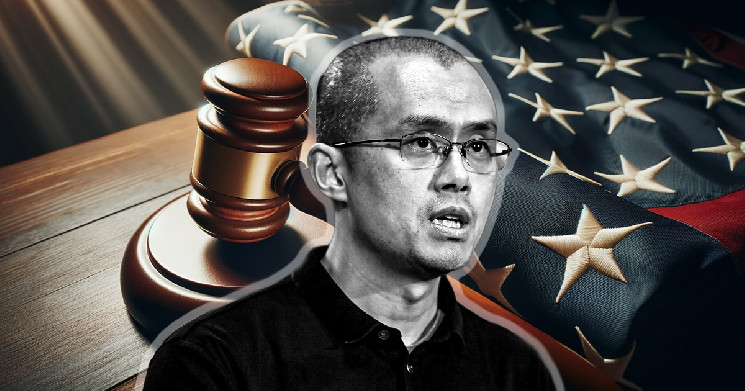

Changpeng Zhao, co-founder and former CEO of Binance, has been instructed by US authorities to surrender his Canadian passport before sentencing in April.

The directive forms part of a series of restrictions imposed on his bond terms by Judge Richard A Jones on March 11.

New restrictions

Judge Jones ruled that Zhao must stay within the United States and inform the Court’s Pretrial Services before any domestic travel.

Additionally, as part of the conditions, Zhao must surrender his Canadian passport to a third-party custodian appointed by his legal representatives. This custodian will accompany Zhao for any travel necessitating identification.

Furthermore, Zhao must surrender all other current or expired passports to his legal team. It’s important to note that Zhao is prohibited from obtaining new passports without explicit permission from the Court.

The recent order reflects the prosecution’s continuous efforts to prevent Zhao from leaving the United States.

Since pleading guilty to a money laundering charge last November, Zhao has faced travel restrictions owing to apprehensions about his potential flight risk and considerable financial resources.

More lawsuit

Zhao’s bond modification follows the recent revival of a class-action lawsuit against him, Binance, and other top executives of the exchange.

In a recent court filing, the United States Court of Appeals for the Second Circuit overturned a district court’s ruling that previously dismissed investors’ concerns regarding transparency in Binance’s alleged sale of securities.

The Court found the investors’ lawsuit timely and acknowledged the potential applicability of domestic securities regulations to Binance’s activities.

Notably, this case continues a slew of legal battles Binance faces across the United States and other jurisdictions like Nigeria.

In Nigeria, the firm faces allegations of market manipulation and destabilization of the African country’s national currency, the Naira. The authorities have detained two top executives of the exchange regarding these allegations, and reports suggest that the firm faces a hefty fine of up to $10 billion.

cryptoslate.com

cryptoslate.com