. With strong promises on the table, the crypto community eagerly awaits the steps his administration will take.

thecoinrepublic.com

thecoinrepublic.com