The US-based crypto exchange, Coinbase is making allegations against the SEC for not providing clear regulations on Cryptocurrency

Coinbase’s lawyers are stating that when the SEC rejected the crypto exchange’s petition in December, it failed to explain its refusal to write cryptocurrency-specific regulations.

Coinbase Lawyers Argue

Coinbase’s lawyers contend that the securities regulator’s claim of authority over crypto assets is arbitrary and capricious since it has declined to establish new regulations for treating such assets. Instead, the regulator has applied oversight of digital assets through enforcement actions, according to the company’s opening brief in its lawsuit.

The SEC Chair, Gary Gensler, has argued that the regulator is working on crypto rules. Besides, it is crucial to maintain commission discretion in setting its rulemaking priorities, even if they are not the rules the industry wants.

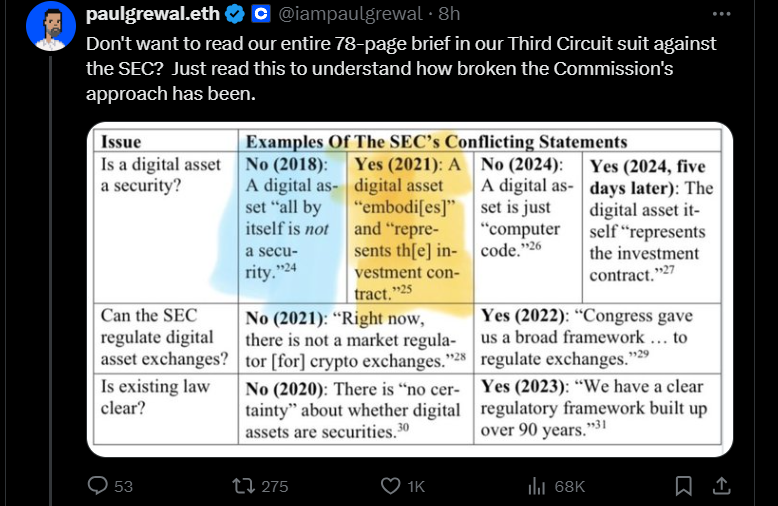

In an accompanying post on March 11, Coinbase legal chief Paul Grewal stated the SEC owes the public an explanation and an opportunity to provide their views on how it is exercising its powers.

He further stated that the SEC’s denial was half-stated, with no apparent reason for its inaction. The company aims to force the SEC to provide that answer through its lawsuit.

What was in the Coinpage Brief

Coinbase’s 78-page brief also claims that the SEC “suddenly changed positions” regarding cryptocurrencies. According to Coinbase, the SEC previously stated that it had “limited authority” over crypto and that there was a legal “lack of clarity.” However, the agency later claimed it had enough authority to regulate crypto.

The exchange asserted that the SEC did not have the authority to change course, as it required approval from Congress, which Coinbase, Kraken, Binance, and others have argued in motions to dismiss SEC lawsuits against them.

Coinbase posted that If the SEC insists on moving forward without congressional authorization, that decision must be made and implemented through prospective rulemaking.

Coinbase’s appeal against the SEC’s rulemaking denial is a separate court dispute from the SEC’s June 2023 lawsuit against Coinbase, which alleged that it operated as an unlicensed exchange and offered unregistered securities.

Oral Arguments Between Coinbase and the SEC

In January, Coinbase and the SEC held oral arguments over the exchange’s dismissal motion in that case, which used many of the same claims made in this one, that the SEC has no authority over crypto exchanges unless Congress says so.

Although this week’s legal challenge asserts that the regulator has failed to regulate crypto correctly, it is not directly linked to Coinbase’s ongoing court battle with the SEC, which could eventually influence how crypto exchanges are treated under US securities law.

In that case, the SEC has accused Coinbase of running an unregistered exchange that lists unregistered crypto securities illegally. The SEC likes to have everything bought and sold over an exchange under its regulation to protect retailers, and the number of scams that the world has seen in the crypto market may be bothering the government.

Summary

Coinbase’s lawyers argue that the SEC’s claim of authority over crypto assets is arbitrary since it has not established new regulations for such assets. The SEC has applied oversight of digital assets through enforcement actions. The SEC Chair argues that the regulator is working on crypto rules. Coinbase asserts that the SEC did not have the authority to change course without approval from Congress.

Disclaimer

The views and opinions stated by the author or any people named in this article are for informational purposes only. They do not establish financial, investment, or other advice. Investing in or trading in stocks, cryptos, or other related indexes comes with a risk of financial loss.

Amanda Shinoy is one of the few women in the space invested knee-deep in crypto. An advocate for increasing the presence of women in crypto, she is known for her accurate technical analysis and price prediction of cryptocurrencies. Readers are often waiting for her opinion about the next rally. She is a finance expert with an MBA in finance. Quitting a corporate job at a leading financial institution, she now engages herself full-time into financial education for the general public.

thecoinrepublic.com

thecoinrepublic.com