According to U.S. Representative Tom Emmer, a central bank digital currency (CBDC) remains a high priority for the Federal Reserve, as indicated in a document shared during a Federal Reserve presentation to Congress.

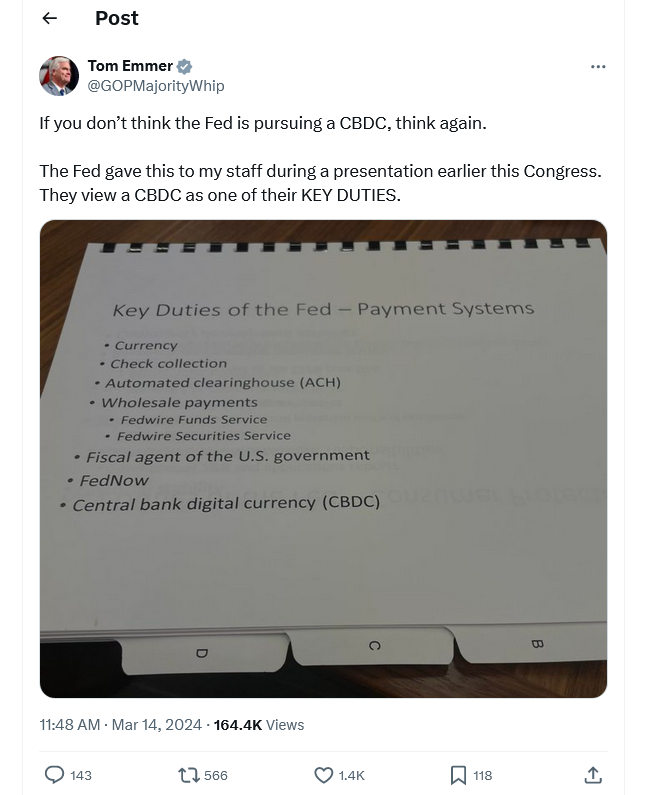

Emmer emphasised the Fed’s pursuit of a CBDC in a post on X, where he disclosed the document reportedly provided to his staff during the presentation. The document outlines seven “Key Duties” of the Fed’s payment systems, with mentions of Automated Clearinghouse and FedNow, among others, indicating a focus on digitalizing the U.S. dollar.

Federal Reserve Chair Jerome Powell’s recent comments during a Senate hearing suggested that the U.S. is not close to recommending or adopting a CBDC in any form. However, the surfaced document confirms that the Fed continues to consider CBDCs as part of its long-term strategy.

The Federal Reserve released a paper on CBDCs in January 2022 to explore their potential benefits and risks. The central bank is overseeing the digital dollar project, which has undergone several pilot programs in recent months.

Despite the Fed’s exploration of CBDCs, concerns have been raised about the implications of a digital dollar, including fears of increased financial surveillance. Former U.S. President Donald Trump has strongly opposed the creation of a CBDC, labelling it a “very dangerous” concept that threatens freedom. Similarly, U.S. presidential candidate Robert F. Kennedy Jr. has pledged to fight against the development of the digital dollar, citing concerns about its impact on human and civil rights.

In response to these concerns, legislative efforts have been made to regulate CBDC initiatives. The House Financial Services Committee has supported the Digital Dollar Pilot Prevention Act, which aims to prohibit the Federal Reserve from conducting pilot programs for CBDCs without approval from Congress.

coinculture.com

coinculture.com