The chief legal officer of the crypto firm Ripple is publicly issuing a challenge to the U.S. Securities and Exchange Commission (SEC).

Yesterday, the CEO of the world’s largest non-fungible token ($NFT) marketplace, Devin Finzer of OpenSea, announced that the SEC had slapped OpenSea with a Wells Notice.

A Wells Notice is a warning issued by the SEC that they are planning to pursue legal action against a company and is not an indication of wrongdoing.

Said Finzer,

“OpenSea has received a Wells notice from the SEC threatening to sue us because they believe NFTs on our platform are securities. We’re shocked the SEC would make such a sweeping move against creators and artists. But we’re ready to stand up and fight.

Cryptocurrencies have long been in the crosshairs of the SEC, and companies like Coinbase, Uniswap, Robinhood, Kraken and Consensys have been fighting against the SEC’s single-track approach of ‘regulation by enforcement.’

But this is a move into uncharted territory. By targeting NFTs, the SEC would stifle innovation on an even broader scale: hundreds of thousands of online artists and creatives are at risk, and many do not have the resources to defend themselves.”

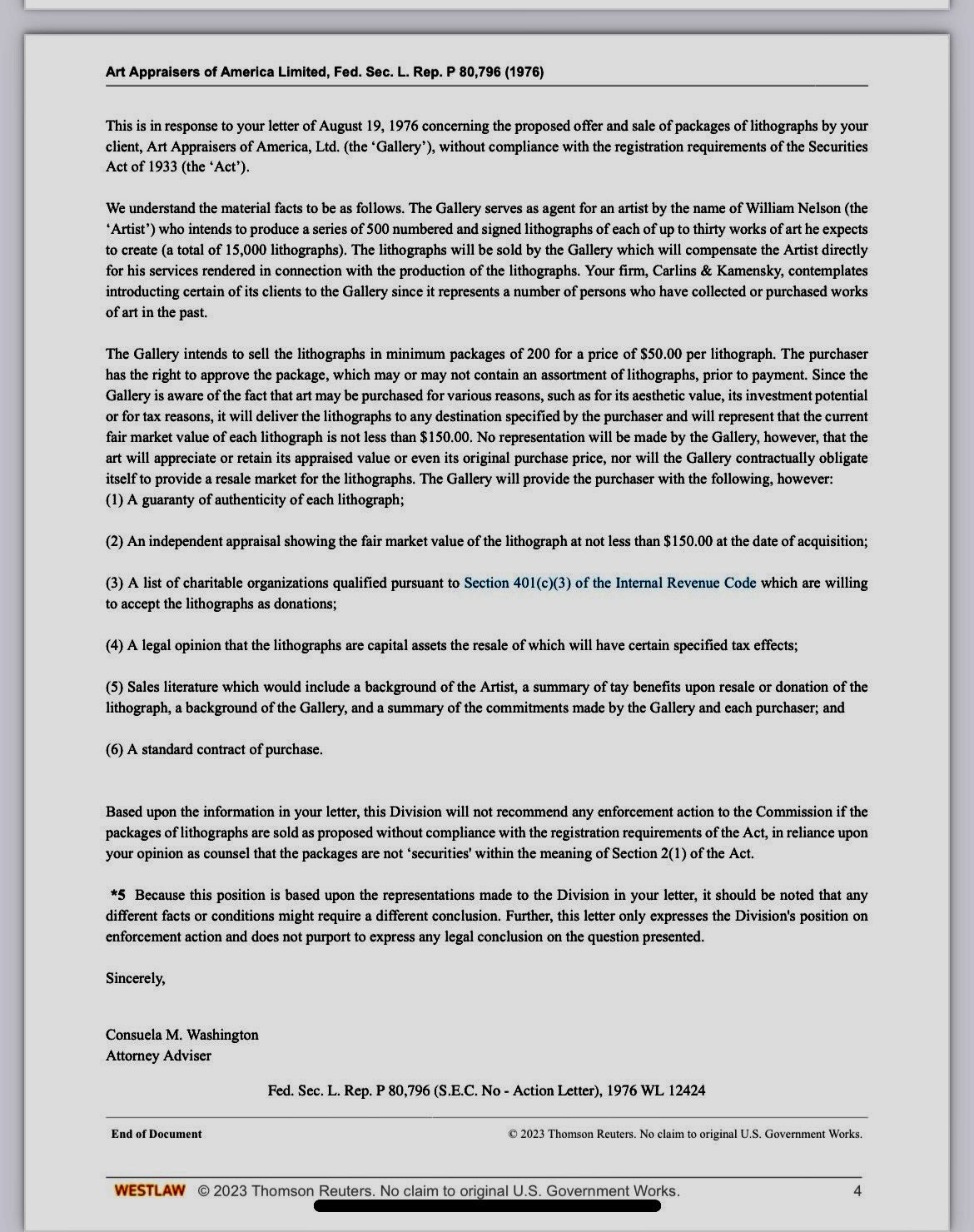

NFTs are viewed by many as the next wave in artistic intellectual property ownership and according to Ripple CLO Stuart Alderoty, the SEC ruled that art galleries did not have to register with the SEC nearly 50 years ago.

“Fun fact: In 1976, the SEC ruled that art galleries, even when promoting and selling to buyers that had investment motives, didn’t need to register with the SEC.”

The SEC has not responded to Alderoty’s statement at time of writing.

dailyhodl.com

dailyhodl.com