After nearly two years of waiting, FTX’s restructuring plan was finally approved by the court on October 7. Creditors can expect to receive their money back, though some dissenting opinions remain.

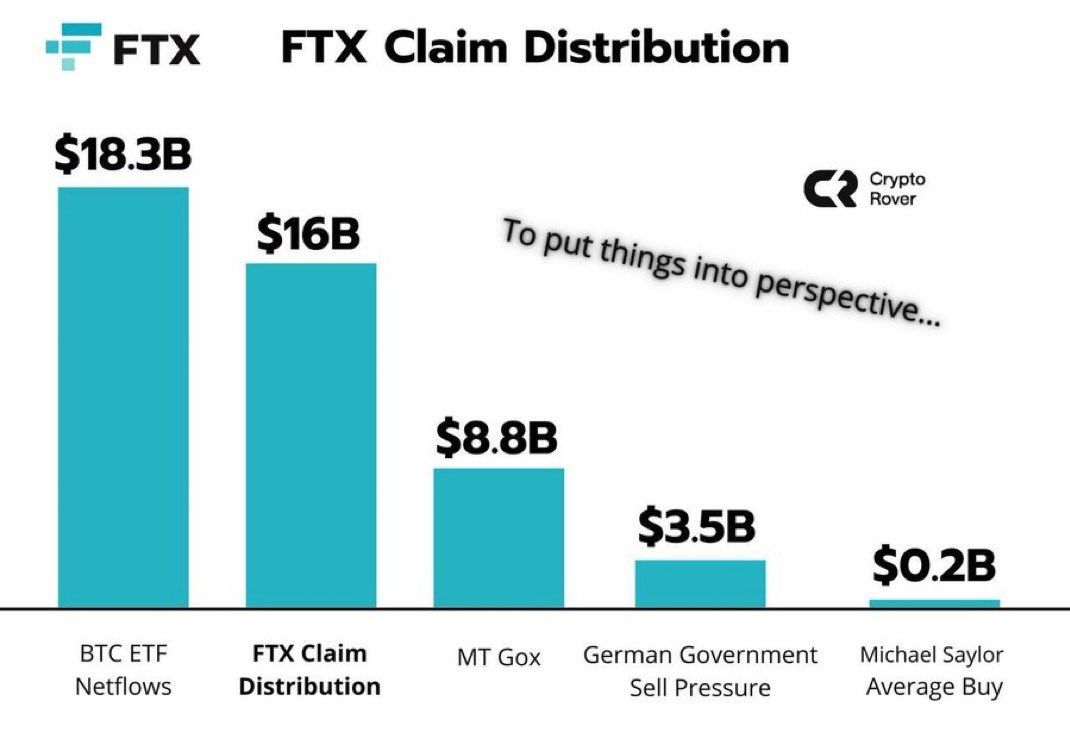

In May, the entity overseeing the bankrupt crypto exchange, FTX, announced its compensation plan. The entity estimated that more than $16 billion in assets could be successfully recovered, ready to be returned to the victims.

Over $16 Billion in Compensation May Be Paid to FTX Creditors

The Delaware District Bankruptcy Court has agreed to approve FTX’s asset compensation plan. According to the plan, 98% of creditors and affected users will receive up to 118% of the assets they requested to be returned.

Creditors will start receiving their payments within 60 days of the plan going into effect. The total amount of compensation, converted into cash, is expected to range between $14.7 billion and $16.5 billion. The plan had previously garnered the support of 94% of FTX creditors and customers.

“The Court’s confirmation of our Plan is a significant milestone on our pathway to distributing cash to customers and creditors.” John J. Ray III, Chief Executive Officer and Chief Restructuring Officer of FTX, said

This sum is nearly double that of Mt. Gox and 4.5 times the amount of selling pressure Germany’s government exerted in the past quarter.

Since the refund is not in crypto but in cash, many predict that it could boost the market.

“$16 Billion payout to crypto investors. Very bullish” Investor Crypto Rover commented

One creditor representative, Sunil Kavuri, criticized the plan, calling it a distortion of the truth. His reasoning lies in the fact that FTX’s asset recovery is calculated based on current market prices, while compensation for users is calculated based on the prices at the time of FTX’s collapse.

According to Kavuri, this means users will only receive 20% to 25% of their assets back. Moreover, only creditors claiming less than $50,000 may hope to receive compensation by the end of this year. Larger claims will likely not be resolved until mid-next year.

beincrypto.com

beincrypto.com