The New Zealand financial market regulator updated its warning list on Wednesday, adding two new entities. The Financial Market Authority (FMA) warns against the activities of the fake BTCSWE and Grandeur Capital Pro.

BTCSWE Is a Clone and Recovery Scam

According to information provided by the FMA, BTCSWE is a legally operating cryptocurrency exchange in New Zealand. However, in recent weeks, someone has been impersonating its representatives, contacting consumers, and promising the possibility of recovering funds lost during unsuccessful investments.

"Fabricated documents were supplied to help convince the victim of this individual's identity and ability to access lost funds," the FMA explains using the example of one victim. "In order to recover this money, the victim was required to pay a contract fee over a period of months."

In this case, the victim lost a "significant amount of money" after the scammers gained access to their account. The FMA contacted BTCSWE and confirmed that it had fallen victim to a "recovery scam" in which someone impersonated its employees.

Two months ago, local consumers fell victim to another recovery scam in which scammers impersonated the British regulator, promising to help recover funds.

Grandeur Capital Pro Misled Clients

As for Grandeur Capital Pro, the second entity on the FMA's warning list, investors who could not withdraw their funds reported to the regulator.

The FMA established that the company uses a fake address and is not licensed or authorized in New Zealand. Therefore, it encourages investors to exercise extreme caution.

"We consider that it is likely that Grandeur Capitol Pro is operating an investment scam. We recommend caution when dealing with Grandeur Capital Pro," the FMA explained.

Number of Scams in New Zealand Decreases

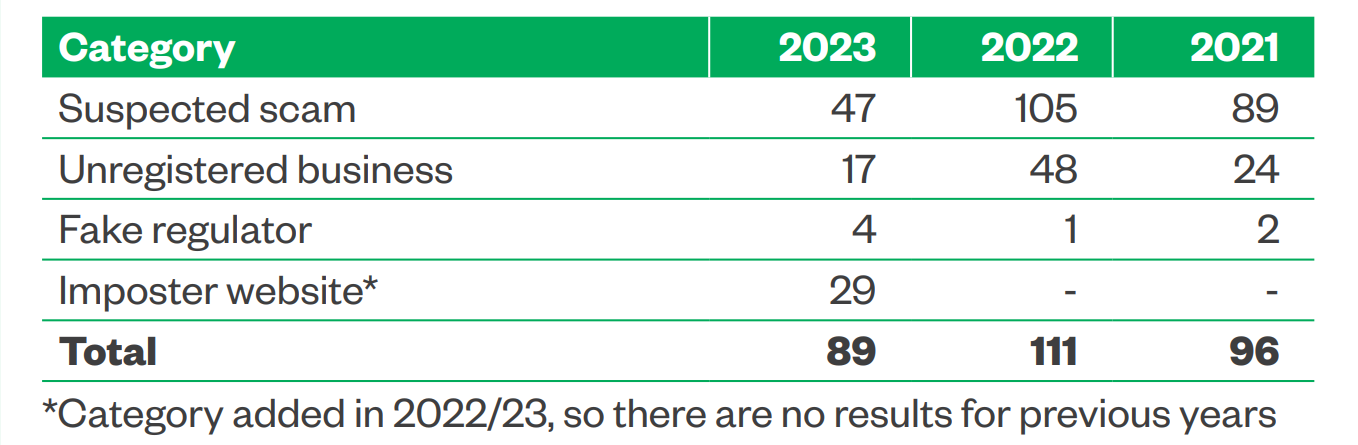

Although the FMA remains very active in warning against potential scams and regularly updates its warning list, according to a report published in December 2023, the number of financial crimes in the country has decreased.

However, there has been an increase in the number of websites impersonating registered entities that offer trading and financial services to retail clients.

In total, the number of suspicious companies operating in the country decreased from 111 in 2022 to 89 in 2023.

financemagnates.com

financemagnates.com