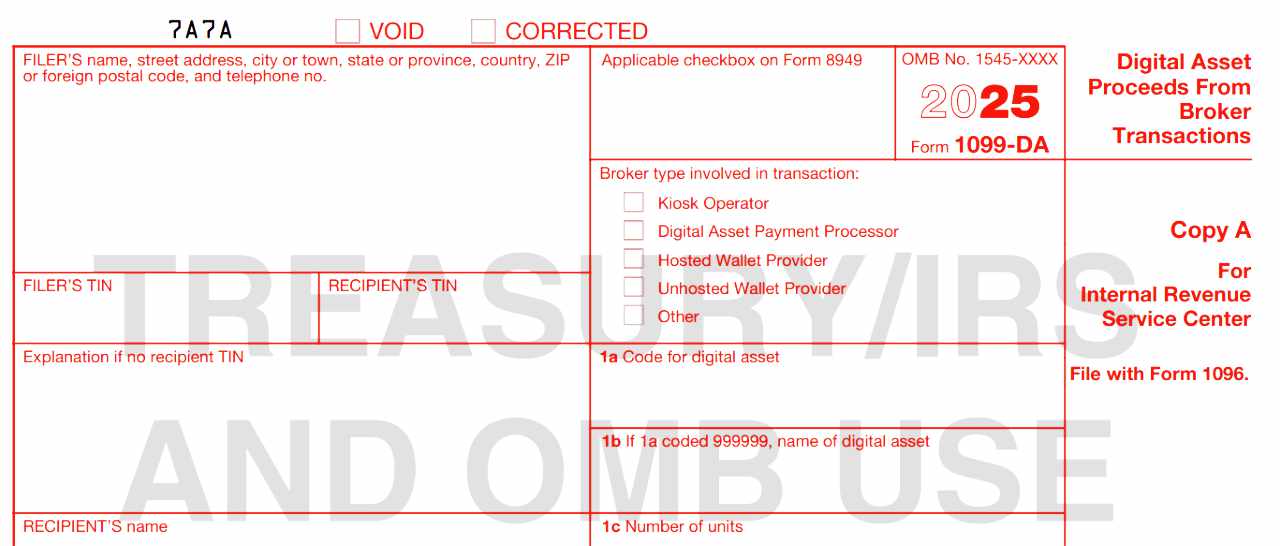

The U.S. Internal Revenue Service (IRS) has released a draft tax Form 1099-DA for reporting digital asset proceeds from broker transactions. Brokers, including unhosted wallet providers, are required to report proceeds from digital asset dispositions to the IRS. A crypto tax expert has highlighted that the collection of certain data points, such as wallet addresses, by the IRS “could raise significant privacy and security concerns.”

IRS Introduces Tax Form 1099-DA for Digital Assets

The U.S. Internal Revenue Service (IRS) released the much-anticipated draft tax form for reporting digital asset transactions on Thursday, applicable for tax filings in 2025. The form, known as 1099-DA, is for reporting “Digital Asset Proceeds From Broker Transactions.”

Per the instructions on the form for recipients, “Brokers must report proceeds from (and in some cases, basis for) digital asset dispositions” to taxpayers and the IRS using Form 1099-DA. Brokers filling out the form must specify whether they are “a kiosk operator, digital asset payment processor, hosted wallet provider, unhosted wallet provider, or other digital asset filer,” the IRS detailed.

The form also notes: “If you received a Form 1099-DA, you generally sold, exchanged, otherwise disposed of a financial interest in a digital asset and should check the ‘Yes’ box next to the question on page 1 of Form 1040.”

Shehan Chandrasekera, head of tax strategy at crypto tax firm Cointracker, shared his thoughts about the new IRS tax form on Friday. He wrote on social media platform X:

I don’t think crypto will be pseudo-anonymous or privacy-preserving anymore, at least in the US.

Chandrasekera described the 1099-DA form as “the first tax form specifically designed to collect your ID and detailed transaction data at scale from ‘brokers.'” He explained that centralized exchanges, certain decentralized exchanges, and wallets “will be required to generate this form for each sale transaction and submit that info to the IRS and you (similar to stock brokers) starting 1/1/2025.”

While noting that the 1099-DA form “captures unsurprising data points such as date acquired, date sold, proceeds, and cost basis of crypto assets sold,” he stressed:

However, the collection and reporting of the following additional data points (especially wallet addresses) to the IRS at scale could lead to major privacy and security concerns.

Regarding sales-related data points, Chandrasekera detailed that the IRS requires information for each transaction, including the “sale transaction ID (TxID),” the “digital asset address from which the units were sold,” and the “number of units sold.” For transfer-related data points, he said the tax authority requires the declaration of the “transfer-in TxID number,” the “transfer-in digital asset address,” and the “number of units transferred in.”

Highlighting that in the new draft Form 1099-DA, the IRS has included “unhosted wallet provider” as a check box, he stressed: “This further signals the IRS’s intention to include unhosted wallets under the broker definition despite the industry feedback.” He additionally explained that what this new IRS form means:

Going forward, you will likely have to provide KYC information before creating an unhosted wallet and/or when interacting with platforms via unhosted wallets.

“This could drastically change how users interact with crypto platforms,” Chandrasekera continued, adding that it will change decentralized finance (defi) as we know it today.

news.bitcoin.com

news.bitcoin.com