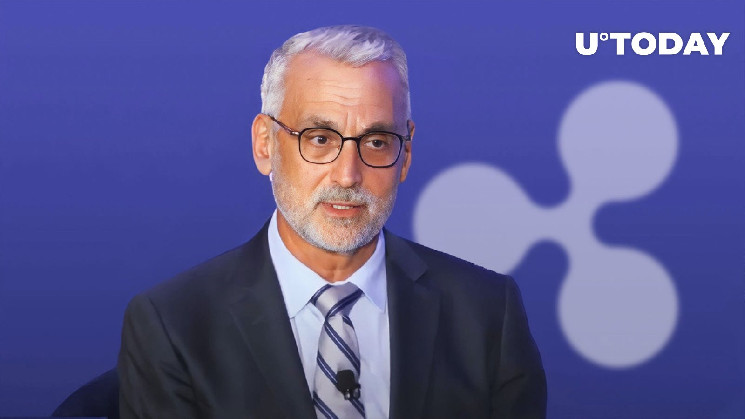

Stuart Alderoty, Ripple's chief legal officer, has celebrated a recent bipartisan vote in the US Senate to kill an anti-crypto SEC rule that could pose a major threat to regulatory custodial services in the US.

Alderoty claims that the "unauthorized overreach" of Securities and Exchange Commission Chair Gary Gensler will not be tolerated by both parties.

As reported by U.Today, some of the most influential cryptocurrency luminaries, including MicroStrategy co-founder Michael Saylor, have praised the Senate for voting to nullify the SEC's controversial SAB 121 guidance.

The rule was supposed to force regulated banking institutions to register the cryptocurrency holdings of their customers on their balance sheets. The industry took issue with this rule since it would make it very challenging for banks to offer custodial services. Some critics also noted that it could potentially negatively impact the rights of cryptocurrency owners. The SEC's cryptocurrency-friendly commissioner Hester Peirce also slammed the agency's approach to regulation custodial services for digital assets as "scattershot."

The cryptocurrency industry and banks united in their efforts to repeal the SEC's SAB 121 rule. The banks are against it since it would negatively affect their balance sheets due to crypto's inherent volatility. Gensler, however, has defended the rule, pointing to the fact that the previous 120 SABs were not called into question.

Alderoty, who keeps a close eye on the latest developments on Capitol Hill, has repeatedly stressed the significance of bipartisan cooperation when it comes to cryptocurrency-related bills.

He has also taken note of recent efforts by US lawmakers to pass a much-anticipated stablecoin bill. Ripple is gearing up to launch its own stablecoin, which has already appeared in the SEC's crosshairs.

u.today

u.today