Erik Voorhees’ crypto exchange ShapeShift has agreed to pay a $275,000 fine as part of its settlement with the US Securities and Exchange Commission after it was found to be dealing unregistered securities.

ShapeShift has also agreed to desist from violating the Securities Exchange Act of 1934.

Three of the five commissioners concurred that ShapeShift dealt unregistered crypto securities from 2014 until early 2021. They also ruled that rather than operating a platform for customers to trade with one another, ShapeShift held crypto asset securities itself and traded against its own users. It did this by selling those assets in securities transactions from its own inventory.

As a result of this behavior, the Commission has voted that based on the Securities Exchange Act of 1934 Section 3(a)(5)(A), ShapeShift can be classified as a dealer.

A dealer is ‘any person engaged in the business of buying and selling securities (not including security-based swaps, other than security-based swaps with or for persons that are not eligible contract participants) for such person’s own account through a broker or otherwise.’

ShapeShift misleadingly branded itself as a simple ‘vending machine’ when, in fact, it acted as a sophisticated counterparty, market-making spreads across millions of securities transactions.

SEC settlement only for early 2021 and prior

Any fines relate only to ShapeShift’s previous corporate actions meaning that subsequent ShapeShift DAO or ShapeShift.com actions from late 2021 onward are not involved in the settlement.

In January 2021, ShapeShift announced that it was integrating Ethereum-based decentralized exchanges and removing KYC requirements. Voorhees had previously complained that implementing KYC had cost it 95% of its usage.

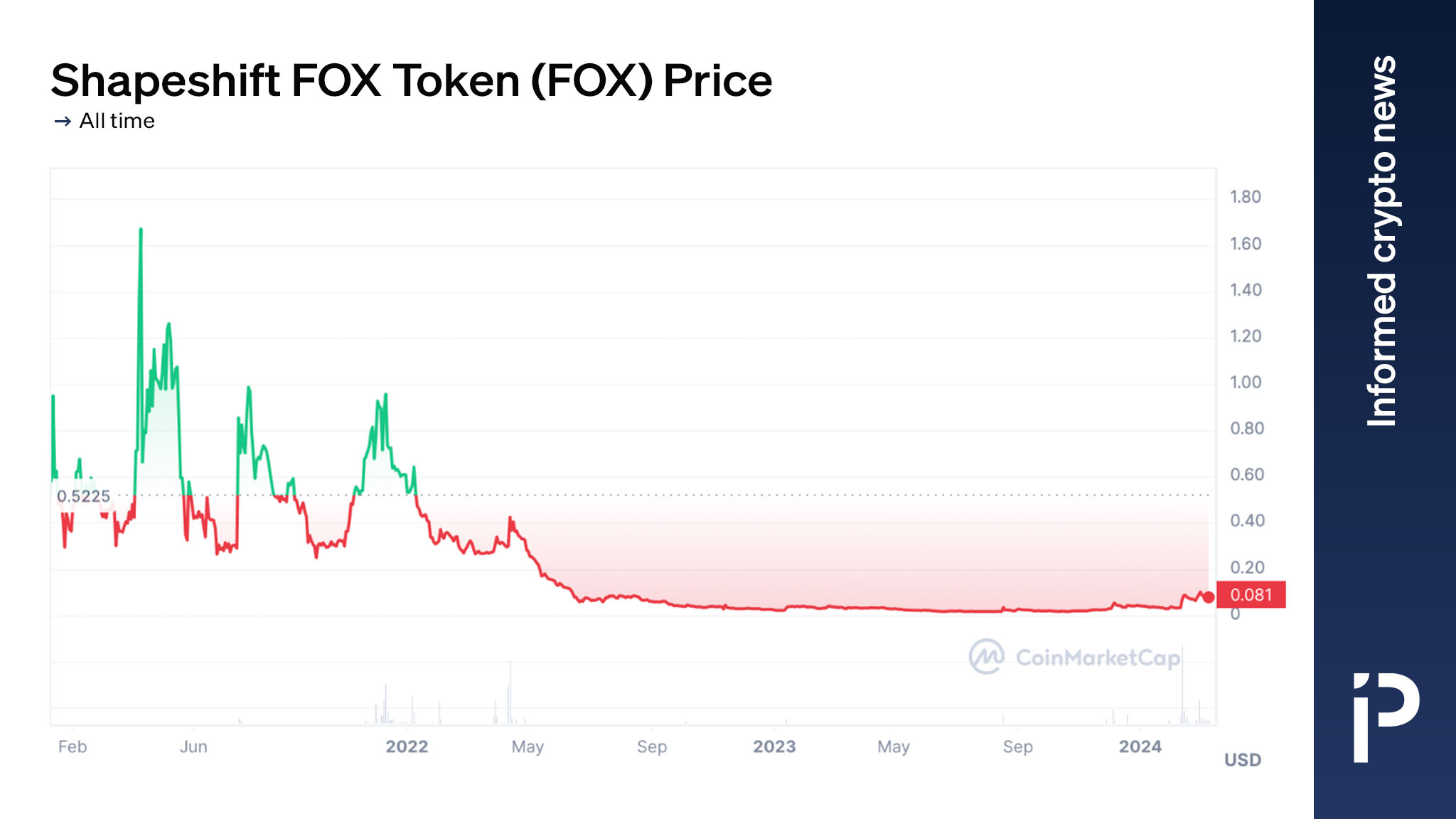

During the first half of 2021, ShapeShift wound down its corporate structure and switched to a so-called decentralized organization governed by FOX token holders. Voorhees personally claims that the FOX token is not a security and was not expressly named in the settlement.

ShapeShift had previously surprised the digital asset community by implementing KYC requirements in 2018 — a likely attempt to stay ahead of regulatory ire. It had also delisted privacy coins Monero, Zcash, and DASH to downplay anti-money laundering (AML) issues.

Three ‘aye’ and two ‘nay’ votes for ShapeShift settlement

The three majority opinion commissioners — Gary Gensler, Caroline Crenshaw, and Jaime Lizárraga — maintain that ShapeShift never registered as a securities dealer, thereby violating Section 15(a) by making “use of the mails or any means or instrumentality of interstate commerce to effect any transactions in, or to induce or attempt to induce the purchase or sale, of any security.”

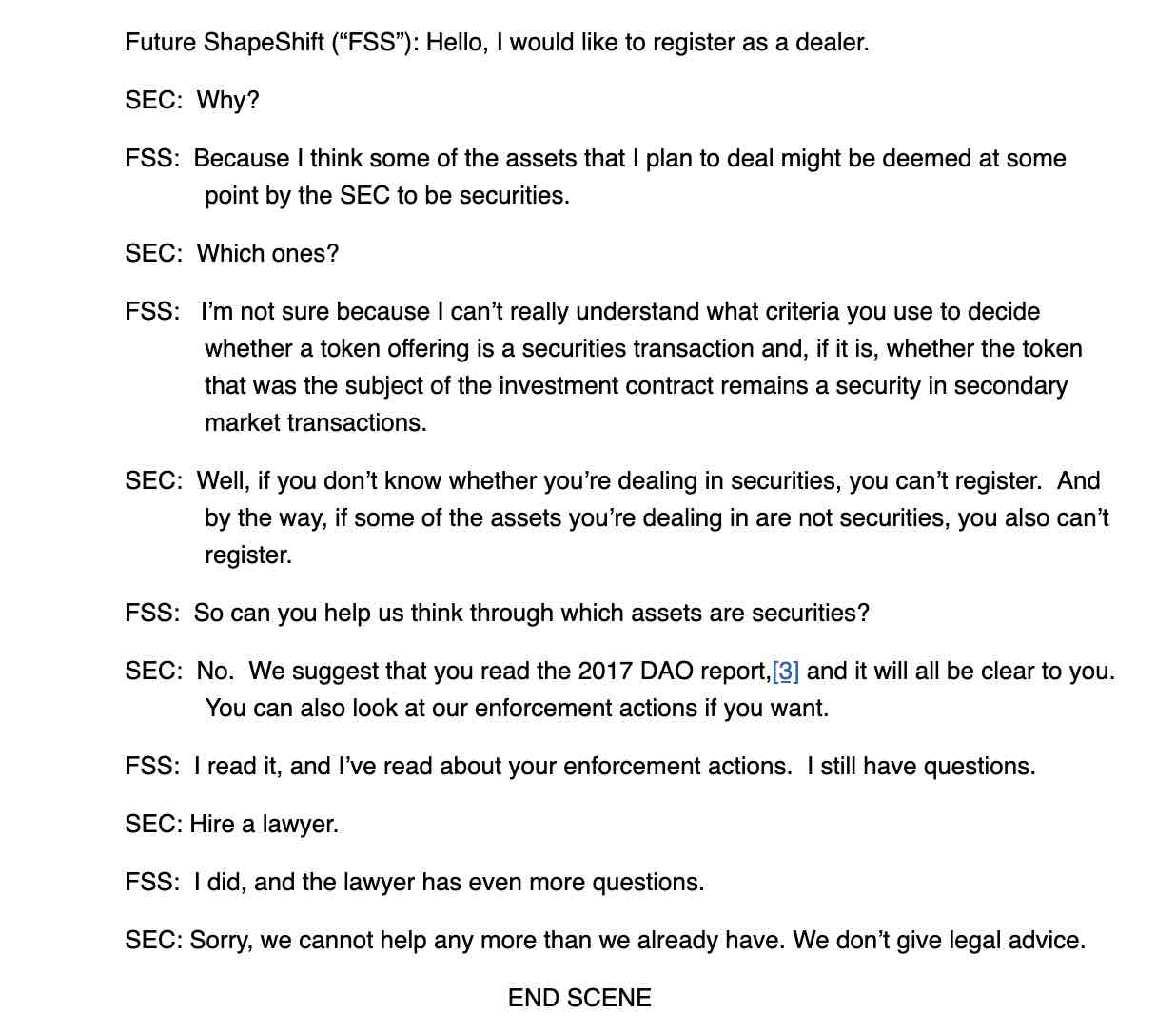

The two minority opinion Commissioners Hester Peirce and Mark Uyeda published a joint dissent. They disagree with the enforcement action and the settlement terms. In particular, they regret the SEC’s failure to specify which assets it believed represented investment contracts.

The SEC has named crypto asset securities

Of course, the SEC has named dozens of specific crypto assets that it considers unregistered securities. Indeed, in previous enforcement actions, such as its lawsuits against Coinbase, Binance, Bittrex, and Gemini, the SEC has named many unregistered crypto securities that ShapeShift also sold to users.

By simply comparing a list of SEC-designated crypto asset securities to the listings on ShapeShift from 2014-2021, there are many overlapping tokens, including ATOM, XRP, BNB, DASH, and many others. ShapeShift listed these tokens, which the SEC later designated as unregistered securities offerings with a full rationale in public court filings.

Nevertheless, in their minority opinion dissent, Peirce and Uyeda wrote a fake play joking about how the SEC would somehow not name specific securities to a hypothetical ShapeShift inquiry. This is a curious take given the nearly 100 crypto asset offerings designated as securities by the SEC.

The vast majority of crypto reactions on X (formerly Twitter) quoted the SEC, Voorhees, the dissenting opinions of commissioners, or media coverage of those sources.

Many pro-altcoin accounts parroted the mistaken belief that the SEC has still not named specific crypto tokens listed for trading on ShapeShift as unregistered securities.

Read more: Explained: Crypto assets deemed as securities by the SEC

Attorney comments on ShapeShift securities settlement

Interestingly, there might also be strategic reasons for the settlement.

Attorney Zack Shapiro, managing partner at law firm Rains LLP, wrote to Protos regarding possible SEC motivations for settling with ShapeShift.

“In the recent settlement between the SEC and ShapeShift, it appears the regulatory body is strategically orchestrating ‘slap on the wrist’ settlements to cultivate favorable precedent, which is indicative of a broader tactical agenda to fortify its legal posture in more consequential litigation against industry behemoths like Coinbase,” said Shapiro.

“This approach underscores the SEC’s tactical recalibration, seeking to secure incremental victories that may bolster its regulatory dominion in the complex and evolving digital asset landscape in the face of unfavorable precedent in its landmark case against Ripple Labs.”

ShapeShift founder Voorhees didn’t directly respond to Protos’ request for comment but in his first public response to the settlement, he simply quoted an excerpt from the Federalist Papers.

protos.com

protos.com