The SEC’s aggressive digital asset enforcement actions have netted billions in settlements, the bulk of which occurred this year.

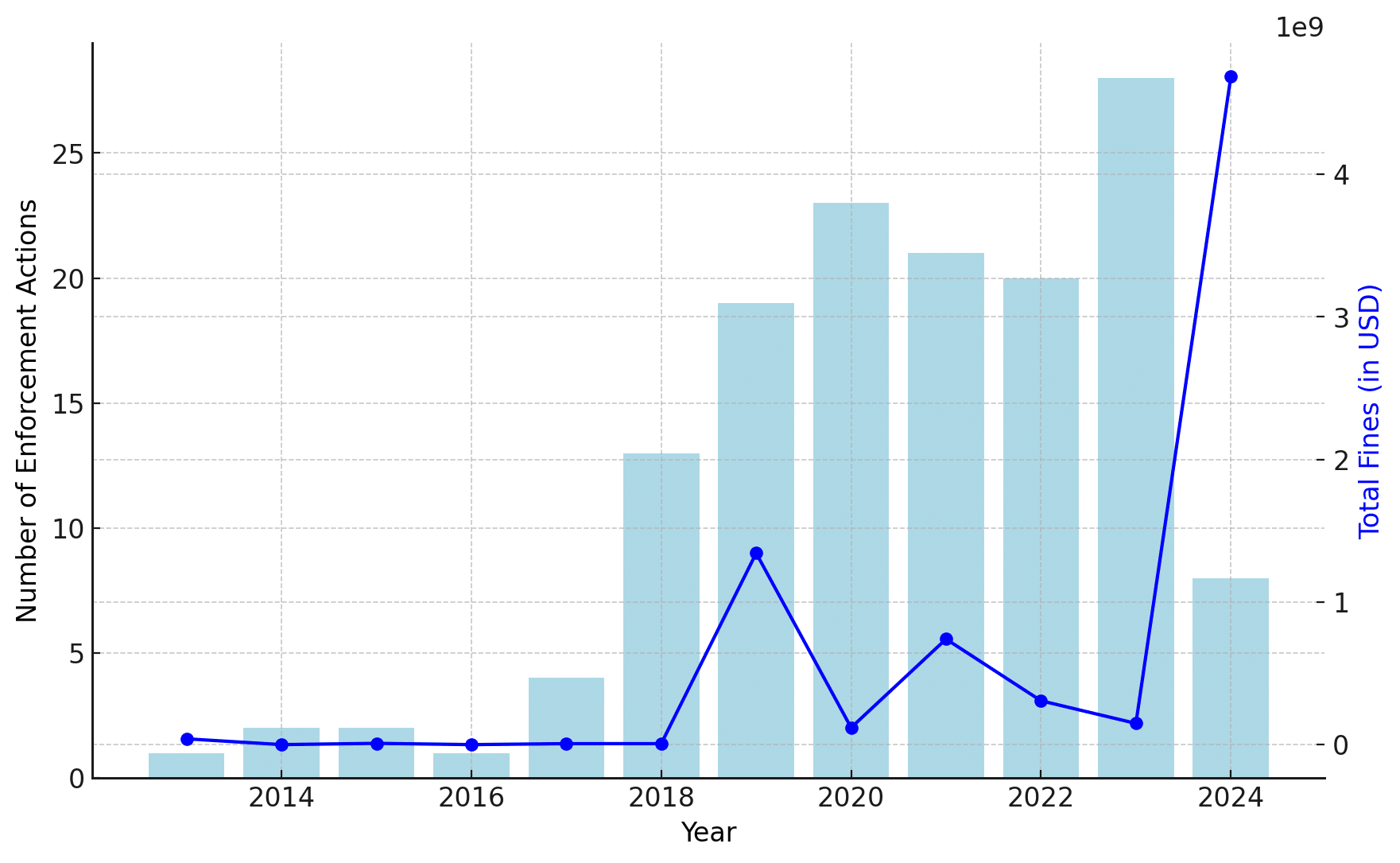

Since the U.S. Securities and Exchange Commission extended its oversight to the nascent crypto industry in 2013, civil penalties levied against crypto firms have totaled over $7.42 billion, according to a Social Capital Markets study shared with crypto.news on Sept. 9.

Notably, 68% of the SEC’s lifetime penalties, worth $4.68 billion, were issued to crypto businesses in 2024 as the agency intensified its Web3 crackdown.

The SEC and Do Kwon’s Terraform Labs reached a record $4.68 billion settlement, eclipsing the $4.3 billion agreement between the U.S. Justice Department, crypto exchange Binance, and its founder, Changpeng Zhao, in 2023.

While the SEC has already pursued 11 cases this year, 2023 was the most active period for crypto-related enforcement actions, with the agency filing 30 lawsuits against Web3 service providers and securing $150 million in settlements.

SEC suits jumped since 2018

The SEC’s crypto crackdown accelerated in 2018, marking the first time penalties issued to digital asset firms entered double digits.

By 2019, the average annual fine against crypto businesses skyrocketed by 2000%, primarily due to a $1.2 billion civil penalty imposed on Pavel Durov’s Telegram Group Inc. and its subsidiary, The Open Network (TON) Issuer, caused the leap.

This pattern of lawsuits confirms that the SEC’s “regulation by enforcement” approach pre-dates Gary Gensler’s appointment as chair.

For many in web3, Gensler’s face ranks high among anti-crypto regulatory rhetoric. Some 20,000 Bitcoin (BTC) 2024 attendees thunderously applauded former President Donald Trump for his promise to fire Gensler if re-elected.

As of now, Gensler remains SEC chair, and the agency continues its broad crypto crackdown. The multi-agency effort has become notoriously known as “Operation Choke Point 2.0.”

Several crypto businesses, like Coinbase and Ripple (XRP), are in legal battles with the SEC. Gensler has stated that most digital assets are securities and, therefore, non-compliant with federal laws.