Cryptocurrency exchange KuCoin, along with two of its founders, has been charged by the United States Department of Justice for allegedly conspiring to violate the Bank Secrecy Act by operating without a compliant anti-money laundering program. This failure purportedly facilitated money laundering and terrorist activities through the platform.

You might also like

SWIFT Advances CBDC Experimentation with Smart Contract and Atomic Settlement Capabilities

Grayscale Expresses Confidence in Approval of Ether ETFs Despite SEC’s Limited Engagement

According to U.S. Attorney Damian Williams, KuCoin’s lack of basic anti-money laundering policies allowed it to operate as a haven for illicit money laundering, with over $5 billion received and over $4 billion sent in suspicious and criminal funds.

The charged individuals include KuCoin founders Chun Gan and Ke Tang, both Chinese citizens, along with Flashdot Limited, Peken Global Limited, and Phoenixfin Private Limited. The founders are currently at large, and KuCoin was operating as an unlicensed money transmitting business.

The Department of Justice alleges that KuCoin targeted business from U.S. customers for its spot and futures exchanges without proper registration with the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) and the U.S. Commodity and Futures Trading Commission (CFTC).

HSI Acting Special Agent in Charge Darren McCormack described KuCoin as “an alleged multibillion-dollar criminal conspiracy.”

The Department of Justice claims that KuCoin did not implement a know-your-customer (KYC) program until July 2023, and even then, it was only for new customers, neglecting existing ones. KuCoin allegedly marketed to U.S. customers while attempting to conceal its awareness of having customers in the country.

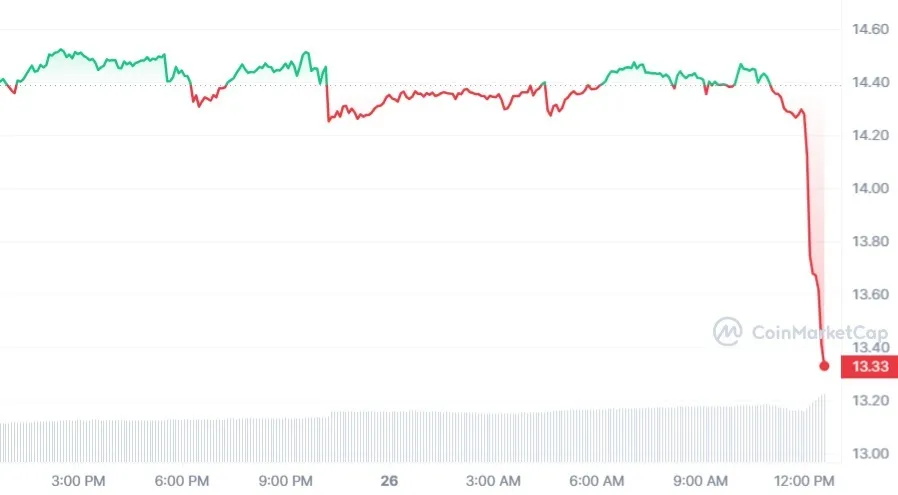

The news of the charges had a significant impact on KuCoin’s native cryptocurrency ecosystem, causing the value of KuCoin Shares (KCS) to drop sharply.

Within hours of the announcement, KCS experienced a flash crash of over 12%, falling from $14.40 to $12.55. This represents the worst day for KCS since December 2023 and puts the coin’s support at the exponential moving average of the last 55 days (EMA55) under scrutiny. While the EMA55 appears to be holding up for now, the long-term consequences of the charges on the exchange and its native token remain uncertain.

coinculture.com

coinculture.com