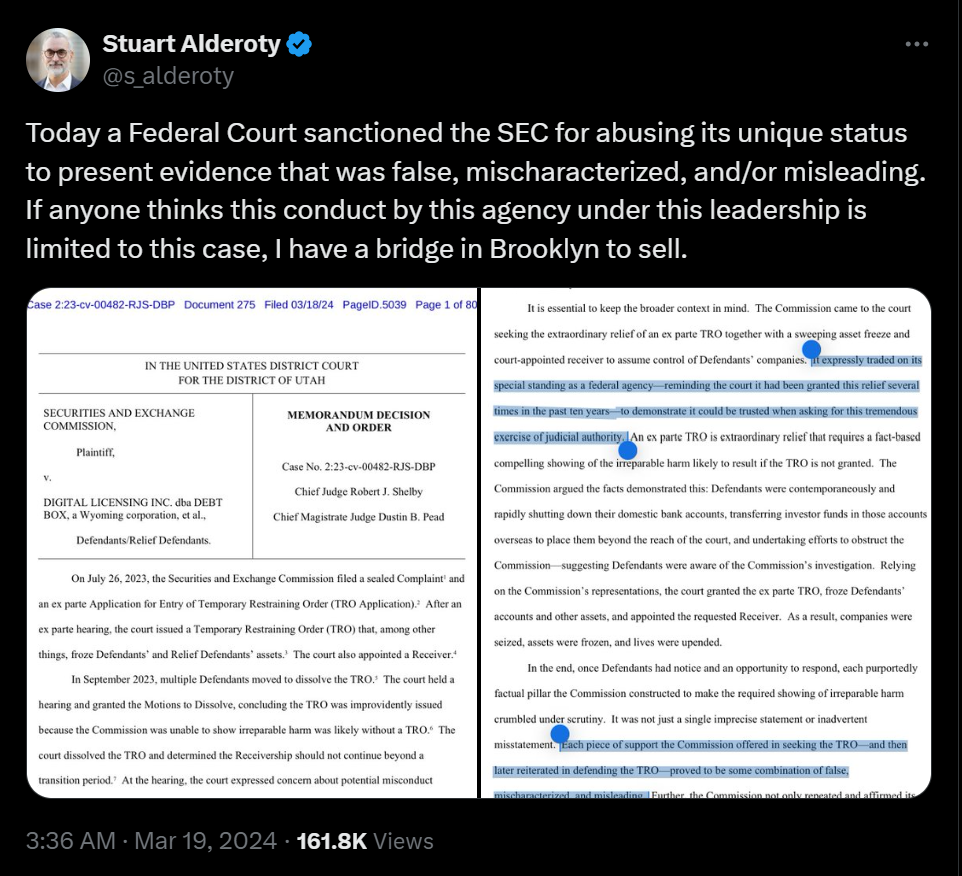

A U.S. district court issued a severe reprimand to the Securities and Exchange Commission (SEC) for what was described as a “flagrant misuse of authority” during litigation against the cryptocurrency sector.

The SEC faced judicial censure after a failed attempt to regulate the cryptocurrency industry more stringently. This misstep involved the SEC being labeled as “malicious behavior” by Judge Robert J. Shelby. He highlighted that the SEC deceitfully influenced the court to impose a temporary injunction against Debt Box, stemming from a legal action initiated in July.

Judge Shelby’s decision detailed that the SEC’s actions egregiously overstepped the powers granted by Congress, damaging both the credibility of the legal process and the integrity of judicial proceedings.

The ruling mandated the SEC to compensate Debt Box for legal and court expenses. Debt Box operates in the cryptocurrency sphere, offering licenses for “node software, ” enabling purchasers to earn through cryptocurrency mining.

Industry Reaction to SEC’s Conduct

Amanda Tuminelli, the Chief Legal Officer at DeFi Education Fund, commented to Decrypt, expressing unsurprise at the SEC’s deceitful tactics. She emphasized the need for judges to demand that the SEC substantiate its allegations with verifiable evidence. Initially, the SEC accused Debt Box of misleading investors about raising funds and misallocating those funds for personal luxuries, instead of business development.

The SEC argued against prior notification to Debt Box about the injunction due to fears of the defendants fleeing to the United Arab Emirates (UAE), citing a transfer of $720,000 as evidence. However, this claim was later debunked, leading to the revocation of the temporary restraining order by the Utah District Court upon discovering the funds remained within the U.S.

The court’s subsequent “show cause order” required the SEC to justify its initial accusations or face consequences. The SEC’s response, admitting to a lack of candor with the court, sought dismissal of the case without prejudice, arguing against the imposition of fines.

Judge Shelby, however, showed little sympathy for the SEC’s position, refusing to overlook the transgressions as mere oversights. He criticized the SEC’s dishonest efforts to secure and defend the restraining order.

Debt Box hailed the outcome as a significant triumph, asserting on Twitter that the case underscores the need for legal and regulatory reforms and the paramount importance of honesty within the judicial framework. The order for the SEC to bear Debt Box’s legal costs was pivotal for regulatory transparency and ethical conduct.

The decision was warmly received by cryptocurrency industry leaders, who have long criticized the SEC’s antagonistic stance toward the sector. Paul Agrewal, Coinbase’s Chief Legal Officer, pointed out the broader implications of government-imposed fines, emphasizing that ultimately, such costs are borne by consumers. He suggested the Debt Box ruling could bolster Coinbase’s ongoing legal challenges against regulatory actions.

Snap | Source: X (Formerly Twitter)

SEC’s Legal Battles

The recent allegations only add to a big list of backlashes on the SEC. Critics argue that the SEC’s regulation by enforcement strategy, rather than providing clear, formal rulemaking, stifles innovation and causes economic harm by leaving companies navigating a murky regulatory landscape without clear guidelines. In the case involving Coinbase, the crypto exchange and its supporters, including the Crypto Council for Innovation and the U.S. Chamber of Commerce, have accused the SEC of crippling innovation through inaction and a refusal to provide necessary regulatory clarity. This includes a specific critique of the SEC’s so-called “pocket veto” approach, where it neither approves nor denies rulemaking petitions, effectively leaving companies in limbo. Coinbase’s chief legal officer has publicly expressed concerns over the SEC’s regulatory clarity timeline, fearing a years-long delay.

In a separate legal battle, Binance challenged the SEC’s lawsuit against it, which includes allegations of fraud and market manipulation, as well as the illegal facilitation of crypto token trades deemed unregistered securities by the SEC. Binance’s defense emphasizes the lack of clear guidelines for crypto tokens’ regulatory status and accuses the SEC of speaking from both sides of its mouth, encouraging industry registration while simultaneously making it practically impossible. This case, like Coinbase’s, highlights the industry’s struggle for regulatory clarity and the perception that the SEC’s approach to enforcement over guidance may be overreaching.

Furthermore, the SEC’s proposals targeting crypto exchanges and trading platforms have been met with concern over their broad and vague language, which could encompass a wide range of crypto-related activities, including decentralized finance (DeFi) systems. The industry has criticized these proposals for lacking clear guidance on which crypto assets are considered securities and for the perceived impossibility of registering crypto asset exchanges and platforms under current regulations. This has led to further accusations of the SEC effectively engaging in regulation by enforcement, without offering a viable path for compliance.

cryptonews.net

cryptonews.net