Decrypt’s Art, Fashion, and Entertainment Hub.

Discover SCENE

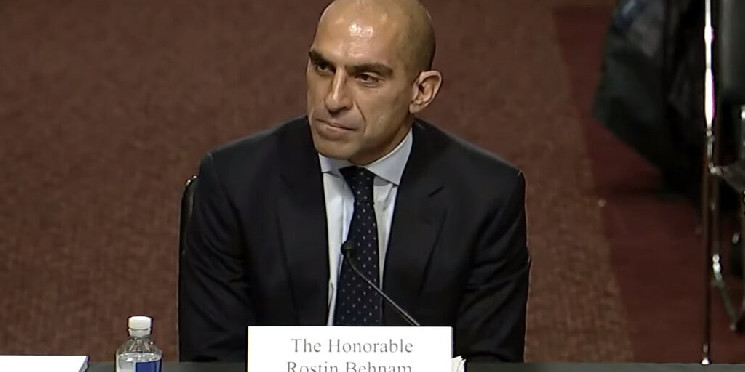

Crypto Twitter was quick to celebrate Wednesday following congressional testimony from Rostin Behman, in which the chairman of the Commodity Futures Trading Commission (CFTC) said a recent federal court ruling reaffirmed Bitcoin and Ethereum’s status as commodities.

While the Securities and Exchange Commission’s (SEC) Chairman, Gary Gensler, has said that Bitcoin isn’t under his agency’s regulatory purview, a cloud of uncertainty still lingers around crypto’s second largest coin—despite the abrupt approval of spot Ethereum ETFs in May.

“In its decision, the court reaffirmed that both Bitcoin and Ether are commodities under the Commodity Exchange Act (CEA),” Behman said, referring to a fraud case pursued by the CFTC in the U.S. District Court for the Northern District of Illinois against an unregistered entity.

BTC and ETH are commodities. pic.twitter.com/HKzgkRaWkn

— Dan (@DN_Founder) July 10, 2024

Decided by Judge Mary M. Rowland, the case’s defendant argued that the CFTC’s statutory authority, when it comes to regulating commodities, “does not extend to any cryptocurrencies.” However, the judge ruled that Bitcoin and Ethereum are well within the CFTC’s regulatory scope based on the case’s similarity with other decided cases and language within the CEA.

But Rowland's decision, and Behman's citation, doesn't mean Ethereum's status is set.

Even though other courts can take the decision into consideration, which was reached in trial court, Rowland’s ruling isn’t binding within the Northern District of Illinois—let alone the rest of the country—Anthony Tu-Sekine, a partner at Seward & Kissel, told Decrypt.

“Anything that happens on the trial court level is not really binding on the other courts in that jurisdiction,” he said. “This is good news, not bad news, but it’s probably not that big.”

CFTC officials first described Ethereum as a commodity in 2019, when then-chairman Heath Tarbert spoke at Yahoo Finance's All Market Summit. While the SEC has never claimed that Ethereum is a security, a since-dropped investigation into “Ethereum 2.0” raised questions.

When it comes to the intersection of crypto and securities laws, judges within the same jurisdiction have issued conflicted rulings. For example, in the U.S. District Court for the Southern District of New York, Judge Analisa Torres found in the SEC’s case against Ripple that the sale of certain cryptocurrencies on secondary markets isn’t subject to securities laws.

“There's another case in the Southern District where the judge actually disagreed with [Torres’] conclusion,” Tu-Sekine said, referring to a ruling in the SEC’s case against Terraform Labs.

U.S. District Judge Jed Rakoff declined to extend Torres’ reasoning while letting the SEC’s case proceed last summer, citing the Howey Test, a framework outlined by the Supreme Court which is used to determine whether an asset is a security.

"Howey makes no such distinction between purchasers, and it makes good sense that it did not," Rakoff wrote. "The court declines to draw a distinction between these coins based on their manner of sale."

Still, the SEC implicitly signaled that Ethereum is a commodity when it approved applications for spot Ethereum ETFs in May, Tu-Sekine said.

If an investment vehicle invests in securities, there are certain regulatory forms that are required along with that, which isn’t the present case among asset managers currently jockeying for a spot Ethereum ETF, Tu-Sekine noted.

Still, Behman’s comments Wednesday were hailed on Crypto Twitter as a major development, as influential accounts like Degen News blasted out tweets in all-caps.

“What a time to be alive,” one user commented.

Edited by Ryan Ozawa.

decrypt.co

decrypt.co