We consider Bitcoin and $ETH as a revolutionary technology and during a recent Senate Committee hearing, CFTC Chairman Rostin Behnam made significant declarations about cryptocurrencies. He reaffirmed that Bitcoin and Ethereum are commodities under the Commodities Exchange Act. This classification follows a recent ruling by an Illinois district court that upheld their status.

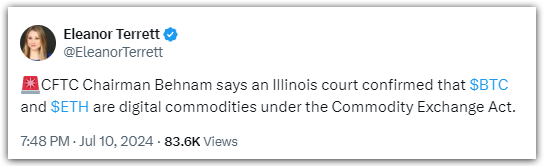

According to Eleanor Terrett, a journalist at Fox Business, CFTC Chairman Behnam said that an Illinois court confirmed that $BTC and $ETH are digital commodities under the Commodity Exchange Act. Here is what she shared on X handle:

The difference between commodities and securities is crucial in regulation because commodities like gold or oil are tradable goods. Whereas, securities represent ownership in a company.. This classification places Bitcoin and Ethereum under the jurisdiction of the CFTC. It marks a clear distinction from assets regulated by the SEC.

Here comes Behnam’s statement! Which states 70% to 80% of cryptocurrencies are not securities and that challenges SEC Chairman Gary Gensler’s view. This difference highlights the ongoing debate about how to regulate digital assets.

Considering Bitcoin and Ethereum as commodities provides clarity. It could lead to broader acceptance in the crypto market. This decision sets a precedent for future rulings and might reduce uncertainty that has slowed market growth.

Looking ahead, Behnam called for legislative measures to strengthen the CFTC’s oversight of non security tokens. He also emphasized the need for strong protections for investors due to the market’s volatility. His statements show a proactive approach to balancing regulation and fostering innovation in the crypto currency world.

Currently we are at a stage of rapid evolution in terms of technology and precautions in the Defi World. As regulations evolve, the distinction between securities and commodities will be key. Behnam’s remarks reflect the CFTC’s commitment to adapting regulations for the rapidly changing digital landscape.

coinpedia.org

coinpedia.org