Coinbase and Ripple legal chiefs, Paul Grewal and Stuart Alderoty, have criticized the U.S. Securities and Exchange Commission (SEC) for its inconsistent approach to classifying tokens as securities. Grewal referenced Footnote 6 in the SEC’s amended complaint against Binance, where the agency admitted creating confusion by labeling tokens as securities. He also pointed out the SEC’s contradictory handling of Ethereum transactions. Alderoty echoed these concerns, cautioning: “Ripple’s case is over, but the ‘fair notice’ defense is still alive for others.”

SEC Criticized Over Crypto Asset Regulations

Coinbase’s Chief Legal Officer Paul Grewal commented on the U.S. Securities and Exchange Commission (SEC)’s admission last week regarding its classification of tokens as securities.

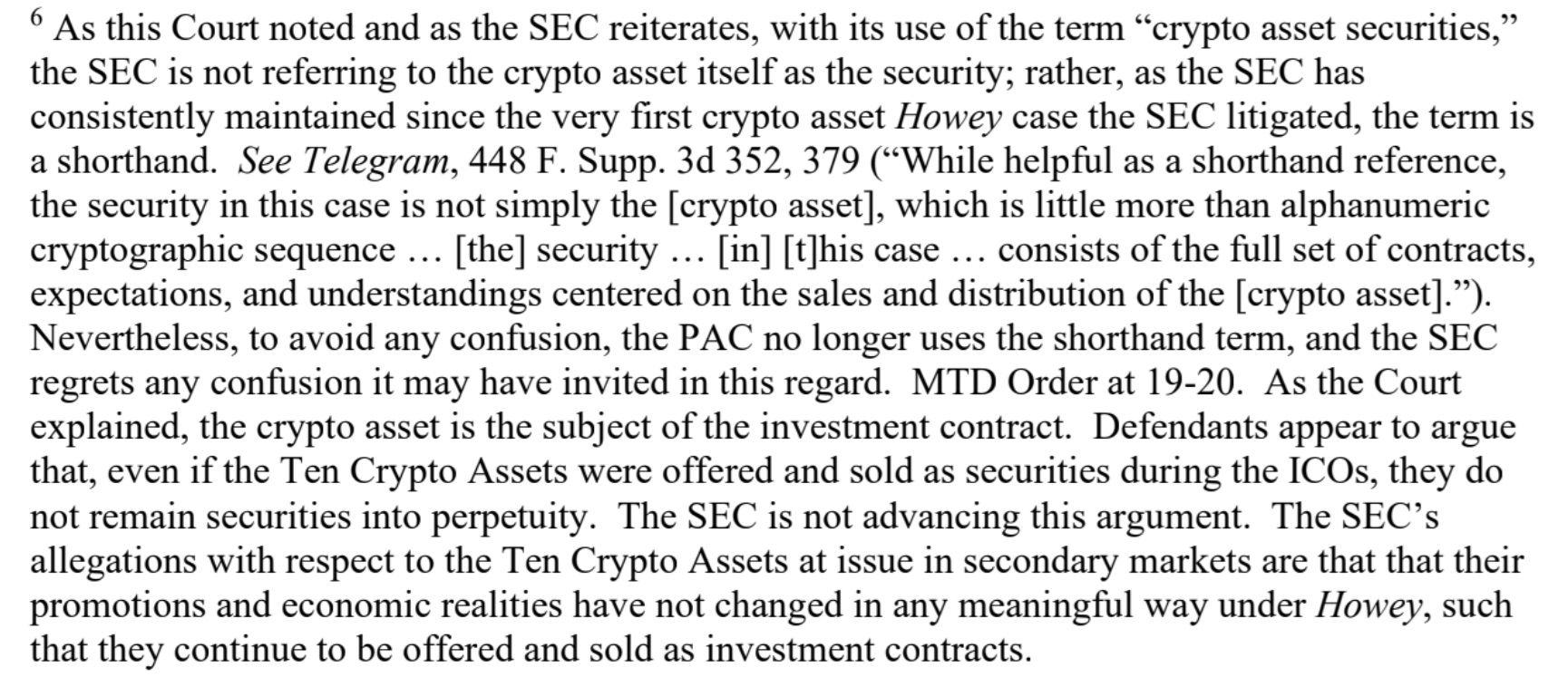

In his remarks on social media platform X, Grewal highlighted Footnote 6 from the SEC’s amended complaint against crypto exchange Binance, where the securities regulator acknowledged causing confusion by labeling tokens as securities. He detailed:

‘The SEC regrets any confusion it may have invited’ by falsely and repeatedly stating that tokens themselves are securities.

Grewal added that he hopes Ripple’s chief legal officer, Stuart Alderoty, “is getting some good sleep tonight,” predicting: “His head’s about to explode when he wakes up and see this.”

The Coinbase legal chief further criticized the SEC’s inconsistent handling of Ethereum transactions compared to other crypto assets. He expressed frustration with the agency’s approach, stating: “That’s apparently for the SEC to know, and the rest of us to find out only if and when we are sued.”

He also pointed out the SEC’s previous claims that tokens, like XRP, are securities, saying it’s evident from their regulatory actions. This record, according to Grewal, contradicts the agency’s current stance, leading to confusion about its regulatory practices.

Responding to Grewal’s post, Alderoty wrote on X: “So the SEC finally admits that 1/ ‘crypto asset security’ is a made up term and 2/ to prove a ‘crypto asset security’ is an investment contract, the SEC needs evidence of a bundle of ‘contracts, expectations, and understandings’?” The Ripple legal chief remarked:

Ripple’s case is over, but the ‘fair notice’ defense is still alive for others. The SEC cites the 2017 DAO report as industry notice that ‘crypto asset securities’ are subject to US securities laws.

Alderoty criticized the agency’s approach, noting: “Seven years later, the SEC apologizes to a federal judge—surely a person of at least ‘ordinary intelligence’—for the confusion it invited by using the inherently unclear term.”

news.bitcoin.com

news.bitcoin.com