This year, with the U.S. Securities and Exchange Commission (SEC) increasing enforcement on businesses accused of offering unregistered crypto securities to American investors, regulators, attorneys, and judges have been utilizing the Howey Test to ascertain whether specific crypto assets constitute an “investment contract” and thereby fall under U.S. securities laws. Below is an in-depth exploration of the Howey Test and its application to crypto assets.

Understanding the Howey Test

If you’ve been keeping up with the enforcement actions issued by the U.S. Securities and Exchange Commission (SEC), you’re probably familiar with the Howey Test. Here is a concise overview of this standard and how law firms, courts, and U.S. regulators have been applying it to digital currencies. The use of the Howey Test in the context of cryptocurrencies has sparked substantial regulatory debate in recent years.

For instance, initial coin offerings (ICOs) from a few years ago, which promised investors returns primarily driven by the efforts of developers or third-party promoters, have been classified as securities offerings by the SEC. It appears that U.S. regulators and the broader community agree on categorizing bitcoin (BTC) as a commodity rather than a security. Ethereum, however, remains more ambiguous, as the SEC and Chair Gary Gensler have refrained from clarifying whether ETH is considered a security.

In specific enforcement actions, the SEC has identified several digital currencies it considers “investment contracts” or crypto securities. For instance, in the lawsuit against Binance, the SEC classified solana (SOL), cardano (ADA), polygon (MATIC), decentraland (MANA), flow (FLOW), and cosmos (ATOM), among others, as securities. Similarly, in the case against Coinbase, the regulator deemed axie infinity (AXS), chiliz (CHZ), sandbox (SAND), and others as securities. The U.S. securities watchdog has named at least 70 crypto assets it believes are securities.

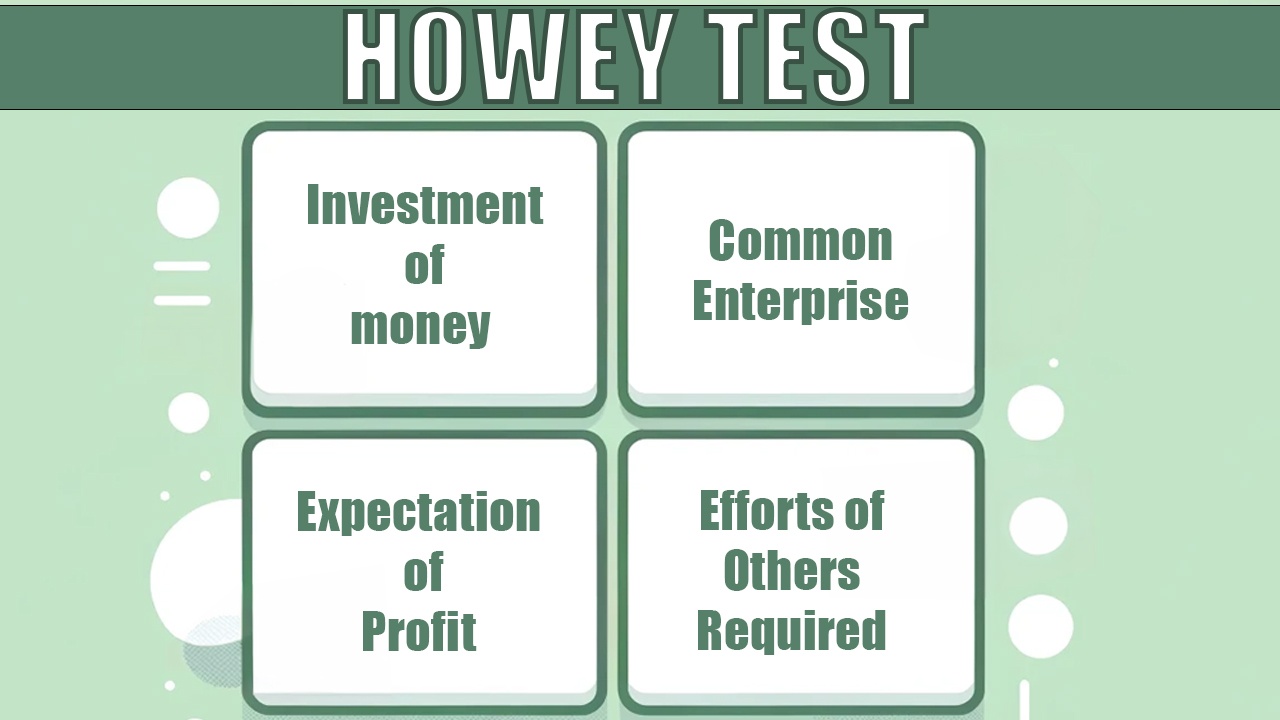

To determine whether an asset is a security, regulators rely on a Supreme Court case from 1946, SEC vs. W.J. Howey Co. This case established criteria for defining investment contracts. According to these criteria, an investment contract exists if there is an investment of monetary value, a common enterprise, an expectation of profits, and an increase in value primarily from the efforts of the organizers or third parties. Regulators and courts use the Howey Test to evaluate if a crypto asset is a security by examining whether there is an investment of money in a common enterprise with an expectation of profit mainly from others’ efforts.

If these conditions are met, the asset is likely classified as a security, subject to federal laws, requiring registration and disclosures. Under the Howey Test, a crypto asset is likely considered a security if the project issues tokens to participants who invest money with the expectation of earning dividends or interest from the platform’s pooled investments. In such cases, the returns on investment depend largely on the developers’ efforts to manage and optimize the investment pool, possibly meeting the Howey Test criteria.

However, applying the Howey Test to crypto assets can be confusing due to their multifaceted nature. Unlike traditional financial instruments, crypto assets can function as a currency, commodity, utility token (used as ‘gas’ for transactions), or even as a stake in a decentralized application. Each functionality might suggest different regulatory treatments, involving various dynamics of profit expectation and third-party efforts, which are crucial elements in the Howey Test.

Therefore, the same asset might be categorized differently based on its use case and the specific circumstances of its distribution and function. This complexity makes it challenging for regulators and courts to apply the Howey Test consistently across the broad spectrum of crypto assets, leading to calls for clearer guidelines or new frameworks tailored to the unique characteristics of digital assets. Crypto businesses argue that the SEC and government have not provided clear guidelines for certain digital assets.

Crypto businesses criticize the SEC for unclear regulations on crypto assets, accusing it of “regulation by enforcement” instead of providing clear guidelines. The industry contends that the Howey Test, developed in 1946, is inadequate for modern digital assets, stifling innovation and pushing companies to relocate to more crypto-friendly countries. There is a strong call for clearer, tailored regulatory frameworks to support technological advancements.

What do you think about the Howey Test? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com